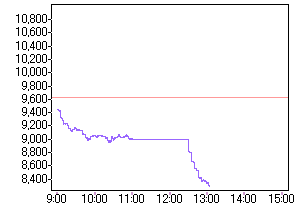

The Nikkei 225 has crashed over 13% so far in trading as concerns mount about that a nuclear meltdown in Japan has already occurred with large amounts of radiation released. Reports are circulating that radiation fallout may reach Tokyo within 8-10 hours. The market open down 2%, but started to crash after the lunch break as investors sold everything and moved to cash. Nuclear power stocks are naturally getting hit the hardest with Tokyo Electric trading ask only (no bids). Wow! There has been mention of the BOJ stepping in to sell the yen. This sort of market action remind be of the Oct 2008 word market crash. Fear, uncertainty, massive losses, etc.

The Nikkei 225 has crashed over 13% so far in trading as concerns mount about that a nuclear meltdown in Japan has already occurred with large amounts of radiation released. Reports are circulating that radiation fallout may reach Tokyo within 8-10 hours. The market open down 2%, but started to crash after the lunch break as investors sold everything and moved to cash. Nuclear power stocks are naturally getting hit the hardest with Tokyo Electric trading ask only (no bids). Wow! There has been mention of the BOJ stepping in to sell the yen. This sort of market action remind be of the Oct 2008 word market crash. Fear, uncertainty, massive losses, etc.

The Nikkei has now fallen 20% over the last two days. This is officially a crash folks!

The Nikkei crash is reverberating across Asia as most bourses are now down 2-4%. In Australia, uranium stocks are like Paladin are being murdered, down around 15-20%.

As we postulated yesterday, markets are likely to continue to decline further. While the market is panicking, now is the time to start getting your buy lists ready. Particularly uranium stocks which are being battered. This is similar to what happened back with Three Mile Island in the US. The smart thing to do was not to panic and sell, but to buy! I think we are witnessing a repeat scenario. I am looking at Japanese large caps also. Imagine buying stocks after the 87 crash. Great deals and big profits to the brave investor who stepped in and bought stocks. Well, Japan has just crashed.

US Dow futures are down 276. I wonder how many HGT algos are going to step in and “provide liquidity.” They are more likely hitting the sell button on US futures, further exacerbating what will already be a scary open for stocks.

Leave a Reply