The Wall Street Journal suggests the Fed is facing a policy conundrum. I would suggest that “conundrum” is an overstatement. Push comes to shove, there will be little debate – if the current oil price shock turns nasty, Fed officials will embrace another round of quantitative easing.

Dallas Federal Reserve President Richard Fisher offers the hawkish view, and remains colorful as always. Today he ranted against QE2:

To be sure, there are some, including me, who worry that the Fed ultimately may have taken out too much insurance against a double-dip recession and slippage into a deflationary spiral. There are some, including me, who argued against the last tranche of insurance we took out in committing to buy $600 billion in U.S. Treasuries between last November and the end of this coming June as we were simultaneously purchasing additional Treasuries to make up for the roll off in our mortgage-backed securities portfolio. There was a strong feeling among those of my policy persuasion that we had already sufficiently refilled the tanks holding the financial fuel businesses needed to drive their job-creating machines. They felt that by being too accommodative, we might run the risk of planting the seeds that could germinate into renewed volatility, speculation and inflation, or give comfort to a government that for far too many congressional cycles has fallen down on the job by spending and borrowing and committing to unfunded programs with reckless abandon.

Am I the only one who sees Fisher as a remarkably irresponsible policymaker? I get the sense that at best he is trying to undermine the effectiveness of monetary policy by repeatedly emphasizing that it doesn’t work. At worst, he is deliberately trying to feed inflation expectations, for what purpose I know not. I think the responsible policy approach would be to exude confidence in the Federal Reserve, particularly during period of turmoil. The policy is in play; no good comes from public derision at this junction. Simply reiterate that the Fed has the tools to remove the accommodation should it become necessary.

Goodness, if anyone took him seriously, he could do some real damage. Luckily, I think by now we have been trained to largely dismiss Fisher. For a more nuanced and thoughtful policy approach, I suggest the competing speech by Atlanta Fed President Dennis Lockhart, with what I think is a key insight:

Where my views might depart from the mainstream to some extent is on the question of the range of plausible economic scenarios from this juncture. In thinking about an appropriate and balanced policy for at least the near term, it seems to me a critical question is whether the range of plausible scenarios is narrowing (that is, is certainty growing) or widening (that is, is uncertainty growing). My view is the range has widened—not dramatically, but somewhat. For some time, my list of headwinds and risks has encompassed European sovereign debt, our own federal, state and municipal fiscal challenges, house prices, and commercial real estate. My sense of the balance of risks has shifted with the addition of unrest in the Middle East and North Africa.

That growing uncertainty has weighed on me in recent weeks. Rather than digging in his heels like Fisher, Lockhart allows policy flexibility in the months ahead:

With the information I have today, my first inclination is to be very cautious about extending asset purchases after June. Given the emergence of new risks, however, I prefer a posture of flexibility as regards policy options. As we have seen, conditions can change rapidly, so I will continue to evaluate the incoming information as much as possible with fresh eyes as I approach each meeting and each decision.

Lockhart’s position will become the dominant view at the Fed. A month ago, the likelihood of additional easing was nearly zero. QE2 would end as scheduled, and the Fed would turn its attention to the timing of policy reversal. The evolving commodity price shock, however, clouds that outlook. To be sure, Lockhart recognizes the potential inflationary impact of recent events:

To recap, one can’t help but notice rising inflation anxiety among the business community as well as consumers based on recent experience with highly visible and highly publicized commodity prices. So far, this anxiety has not translated to a loosening of the moorings of inflation expectations….But my concern is that broad inflation worries—even if in reaction to what are probably temporary relative price movements—could shift and cut loose inflation expectations. It goes without saying that we policymakers must watch indications of expectations very carefully and be on guard for an approaching inflection point.

But he recognizes that this should not be the baseline expectation. Instead:

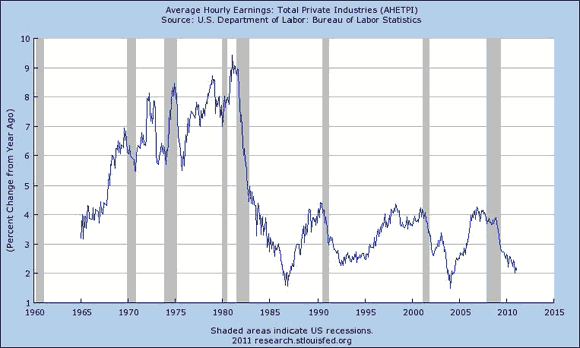

In my opinion, central to the question of the potential for price action becoming broad inflation is the behavior of wages. I remember the early eighties well. I was in a management role in a bank then, and in my organization we were moving salaries around 10 percent a year to retain our people. Wage accommodation of rising prices has the effect of institutionalizing and embedding inflation. However, I do not see widespread wage pressures developing any time soon in the current circumstances of upwards of 20 million people either out of work or working part-time for economic reasons.

The February employment report would appear to support Lockhart’s position – average hourly wages climbed by a mere penny. Indeed, it is hard to see the basis of a wage-price inflation spiral evolving:

Spencer at Angry Bear adds succinctly:

With income growth this weak fears of significantly higher inflation appear to be misplaced. Although headline inflation may be ticking up because of food and energy, the weak income growth implies that the impact of higher food and oil prices will be felt much more in weak consumer spending rather than higher inflation expectations.

Bottom Line: The ongoing commodity price shock argues for further monetary accommodation, not less. In the current environment, efforts to pass through higher prices to consumers will only erode spending power, not provide the basis for additional wage gains. This is not Europe or Asia; dismiss policymakers who suggest otherwise.

Leave a Reply