Today on SMACKDOWN we’ll look at just how inflationary the Fed’s programs have been to date.

My premise remains that consumer inflation occurs because consumer spend more nominal dollars. I won’t go over the rationale for this viewpoint right now, you can read it here or here. Given this, any program will only be seen as inflationary if it puts cash into consumer pockets, or at the very least, results in goods being purchased.

The headline grabbers are stories like this one at the New York Times. They throw out numbers like $12 trillion and we all cry out inflation! But a large percentage of these figures are asset guarantees, such as the money market insurance program. These programs are clearly not inflationary as they never even involved any exchange of cash.

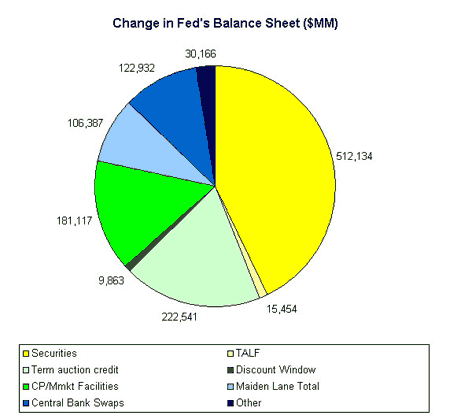

In order to see how much money may actually go into the economy, let’s take a real look at the Fed’s balance sheet. We know it has exploded in size:

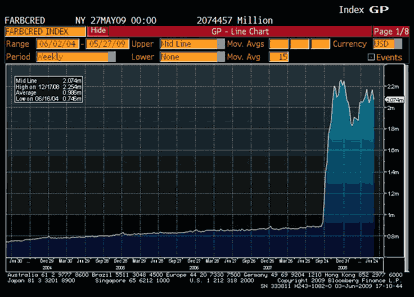

We also know that most of the Fed’s outlays have been funded by crediting bank reserves. That is, the Bernanke’s old “electronic printing press.” If printing money makes you shudder, you aren’t alone.

But remember, even printing money doesn’t cause inflation unless that money reaches consumers. I’ve said before: if the Fed mints a quadrillion new Sacagaweas and just sticks them in a vault at Ft. Knox, there is no inflationary impact.

Alright so what’s in the Fed’s balance sheet? What have they buying with all that printed money? (All figures represent an increase).

I’ve color coded this based on inflationary impact. The various shades of blue are non-inflationary. Starting at the top and moving to the left, the first is the Maiden Lane transactions. These are all related to Bear Stearns and AIG bailouts (note I added some AIG-related loans that technically aren’t part of Maiden Lane LLC into this figure). Can’t see how these impact inflation in any meaningful way. The next is related to dollar swaps with foreign central banks. Again, while I think this helps provide meaningful liquidity to the worldwide financial system, the impact on consumer inflation is minimal, even if the Fed is “crediting reserves” to help provide the cash. Finally we have “other” Fed activity, which involves stuff like the Fed’s gold stock. Not an issue.

Term Auction Debt and the CP/money market programs are a little more nebulous. These plus the actual discount window is in green. The Term debt is mostly the TAF and the TSLF, both of which were meant as quasi-discount window loans to banks and primary dealers. Neither is as heavily used as it was in late 2008. I’d argue that the these term loans are merely replacing other types of borrowing that would otherwise have occurred in the capital markets. So while it is interfering in markets, it isn’t inflationary. The commercial paper program is similar. If it just replaces private sector borrowing, it isn’t inflationary.

Now wait a minute, you say, the market is over-leveraged. This kind of short-term debt is what helped get us into this mess! The private sector should be winding down! The Fed shouldn’t be encouraging short-term borrowing of this nature. That’s besides the point when you are thinking about inflationary impact. Inflation (or deflation) is caused by the change in effective money supply from one period to the next. If all the debt was suddenly drained from the system, it would surely be severely deflationary. So to the extent the Fed is substituting its own balance sheet for private lending, that’s a neutral event in terms of inflation. Indeed, according to the Fed, financial debt grew at a 6% pace last year, down from 12% in 2007 and the slowest pace since 1991.

The other programs (in yellow) do have some inflationary impact. Securities held directly are, most notably, the Fed’s mortgage, agency, and Treasury buying programs. (I’ve subtracted the decline in repo from this figure, since these new programs really replace the Fed’s old repo-based programs.) When the Fed buys bonds, they are buying them from someone, and that cash eventually makes it into the system. I’ve argued that in fact, securities purchases are just a convenient means of pumping dollars into the economy. So it seems that an inflationary result is the goal.

Same with the TALF. The idea behind the TALF is to restart the ABS markets, which would provide cash directly for credit-based consumption. This is practically printing money and giving it to consumers. However, for better or worse, the TALF has been little used. It was supposed to be up to $1 trillion. It would be just as well to let him go, he’s too far out of range.

Now let’s add up the “inflationary” increase in the Fed’s balance sheet. $528 billion.

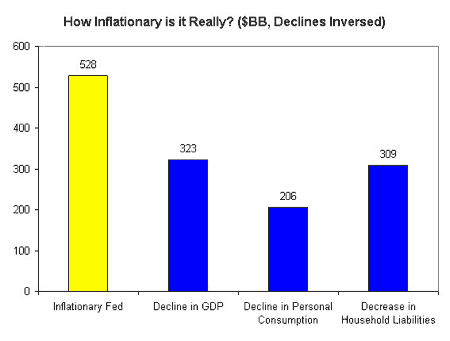

Now let’s compare that with some other key indicators of consumer behavior. The chart below compares the increase in the Fed’s programs with the decrease in the other indicators. The decreasing elements have been inversed to illustrate the relative size.

The amount of inflationary Fed programs is slightly larger (in the scheme of the overall economy) than the decline in nominal GDP, consumer debt, and consumer spending. Now none of these figures are directly comparable, i.e., you can’t say the inflationary impact is simply x – y. But comparing the relative size of each of these gives some sense of context.

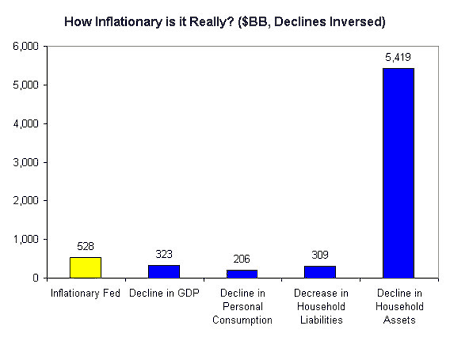

Now if we add the decline in household assets…

Suddenly the Fed’s activity seems like a drop in the bucket. And that figure is only through 12/31/08. We don’t yet have the Fed’s Flow of Funds report through 1Q. We know that household assets are continuing to decline, as evidenced by the continued drop in home prices.

Now we know that eventually consumers will regain their footing and start to spend (and borrow) again. So even if you agree that the Fed’s actions aren’t inflationary for now, they may become inflationary once the economy starts recovering. So its all about the exit strategy. That will be next time, on SMACKDOWN!

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply