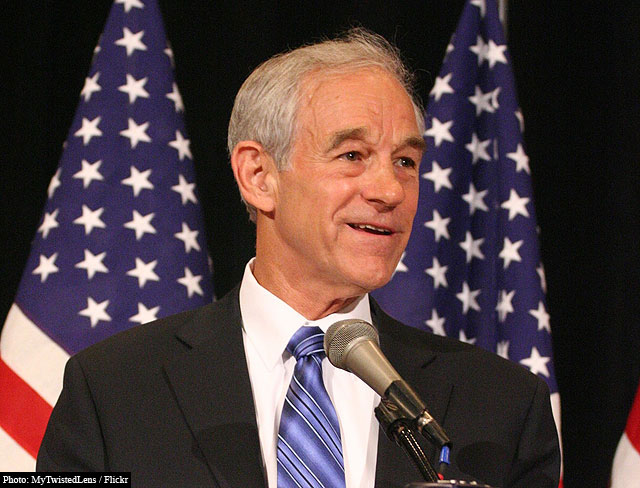

I can appreciate Ron Paul’s libertarian philosophy. And because this is so, it pains me all the more to say what I am about to say. The guy can be a real pinhead at times. And this is never so evident as in his persistent “attacks” against the Fed.

Now, of course, I work at the Fed, so maybe you think I’m just complaining for the sake of defending my employer. If you think that, I can understand why you do. It is because you do not know me.

There are legitimate arguments one could make against the Fed as an institution and/or about the conduct of Fed policy. And then there are the stupid arguments, for example, the one contained on pg. 25 of his book End the Fed:

One only needs to reflect on the dramatic decline in the value of the dollar that has taken place since the Fed was established in 1913. The goods and services you could buy for $1.00 in 1913 now cost nearly $21.00. Another way to look at this is from the perspective of the purchasing power of the dollar itself. It has fallen to less than $0.05 of its 1913 value. We might say that the government and its banking cartel have together stolen $0.95 of every dollar as they have pursued a relentlessly inflationary policy.

One might indeed say that, Mr. Congressman. But if one did, one would behaving like an opportunistic politician, which I know you are not.

Now, let us examine what is wrong or misleading in the statement above.

First, with the exception of the last sentence (which he weasels around with his “one might say”), there is nothing factually incorrect. Indeed, the data source cited by Paul is (ironically enough) the Federal Reserve Bank of St. Louis. (I’m glad he trusts us enough for some things.)

So the question is not whether he has his facts straight on this matter. The question is whether these facts matter at all.

There is this old idea in monetary theory called money neutrality. Money neutrality means that larger quantities of money ultimately manifest themselves in the form of higher nominal prices (and wages), and not on real quantities. No serious economist disputes the idea of long-run money neutrality.

Yes, what cost $1 in 1913 now costs $20. But so what? Money neutrality states that if you were earning $1 per hour in 1913, you are now earning $20 per hour (and even more, if labor productivity is higher).

So there you go, the Fed is responsible for increasing your nominal wage by a factor of 20. How do all you workers out there like them apples? Ron Paul wants to rob you of these wage increases!

Here is another example of the Congressman misleading the public (perhaps unintentionally); see his recent interview here with CNBC’s Larry Kudlow: Fed Under Fire.

At the 3:50 mark, Kudlow asks Paul: “Would oil be at $102 a barrel now if we had a sound dollar policy?” Paul’s reply is that, if Bretton Woods had not been abandoned (in 1971), oil would now be trading closer to $5 a barrel.

I ask you…how embarrassing of an answer is that? I mean, maybe oil would be trading at $5 a barrel. But what he is implicitly suggesting is that your nominal wage would not be scaled back in proportion. That is, he is suggesting that by cutting the value of paper, the Fed has somehow diminished the purchasing power of your labor over the past 100 years. Can he be serious?

The Congressman evidently suffers from money illusion. It is an affliction that can be forgiven in most people. But not one who likes to think of himself as a person learned in the finer principles of monetary theory.

And, as an aside, am I the only one who chuckles whenever he berates the Fed for creating money “out of thin air?” (I reiterate, there may be many legitimate complaints one could make against the Fed, but the “out of thin air” charge…well, let’s just say it…lacks substance).

Is it not true that the Treasury also creates its debt “out of thin air?” Do you think getting rid of the Fed (which, in conducting monetary policy, is simply swapping one form of thin air for another) will prevent Congress from issuing its own thin air? Do you really believe that a gold standard would mitigate the government’s ability to tax? (Seigniorage revenue for the U.S. is peanuts as a fraction of total taxation. Moreover, keep in mind that the inflation tax is collected off of foreigners as well.)

Let me conclude by saying that I think that America is, on the whole, well-served by having a voice like Ron Paul in Congress. I’d like to invite him to the SL Fed for lunch one day. I’d ask him to tone down his rhetoric and present his (frequently very good) arguments in a more sober manner.

But maybe this is too much to ask of a politician. Even a libertarian one.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

I think you’re missing the real issue. The theft that occurs that Congressman Paul has often pointed out when we have inflation occurs in three different instances as prices go up:

1. When an individual is paying higher prices for goods but is yet to receive an increase in pay.

2. When an individual, such as somebody living off of a fixed income like social security, is paying higher prices but continues to receive the same fixed income payments.

3. When an individual is paying higher prices and has any sort of savings account that doesn’t have an increase in interest rates immediately to keep up with the inflation rates.

If you fail to acknowledge that people who fit into any of the above categories are hurt and robbed by inflation, you are being dishonest. This is Dr. Paul’s point. Would you like to respond?

David Andolfatto just be honest and tell us that you want big government. PERIOD

Glad to see that only retards do work at the Federal Reserve

David Andolfatto just be honest and tell us that you want big government. PERIOD.

JaJa, to be honest, I share many of Ron Paul’s libertarian leanings. I am not against ending the Fed. The Fed was created on behalf of the American people as an act of Congress. Congress has the right and power to eliminate the Fed. If this is what the American people want, then power to the people!

PS. I am not American.

David,

You give a good example of what is wrong with most media outlets today. You purposely omit fact and take text out of context to make false statement to support your propagandist views – How embarrassed are you for making this statement – “Yes, what cost $1 in 1913 now costs $20. But so what? Money neutrality states that if you were earning $1 per hour in 1913, you are now earning $20 per hour (and even more, if labor productivity is higher).” To justify what the Fed practices.

Look at the rate of inflation compared to the rate of wage increases over the last twenty years. You work for the Fed and have bias, but yet you decided to write this article and this website decided to publish it – I am embarrassed for both of you.

P.S. to the Web Admin. You required me to give you my email address so I could comment, but don’t bother contacting me. I have no desire to support propaganda

Inflation Wages

$14.86 Jan 2011 Real average hourly earnings(1) $10.32 $10.38 $10.35 $10.34

$10 Jan 1994 Total Private………… |$10.77 |$10.97 |$11.07

Looks like we lost about $4…

http://www.bls.gov/data/inflation_calculator.htm

1994 http://www.bls.gov/news.release/history/realer_021794.txt

2011 http://www.bls.gov/news.release/archives/realer_02172011.htm

I enjoyed your article – but this is simply not true. In fact, in 1910 the country and many in the Congress were adamantly opposed to a central bank – even the progressive democrats like William Jennings Bryan (although yes, for different reasons than conservative libertarians like Paul). The people of the nation were pushing for legislation that would get the money and power that had accumulated into so few hands (this small group were called the Money Trust back then) and effectively break it up. In effect, the Money Trust were the wolves who dressed up in sheep’s clothing. They designed the legislation in 1910, in private, in collusion with three government employees – Senator Nelson Aldrich, as well as the Secretary and Assistant Secretary of the Treasury at the time. What they created can be defined as nothing other than a cartel. The legislation was intelligently, and quite corruptly, designed – words were carefully chosen in order to intentionally fool the public and members of Congress – ‘central bank,’ ‘cartel,’ etc, these were words that would not appear in the actual legislation, for obvious reasons.

If the people of this country really know all of this, and were really awake to the fact that banking cartels serve no other purposes than to enslave a nation of people with debt in perpetuity – if this was all well-know – people would be demanding a change. If most people would stop, think and realize that not only has the Federal Reserve failed at its dual mandate, and miserably at that, but they have also presided over the worst financial crisis this country has ever seen. Just look at what the alleged purpose of creating the Federal Reserve was in the first place, and then compare macroeconomic and monetary volatility of the U.S. in the decades leading up to its creation, and after its establishment. Sure – the U.S. had panics and other economic disturbances prior to the Federal Reserve – but until the 1920’s rolled around, this country hadn’t the clue was economic disturbance was all about.

It’s a failure of momentous proportion.

Certainly no one involved in the fed, or any other fiat central banking system, has any interest in protecting the ability of a tiny handful of people to create wealth by pressing the zero button on a keyboard. It’s not particularly appealing to them that they can fund any war, bailout, social program, spy network, campaign, cover up, etc., etc.

Right, David?

I mean, do you acknowledge, David, that that kind of power is inherent in any fiat currency system? Well, you have to, because it’s inescapable. A lot of economists’ theories and jargon might gloss over it nicely and make people feel like they aren’t looking at a counterfeiting operation, but the fact remains, a small group of people are creating money from their imaginations. And, lets not forget, guns and threats are directed at anyone who doesn’t participate in their system. Strangely similar to organized crime, ain’t it?

But I gotta say, David, you’ve managed to put some nice makeup and a good-looking prom dress on this pig.

Yes, what cost $1 in 1913 now costs $20. But so what? Money neutrality states that if you were earning $1 per hour in 1913, you are now earning $20 per hour (and even more, if labor productivity is higher)

This statement is absolutely false…you are not earning $20 now, you are really earning.05 per cent on every dollar you earn for that same hour you work…nice try…the FED has robbed the value of the dollar by its inflationary policies which eventually produce rising prices on goods. Inflation of the money supply has outpaced the rise in wages…therefore, people are becoming poorer as inflation rises…

Jimmy:

I think you’re missing the real issue. The theft that occurs that Congressman Paul has often pointed out when we have inflation occurs in three different instances as prices go up:

1. When an individual is paying higher prices for goods but is yet to receive an increase in pay.

I did not dispute the possibility of short-run money non-neutrality. The question is whether this is true over the long-run (the last 100 years), the way Paul seems to suggest. I say no.

2. When an individual, such as somebody living off of a fixed income like social security, is paying higher prices but continues to receive the same fixed income payments.

Over the short-run, fine. But again, I am talking long-run. And you are assuming that in the absence of inflation, a government interested in cutting SS benefits would not simply cut them directly.

3. When an individual is paying higher prices and has any sort of savings account that doesn’t have an increase in interest rates immediately to keep up with the inflation rates.

The Fisher relation holds in the long-run. You are wrong.

If you fail to acknowledge that people who fit into any of the above categories are hurt and robbed by inflation, you are being dishonest. This is Dr. Paul’s point. Would you like to respond?

My post has nothing to say about inflation. I am talking about long-run differences in the price-level. There is a difference. I should have communicated it better.

David wrote:

“My post has nothing to say about inflation. I am talking about long-run differences in the price-level. There is a difference. I should have communicated it better.”

Then you are missing Dr Paul’s point, which is NOT ABOUT THE PRICE LEVEL. Rather, it is that inflation (defined as expansion of the money supply) results in a transfer of real wealth:- from those whose cash holdings are not augmented immediately (we may fairly call this group “Main Street”) to those who receive the new money first (“Wall Street”).

This redistribution of wealth is irreversible, and I see no reason to think that it is mitigated even in the long run. Further, even the short-run effects are always with us as long as the inflationary policy continues.

“I see no reason to think that it is mitigated even in the long run.” I’m not an economist, but I agree with this.

If over “the long run” the Fed has issued money to only selected banks, then those banks have reissued the money with a markup… it seems to me that those banks are winners “over the long run” and everyone else is a loser.

David, can you explain how people and non-bank organizations are winners over the long-run? Or how this is neutral? It seems counterintuitive to me.

Frankly, I think the whole issue exists in something of a zero-sum context. And the real issue is TRUST. Does one trust Central Planners or a Free Market?

You make valid points, but RP is really addressing that fundamental question. So I’m confident that if you had a one-on-one with him, he’d acknowledge your points… but still dismiss them based on his governing philosophy… free market is better than central planning. Both have pros and cons, but reducing centralized power… and empowering the individual is best.

David, your answers to Jimmy display a profound and deep ignorance about the nature of inflation and the connection between short and long term effects.

You casually and almost inconsequentially gloss over the fact that inflation has “short term” wealth transfer effects. You admit that it does, but then you say “in the long run”, money is neutral. Well sure, if inflation in the real world consisted of the Fed inflating the money supply for ONE TIME ONLY, and then no more inflation of the money supply thereafter, then sure, the short term wealth transfer effects will be attenuated, and the long run effect will be to increase prices and nominal incomes.

But here’s the rub you monetary crank: The Fed CONSTANTLY inflates the money supply over time, which means the long term effects you are talking about are overwhelmed by the constant short term effects that actually take place. Yes, the money used in a given round of Treasury purchases will eventually be spread out into the economy, raising prices and incomes, but no sooner will the effects of that be made, the Fed will have already inflated the money supply once more, which means there is ALWAYS short term wealth transfer effects taking place, which means in the long run, there will have been a constant stream of wealth transfer from those who typically get the new money last (those on fixed incomes, widowers, pensioners, etc) to those who receive the new money first (Wall Street primary dealers, the Treasury, etc).

Ron Paul was not talking about the long term effects of a single round of inflation, which is, as you said, “neutral.” He knows, as well as those who are not monetary cranks, that inflation is NEVER one time only. The Fed continually creates and then injects new money into specific parts of the economy all the time, and that means the short run effects of inflation (wealth transfer) completely and totally overwhelm the long term effects of way in the past inflation, which has percolated through the economy yes, but by that time, more wealth transfer has taken place because of the continuous inflation from the Fed.

So if you take the inflation the Fed has continuously created since 1913, then there has been almost 100 years of wealth transfer. THAT is what he means when he said that the Fed has taken 95% of the purchasing power of money.

You are suffering from the illusion that inflation is not always affecting the economy in the short run, which is just another way of saying it affects the economy in the long run. You mistakenly believe that because a narrow focus on a particular round of inflation, and following those given dollars, will be neutral in the long run, as they spread throughout the economy, increasing prices and incomes, then somehow that means inflation in general is also neutral over the long term. Nothing could be further from the truth.

So David you are happy about short run theft(non-neutrality), because in the long run there is “money neutrality”? You are ridiculous.

The primary dealers earn billions of dollars of fees off your bond, money printing scam every month. There are many of angles for making illicit profit when you print trillions of dollars at will, you are sophisticated to figure a couple of them out.

You work for a den of thieves admit it.

The author should look in the mirror before he calls Ron Paul a pinhead.

It is not surprising to read a intellectually bankrupt Fed economist call Ron Paul a “pinhead”, ad hominem attacks are all that is left when a argument cannot be attacked with logic.

David Andolfatto admits that printing money will increase the cost of goods, but he thinks it doesn’t matter because wages will go up the same amount: “money neutrality”…therefore everything is fine nothing else to talk about right?

Andolfatto neglects to think about or explain why the people who get the money first(the primary bond dealers, corrupt politicians, politically powerful corporations, elite bankers) will get to spend the money on low priced goods while we the masses get stuck with the higher prices. If Andolfatto truly believed in the absoluteness of money neutrality then it seems he would have no problem with counterfeiters! His argument is absurd and his attack of Ron Paul is an embarrassment to those who still think the Federal Reserve serves a legitimate function besides empowering the elite.

Total agreement there Jimmy. It just amazes me how we human make things so complicated, why don’t we just go back to before the FED then we don’t need to depend on the FED for our pay raises.

Social Security payments come with a cost of living increased (COLA) that is tied to the CPI.

Nice try Davey. I like how you are turning into a psychologist and getting in the mind of Ron Paul.

“… he is suggesting that by cutting the value of paper, the Fed has somehow diminished the purchasing power of your labor …”

I’m pretty sure Ron Paul is not arguing that long term wages don’t eventually follow the direction of overall prices. He’s talking about (read the thousands of other articles he’s written) the short term spikes that the Fed and friends use to transfer wealth. You know, the ones they have advance knowledge of so they can pull money in and out of certain investments? If you don’t understand, ask your boss.

I think Ron Paul is right on this one… hope he runs this time around.

The author of this article is woefully misinformed. Of course, the phrase “creating money out of thin air” is a shorthand. Even Ron Paul knows that in practice the situation is much more complex, but the practical effect is as if it were creating money out of nothing. See Robert P. Murphy, ‘The Fed as Giant Counterfeiter’, .

Regarding the money illusion, it is a flawed Keynesian assumption. Ron Paul is an Austrian economist, so obviously he does not buy into Keynesian argument. As NBER member and IMF chief economist Olivier Blanchard has said, there is no real evidence: “All the models we have seen impose the neutrality of money as a maintained assumption. This is very much a matter of faith, based on theoretical considerations rather than on empirical evidence.”

How do you miss such obvious facts David? Okay, so, your wage has increased since 1913, So what happens to the savings of a 70 year old man? He has been saving his money for 40 years. Do is savings keep up with inflation?

By the way, yes pay eventually rises as prices do but they are always well behind. If i was to get a raise every time prices went up due to the fed then my employer would have to constantly pay me more almost every single day. The bankers benefit because they get the new money first when it is still worth more because the market hasn’t realized it yet. By the time that money trickles down to me I have already been paying higher prices for a year if not longer.

Your point about Congressman Paul’s statement about oil is also lacking any serious thought. Yes oil might be 5 dollars a barrel and yes we would be making less money. Does that mean nothing would be effectively different? NO!! When we were on a gold standard before the Fed was created by private bankers money actually gained value! Something that cost 100 dollars at the beginning of the 1800’s cost only 60 by the end of the century. In a capitilist market with real money and without a central bank manipulating it prices go down!!!! So yes, in actual terms, oil would be much more affordable than it is today, and we could actually save for retirement without having to risk our money in a stock market or other risky ventures!

Seriously, how do you have this job? Do you even think about the things you write about. It’s fools like you that destroy Ron’s honest message. I just pray that some will be smart enough to look into the things you say.

Thanks, Dan. I think.

People,

I’ve read up to this point… you’re losing your time. The guy said he works for FED. What do you expect him to do? To chant End the Fed?

David, in addition to what Jimmy said, you’re also missing the issue of savings. If you had $100 saved in 1913 would then Fed substitute that for $2,000 of todays dollars? No- ones savings are greatly diminished- and they are constantly being diminished when the Fed prints.

I do agree with you that a move to the gold standard would not mitigate the government’s ability to tax, but that’s another issue that needs to be resolved. It needs to be seen that the governments use of forced taxation is immoral and anti-liberty- it needs to end.

BTW, if you want to be taken most seriously and provide useful political dialog (something much needed in this country) you would do yourself well to drop the ad hominems like calling people “pinheads”. Just my $0.02.

Good day.

Bryan

Bryan,

David, in addition to what Jimmy said, you’re also missing the issue of savings. If you had $100 saved in 1913 would then Fed substitute that for $2,000 of todays dollars? No- ones savings are greatly diminished- and they are constantly being diminished when the Fed prints.

I do agree with you that a move to the gold standard would not mitigate the government’s ability to tax, but that’s another issue that needs to be resolved. It needs to be seen that the governments use of forced taxation is immoral and anti-liberty- it needs to end.

BTW, if you want to be taken most seriously and provide useful political dialog (something much needed in this country) you would do yourself well to drop the ad hominems like calling people “pinheads”. Just my $0.02.

Come on now. No one saves by sticking money under the mattress. Here, let me refer you another blog piece of mine that may give you some pause:

http://andolfatto.blogspot.com/2011/02/is-gold-good-store-of-value.html

I didn’t mean to suggest that Paul is a pinhead. I meant to say that he can have pinheaded ideas at times. Just like all of us. But you are right, I should not have said it. It just gets people riled up for no good reason. Thanks.

Thanks for the reply. I agree, putting money in a mattress isn’t a good way to go, and I’m not arguing in favor of gold (but many do). Fed or no fed, there is no perfect way to store wealth. The issue is that you have to work to assure your stored Fed notes keep above water whenever the Fed decides to print- it’s a major time sink and you are at the mercy of the Fed board, not the free markets. I point this out as it’s relevant to the money neutrality theory. Still, I agree that the “dollar is only worth $0.04” position needs context and calcification in which money neutrality is a part of. Some Ron Paul supporters do get hysterical about this argument, it’s a recognized problem.

There are still a lot of other issues with Fed printing that others have pointed out here, such as who gets the new money first is better off since the inflation hasn’t hit the market yet.

My most important personal issue with the Fed is that I’m forced to use Fed notes, most notable through forced taxation. If I wasn’t required to use Fed notes I wouldn’t, thus I wouldn’t care much what monetary policies the Fed adopts. Without a built in legal demand, backed with deadly force, a fiat currency would quickly die. The fundamental issue is the immorality of forced taxation, the Fed is just peripheral to this. If you think that forced taxation isn’t immoral I’d love to hear the argument.

Thanks again.

Bryan,

Quote: I agree, putting money in a mattress isn’t a good way to go…

Don’t agree with this guy, he expects this so that he can prove to the audience that you’re losing your argument…

Putting money in a mattress should preserve the value of the money (like when putting gold in a matress preserve it). Nobody sayd it’ll increase it, do they? ( Do you see the straw man argument David is putting?)

What these guys want is give them the money… so that it won’t be your anymore… :-)))

Adrian, to be most correct, my statement should have said that “putting Fed notes in a mattress isn’t a good way to go”. I actually thought that David’s straw man was that if I didn’t like Fed notes that gold the was the other option. Saying “money” is totally ambiguous to the casual reader, so thanks for pointing that out.

David

When was the Fed created?

When was the Great Depression?

How many periods of panic, recession, and depression happened before the Fed?

How long a period of time was that?

How many have happened since the Fed was created?

How long a period of time was that?

There is great reason to get riled up. Trillions of dollars have been straight up stolen from the people and you guys are expecting me and my children to pay interest on it the rest of our lives. Sorry not happening. A revoultion is coming.

The gig is up…people are saving under their mattresses…just not in cash, silver hit $37/ounce today…physical precious metals people add more every month and the COMEX is going to default.

There are hundreds of thousands of americans and millions internationally who are awake. I bet you think food prices have nothing to do with monetary policy?(would be interested to know what you think actually). I have to hand it to you, I respect you for talking with people…most fed bankers run to their keynsian fetishists clubs and hide.

David, you’re a central planner and a socialist. You fix prices and work for a criminal enterprise. The Fed only exists because of a government mandate. Legalize competing currencies and the Fed would be out of business tomorrow. You dream of being on Ron Paul’s intellectual level, but you deny reality. Anyone who works for the Fed is a socialist, central planner, and scumbag.

Why don’t you just have a listen to these from the floor of Congress and see how the FED was COMPLICIT in the frauds committed upon the entire working class of America.

http://www.youtube.com/watch?v=ld5tERIBvsg

http://www.youtube.com/watch?v=n0NYBTkE1yQ

http://www.youtube.com/watch?v=rCWXrMCGJT4

http://www.youtube.com/watch?v=PXlxBeAvsB8

http://www.youtube.com/watch?v=mXmNpdYpfnk

Bernanke sent TWO Regulators to look at Lehman’s books…What kind of schmuck do you take me for?

Tell me what the FED has done in MAIN STREET’s Best Interest PLEASE! PLEASE enlighten us with your Wall Street wisdom….

Don’t hold your breath waiting on a reply to this small piece of truth!

Mikeykeat,

Well, you can start by looking at this:

http://andolfatto.blogspot.com/2010/12/oh-outrage.html

The Fed has remitted record revenues to the Treasury (the American people) through its emergency lending facilities and purchases of American mortgages (MBS). I am not sure how this constitutes a bailout. Perhaps you would have been happier if the Fed lost money on these facilities? You tell me.

And our “Treasury” made sure Goldman Sachs got 100 cents on a dollar reward on their “bet” with AIG covering the back end of the mortgages they knew were going to blow up. And then our “Treasury” gave away another $6 Billion of OUR TAX Revenue to Goldman Sachs as evidenced in the article below:

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a6bQVsZS2_18

So they get a tax rate reduction from 34% down to 1%. Then Lloyd Blankfein raises his annual salary from $600K to $1.8 million?

http://www.businessinsider.com/lloyd-blankfein-2-million-salary-2011-2

It can be argued to the cows come home the FED acts in America’s and its Treasury’s best interest. The issue is the FED acts ONLY in the best interest of a thin slice of elites and banks.

From the link: http://dealbook.nytimes.com/2010/04/21/financial-debate-renews-scrutiny-on-banks-size-2/

“The banking industry has become much more concentrated as it has grown in recent years. In 1995, the assets of the six largest banks were equivalent to 17 percent of G.D.P.; now they amount to 63 percent of G.D.P. Meanwhile, the share of all banking industry assets held by the top 10 banks rose to 58 percent last year, from 44 percent in 2000 and 24 percent in 1990.”

As Woodrow Wilson said after signing the Federal Reserve Act:

“I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated Governments in the civilized world no longer a Government by free opinion, no longer a Government by conviction and the vote of the majority, but a Government by the opinion and duress of a small group of dominant men.” -Woodrow Wilson, after signing the Federal Reserve into existence

Ron Paul has thankfully awakened the REAL PINHEADS (the US Citizenry inclusive of myself) to the fruadulent moral turpitude perpetrated by the FED on the common working class of America. How can anyone present an arguement that it is in the interest of America to have a secret private group fund our Governments operation WITH INTEREST as opposed to the financial framework initially assembled by the Founding Fathers? The same Founding Fathers whose revolution was against the yoke of servitude to Foreign Banks.

We’d be happier if you’d let Goldman Sach and JP Morgan go bankrupt…no need to print money to pay AIG CDS debts to the big banks and then turn around and tell my family to pay interest on that new debt.

Hey why were house prices so inflated anyway? Remember that money you printed 2000-2006? You made my first home purchase a lot more painful. Taking food out of my kids mouths…feel good buddy? Still think that your neutral money printing had nothing to do with home prices inflating to 7 x income when it was about 2 x income early in the century?

Another example of the theft,

If I purchase a one year treasury bill that currently yields less than one percent interest at the end of the year I would have have $101 (even less if I have to pay taxes) but because of the current two percent inflation I would actually have less purchasing power. It works out as a pretty nice game if you are the treasury.

Johnc,

Sure, that’s IF you purchase that Treasury note.

My advice is: don’t purchase it.

No one is forcing you.

> Sure, that’s IF you purchase that Treasury note.

> My advice is: don’t purchase it.

> No one is forcing you.

Here you show a fundamental misunderstanding of economics. I purchase dollars with my labor! The vast majority of people who actually real work for a living do that!

We are forced to use US Dollars because of legal tender and tax rules.

Do you not comprehend that us serfs are compelled by the government (and the Federal Reserve) to be involved in a scheme that we don’t want to be involved in AT ALL???

It is a scheme that we know exists solely to profit the “financial services” industry at our expense. There is no other excuse for it.

Your First “point”

You missed the mark on this one as you don’t understand the nature of inflation. Specifically, the lag between wages and price inflation. If wages magically increased with prices the moment money was created we probably wouldn’t even have a word for inflation.

But that is not the case now is it. Since inflation is haphazard, wages in some sectors can lag years behind prices. This is where the injustice of the inflation is. And Guess who suffers the most from this lag? The working poor! The people at the bottom of the pyramid who get the new money last. Shame on you.

Your second “point” . If money is a medium of exchange in which value is attached. What is the medium called money ultimately exchanging? Labor. When you debase money you debase our labor. In lieu of a barter system, we have no choice but to use your Federal Reserve notes to trade our labor due to legal tender laws.

You conclude your article with some rambling nonsense that doesn’t serve to make a succinct point. But it reveals much confusion on your part as to where Mr. Paul stands on and what his reform would be. (yes your precious Fed would be consigned to the dust bin of history but you can’t correctly identify his alternative.) How can you not know?

http://mises.org/daily/3497

I appreciate your attempt to contribute to the issue, but you missed the point. Most have already stated, so I am probably being redundant, but I wanted to speak my mind. The comparison is made to theft because savings are essentially depleted to pay off debts (which also lose value as the savings lose value, unless the interest rate is higher, in which it would remain the same. But considering the Fed tries to keep interest rates ridiculously low, this is clearly not the case). In fact, paul even refuted the “everything stays the same” argument, as have many other austrians.

Inflation does not effect everyone evenly and at the same time. It benefits whoever gets the new money before everyone else. In the end, everyone may have the same real wages, but the way the got there is unequal. Some people get the money before prices rise, making them better off. But most people see the prices rise before their wages, hurting them. It is simply a more devious example of distribution of wealth, masking by helping the economy and the American people. It is so successful at tricking people that even honest people like you, David, are prone to its deception.

Bravo Jimmy-

Bravo!

I must admit- I am greatly appreciative of the authors TONE in this editorial piece

Neutrality is an interesting point, but it is not enough to discredit the congressman’s position as ILLUSION-

I look foward to reading the authors response to Jimmy , because the very factors stated so eloquently is exactly why there is an everwidening gap between lower and upper class-

Once you retire , become disabled, or loose employment- there is brutal consequences sending these formerly productive persons into fixed budget POVERTY-

In turn— leaving houses and assets to be claimed and sold by the government in reverse mortgage schemes set up to take care of Medicare or Medicade recipients in their later years– but for a price- Robbing families of hard earned legacies because of the unexplainable increase in medical cost-

What cost $1 at a doctors office in 1913 , now cost $5000 due to profiteering ( as opposed to the $20 you stated)

Many commodities have gone this route-

So, where is the answer there?

I smell either inflation or another problem that is less talked about-

Joint Monopolies of sister industries that is condutive to cost of living increases- that should be offset by your neutrality spin— but are not-

Haves vs have nots 101

David, stop hiding under your desk and respond to the legitimate claims that your piece is factually and philosophically wrong. To do otherwise will confirm this as nothing more than a hit piece, lets talk David.

Handyman,

I was not hiding under my desk. I was just not aware that this discussion was taking place. I think it was you who alerted me to it via an email. Thank you for doing so.

“I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated Governments in the civilized world no longer a Government by free opinion, no longer a Government by conviction and the vote of the majority, but a Government by the opinion and duress of a small group of dominant men.” -Woodrow Wilson, after signing the Federal Reserve into existence

David,

How can you not know this? Better question – How the hell did you get a job with the FED? Never mind – they don’t hire people that think for themselves.

My guess is your stalling for time. Tick – Tock

This guy is a professor of economics!!!! How does someone so clueless teach others? Gee, I wonder why so many college kids are protesting at the statehouse in wisconsin? Clueless teaching clueless.

Andolfatto is inconsistent in his argument.

He first argues price-to-wage ratios and then admits to seigniorage which is a tax on anything dollars. He insists this is small, and even if he looks at only the portion for the federal government, it is not small.

But, going back to price to wage ratios, he forgets that there is a central source of the creation of money so there is a dynamic effect. Just as surfers ride waves, so do those close to the source of money.

Even without the wave of money, just the noise created by trying to match prices and wages in shifts as the pool increase through this wave is damaging.

In addition, people would made different choices were money stabilized. The difference between what one earns in savings in that case compared to under the Fed could be as much as 12%. Instead of losing values, savings might actually grow in wealth. Folks would have homes but home mortgages would be rare. Americans would own America. People would make better investments.

The repeated Fed argument that both wages and prices go up does not wash.

If you work at the Fed all I can say is go to hell and I god dam hate you. I pray that famine and pestilence hits you and your family.

Whoa, Joe… simmer down. While I don’t agree with the author’s article any more than nearly everyone else who has commented here, resorting to vulgar verbal attacks does nothing to further meaningful discourse. In the end, the author is likely employee #2356 with the Fed, works behind a desk shuffling papers with a very specific job function, earns a paycheck and goes home to try and take care of himself and his family just like you and I do. Even Bernanke is nothing more than a puppet controlled by the unseen and unknown. It’s not the author’s fault the Fed is here or even that they do what they do.

Taking the communicatory high road is immensely more effective to getting your point across in the “long-run”… pun definitely intended.

Tone down the rheteric? Not a chance paper boy, J.P. Morgan, Rockefeller dick sucker. Thief!

David.

Do you believe in the Mundell-Tobin effects? There is a long-standing debate about the Fisher hypothesis – independence between real rate and expected inflation. The data summarily rejects that. Run a VAR of real consumption growth and price changes and you will see. In fact, the grainger causilty term suggests that higher inflation is associated with contraction of real activities. Anyway, as an economist I am sure you don’t like price fixing. But, you do like to set interest rates. Care to comment?

-FM

The price-fixed comment is a good one. As you suspected, my free-market tendencies lead me away from the idea that price-fixing by a central authority is good. And indeed, the Fed, via its “Taylor rule” policy can be accused of fixing the short-term nominal interest rate. An alternative rule would be to fixed the rate of expansion of base money, along the lines that Friedman advocated long ago.

Which begs the question if you’re going to be fixing a certain rate of expansion of the monetary base, why not just leave it completely fixed? I.e. why have an expansion rule instead of a non-growth rule? In what way does the economy benefit from an expansion of the monetary base?

If we are going to follow Friedman’s proposition, we do not need a Fed. We need a room with a machine and no keys. If there are serious economists engaging in monetary policy at the Fed, tell me how come they aren’t honest about moral hazards of central planning. Risk-free interest rate is the price of certainty equivalence. Fed monetary policy actions perturb that equilibrium in the market. And don’t even start with targetting BLS inflation? It has become a running joke.

Anyways, my point is Ron Paul’s criticism of the Fed is very valid. I also think you mischaracterize his support for the gold standard. It is certainly the case that he thinks favorable of the gold standard, but he advocates a competing currency. I think he has also introduced bills in Congress to legalize competing currency. As an economist, I hope you don’t fear a little competition.

this guy aviousely dosent have a life and wants a pice of the pie to be famouse talking about sewage crap but dont blame him there is many like him. But,

RON PAUL HAS BEEN BUSTING HIS ASS FIGHTING FOR OUR FREEDOMS SINCE THE 70’S HE SPEAKS TRUTH AND INSPIRES ALL WITH HIS COURAGE HE IS A LEGACY AND A HERO TO ALL GOD BLESS RON PAUL AND BLESS ARE NATION…

ADIN…………

“”Yes, what cost $1 in 1913 now costs $20. But so what? Money neutrality states that if you were earning $1 per hour in 1913, you are now earning $20 per hour (and even more, if labor productivity is higher).””

Oh this is the best one in the white shoe boy’s piece. He don’t care because he’s never worked a real day in his life. He’s never worked in the real world. He’s never had to pay the bills. He’s a god dam white shoe boy. He’s never worked a day of labor in his life. He’s probably never raised a family. He thinks he cool and can dismiss the hate and anger, but the white shoe boy is wrong. END THE GODDAM FED! Return me to sound money white shoe boy.

Uh, thank you Joe.

For the record, I worked for many years in the construction sector, alongside my dad. I lost my job in the recession of 1982. I do not blame Fed Chair Paul Volker for that experience though.

All I can say is my 85 year old mother still works and earns her keep, while lowlifes collect free handouts. She is robbed of her earnings with higher prices for goods. And this white shoe boy and his money printing machine and assholes in Washington with there tax machine tell her to pay more with less. I can’t wait for the spark. Bring it on white shoe boy!

Then you state:

David you state:

“There is this old idea in monetary theory called money neutrality. Money neutrality means that larger quantities of money ultimately manifest themselves in the form of higher nominal prices (and wages), and not on real quantities. No serious economist disputes the idea of long-run money neutrality.”

The most important is “in the long run”. As everyone above has pointed out the working poor trying to save and increase their wealth are on the wrong end of the long run and as such loose. In truth, because of continuous inflation those working poor never catch up, they are always losing purchasing power behind the inflation curve.

You then state:

“Yes, what cost $1 in 1913 now costs $20. But so what? Money neutrality states that if you were earning $1 per hour in 1913, you are now earning $20 per hour (and even more, if labor productivity is higher).

So there you go, the Fed is responsible for increasing your nominal wage by a factor of 20. How do all you workers out there like them apples? Ron Paul wants to rob you of these wage increases!”

Do you not see the contraindication in your conclusion? Your money neutrality theory contradicts the idea of wage increases. It actual states we have had no wage increase but stagnation even in the face of higher efficient productivity.

So in conclusion, being on the wrong end of the inflation curve, coupled with your money neutrality example, that states we have had no real wage increase but stagnation, workers are actually always losing purchasing power and the ability to create wealth through savings to the Fed.

So David, “How do ..you.. like them apples?”

Boo yah! David, have some crow with your apples.

Fudwamper:

I’m afraid I do not see the point you are trying to make.

For the record, real per capita income (and virtually all real quantities, including real wages) have been growing on average at about 2% per annum over the last century in the US. That’s fast enough to double real incomes every 36 years or so. I do not think that inflation, or Fed policy in general, has any material impact on this real rate of economic growth. This is my point.

If fed policy has no impact on the real rate of growth, why have fed policy at all?

Hey guys I ahve to back David up. Counterfeiting actualy helps the economy… or at least it doesn’t hurt it in the long run. Gee when do I get my job at the Fed? I could be a good justifier of theft David, see?

I appreciate that the author of this article does not use the usual degrading and dismissive language when discussing this issue.

I would also love to hear a counter argument to Jimmys (and others) points, as of yet I have never heard anyone give a suitable reason why Ron Paul (and the entire Austrian economic theory) is wrong here. From what I have seen inflation is nothing more than an attempt to force people to make investments they would not otherwise make (risky) just in order to stay ahead of the curve. This might be fine for people who make there livelihood in the financial sector, but for normal working people these investments are a serious burden.

To those leaving disrespectful comments: As far as I can tell Ron Paul has made it his life mission to encourage dialog on these issues. I believe you are doing him a disservice when you shut down these discussion with rudeness vs encourage them with reasoned positive responses.

Here is an author who is trying to bluff it — just like the Fed. Here is a writer who actually congratulates the Fed for persistently diminishing the purchasing power of the dollar. To counter his own stupid comparison — this means that a silk tie that would cost you $1 in 1913 would now cost you $20 now. His glee at earning a dollar an hour in 1913 and earning 20 dollars per hour nows is so remarkably dumb.

Just because the dollar digits go up, does not mean that you can necessarily purchase more for your buck does it?

It takes a real blind idiot to completely misunderstand the importance of actual purchasing power.

Bill Jencks,

I’m afraid you missed the point. My claim that the Fed was responsible for increasing incomes by a factor of 20 IS ridiculous. It was meant to be ridiculous. But it is exactly the SAME argument that Paul uses, but in reverse. Open your eyes, and ye shall see.

So, YOU WORK AT THE FED?

How do you define a dollar, David? You failed to accurately define the currency you help to advance.

Inflation causes chaos. Not the opposite.

John Dadis:

I thought it was funny when Paul asked Bernanke to define the dollar (Beranke’s response was equally funny).

The term originates from the German “Thaler.” Historically, it measured a specific weight of gold (not uniform across all dollar measures). With the abandonment of the gold standard, the “dollar” is now simply an accounting unit. It is like asking me to define what I mean by an “inch” or a “mile.”

If the Fed was in charge of measurements, there would have been 12 inches in a foot yesterday, 13 inches today, and would be 14 tomorrow.

Edwin Vieira has answered the question based on the history of the U.S. monetary system. You might find this interesting.

http://www.fame.org/HTM/Vieira_Edwin_What_is_a_Dollar_EV-002.HTM

So David when the fed and income taxes were instituted I believe the average wage was around $2000 that was not taxed which is the equivalent of around $69000 in silver or $55000 in gold the non manipulate-able by politicians and bureaucrats form of money that comes in a specific weight that cannot be changed.How much would the tax be on the equivalent income be on the silver or gold be??A lot more than zero I suspect.What I believe most people object to is the non stop justification by people manipulate and profit from the current system.This system will end because it doesn’t make any sense for the people under the well off and connected.I know personally a developer who is also the head of the chamber of commerce who says things are getting better however I run a business that has laid off a person who has worked for 17 years and reduced the hours of another long term employee,the difference is access to politicians and credit. Things look great with the right perspective.

Money illusion is a false concept as the third party, the fed, decide the value of money. It should be fixed to the market, which would still change, but not based upon the whim of a small group of private bankers.

Inflation really is a tax on fixed income and savings. It also gives the illusion of growth.

Maybe if I could print money in secret everything would be ok. I would.

wow i have never read more outright twisted bulshitt in my life. When the money supply inflates the only reason a person’s wages go up is because your forcing them to make more money due to price increase. They arent being paid more. You are taking money straight from EVERYONE and putting it where you want. YOU ARE A LIAR AND FUCKING IDIOT.

How ironic is your name supposed to be?

hey pinhead

how about people on fixed incomes and those who do not receive a cost of living raise?

how about those who save and watch as their saved dollars buy less each day?

the purchasing power of the dollar goes down which robs these people of their wealth

ron paul is exactly correct about this

you can try to execute your agenda and marginalize the truth sayers but in the end you will fail because you can only keep people in the dark for so long

What makes you think that in a deflationary environment, your nominal payments would not be decreasing at even a faster rate?

when`s the last time your taxes and rent went down?

The author of the article seems to like many of Ron Paul’s ideas. If his only problem is with Ron’s take on the Fed, he should have no problem voting for the man. Ron is clearly more educated than the other potential candidates and he is honest. What else does a voter need to know?

You almost have it right.

First, if I did vote (which I am not permitted to do in this country), I could do worse than cast a vote for Ron Paul.

Second, it is not that I am attacking Paul for attacking the Fed. I am attacking specific arguments he makes in his attack of the Fed. These arguments are silly. He should focus on the arguments that make sense. There is a legitimate debate to be had over the proper structure of the money and banking system in an economy.

In 1913, Congress thought it was a good idea to create the Fed. The Fed is a creature of Congress. The Fed behaves in the way that is stipulated by the Federal Reserve Act — an act of Congress.

If you do not like the Federal Reserve Act, then fine. Ask Congress to revoke it. But what is the point of “blaming the Fed?” I don’t get it.

You’ve said:

“In 1913, Congress thought it was a good idea to create the Fed. The Fed is a creature of Congress. The Fed behaves in the way that is stipulated by the Federal Reserve Act — an act of Congress.”

“There are always people in any society that feel hard done by, that fall by the wayside, that feel victimized by the “power brokers.” The Fed is simply a convenient scapegoat. I sometimes wonder whether this was the reason it was created by Congress.”

YOU’RE WRONG.

Congress is the scapegoat, and the Fed is a creature from Jekyll Island.

You need to find an hour, a comfortable seat, and listen to the following speech before you repeat the above quoted *propaganda* ever again:

VIDEO: https://www.youtube.com/watch?v=lu_VqX6J93k

if you want to call ron paul`s argument silly-

please give us your definition of inflation-and please explain to us why the dollar has lost about 94% of it`s buying power since 1913….

The Fed was created in response to the crash of 1907 that was due to fractional reserve banking which in some ways is akin to a Ponzi scheme (in a Ponzi scheme if a large fraction of investors withdraw their assets, the system collapses. The same is true with fractional reserve banking)..

Technically the Fed is unconstitutional because the constitution prohibits issuance of bills of credit

14 trillion “dollars” in debt, good job fed.

Money (paper reserve notes) is money because people still think it is and can buy stuff. People quit thinking that its money, it quits being money.

That’s the beauty of any kind of “consumer confidence” inspiring headline that may say something like, “Fewer Jobless Claims Last Quarter” or anything as vague as that… and guess what? 50,000 “consumers” thinking all will be well again, will run out and buy flat screen TVs… on credit probably.

David, it is difficult to shake someones hand with the right hand and slap them in the face with the other, isn’t it? It didn’t work out for you this time. How much did the Fed pay you to write this article? Or is that rolled into your university salary?

Jeff,

Yes, it doesn’t seem to have worked out. I should not have called the Congressman a pinhead. But then, I didn’t expect my blog to picked up by Wallstreet Pit. There ya go.

Btw, I was not paid anything to write that article. It reflects my own honest opinions. The purpose of the blog is to stimulate debate. The wage I earn is in the form of increased understanding. Thanks.

Pablo Escobar:

Regarding the money illusion, it is a flawed Keynesian assumption. Ron Paul is an Austrian economist, so obviously he does not buy into Keynesian argument. As NBER member and IMF chief economist Olivier Blanchard has said, there is no real evidence: “All the models we have seen impose the neutrality of money as a maintained assumption. This is very much a matter of faith, based on theoretical considerations rather than on empirical evidence.”

You suggest that I am a “Keynesian.” I am not. So right off the bat you have something wrong. And Blanchard is talking about short-run non-neutrality. My post is about long-run non-neutrality. You should learn to read more carefully before claiming that somebody is “woefully uninformed.”

What an embarrassingly horrible column.

Dear David, any prejudgment I might have made against you prior to reading this may well have been because I did not know you. But now that I have read this, I know without a doubt that you are either utterly dishonest or a very, very, dim bulb.

You write, “I ask you…how embarrassing of an answer is that? I mean, maybe oil would be trading at $5 a barrel. But what he is implicitly suggesting is that your nominal wage would not be scaled back in proportion.”

Pardon? So you agree that what he says may be true, but you disagree because of something that you claim he implies? But the only reason you have for thinking he implies it is that you made it up? Nowhere in any of the quotes you provided does Ron Paul imply such a thing. Nowhere does he deny the principle of money neutrality, either implicitly or explicitly. As I would have hoped you would be aware, Ron Paul is pretty well-read in the Austrian economists, who clearly taught money neutrality, and who also clearly and cogently argued against central banking and the so-called “inflation tax” that it necessarily entails, which redistributes wealth from those holding old currency to those getting new currency. The neutrality of money doesn’t in any way mitigate against this.

I also noticed how you conveniently only spoke about the affect of devaluation of the dollar on our wages, without mentioning its affect on our savings. That can’t have been accidental. You must think we’re all pinheads as well.

Eric,

Well, maybe I’m not the sharpest tool in the shed, that’s true. But I suggest that your assessment of my post is based on your own complete misunderstanding of what I am trying to say; and that this, quite possibly, is the consequence of my inability to express ideas clearly.

Thanks.

David,

This article shows us many things under the surface. It’s unfortunate that you felt the need to attack one of the only honest politicians, and also understands economics.

Clearly you are beholden to your statist allies at the Fed, and you are cowtowing in an attempt to show loyalty. I’m guessing that a new position opened up and you are hoping to better yourself somehow financially since you could not succeed in the real world of economics, being that you lack certain cognitive abilities.

Your ethics and character are not impressive either as you fail to properly refute the many good points raised in the above comments.

Big gov’t trumpeteer and very litle substance is all I read in this hit piece.

Rational Thinker:

You should change your handle.

I think it is my right to attack silly ideas. Ron Paul may know more economics than most politicians, but he is an MD, not a professional economist. I don’t lecture him on how to conduct a hernia operation.

And if I am so beholden to my “statist allies at the Fed,” how do you explain this post of mine: http://andolfatto.blogspot.com/2010/12/okuns-law-rules-fomc.html

Strike two for you.

And as for the ethics and character charge, strike three.

You are out.

“I think it is my right to attack silly ideas. Ron Paul may know more economics than most politicians, but he is an MD, not a professional economist. I don’t lecture him on how to conduct a hernia operation.”

This begs the question: What/who is a *Professional Economist*?

I would say, if Ron Paul is not a *Professional Economist* — nobody is, because he has been consistently correct in the most epic ways where all of his opposites have been consistently wrong in the most epic ways.

So far I have to say the absolutely worst comment was suggesting that Ron Paul is wrong because he is a Doctor. Sorry, but a doctor can be correct about something regardless of his profession. I am a musician it’s what I do for a living. However, that doesn’t mean that you can’t play music even better than me (if you study and pracitce hard enough)just because you chose a different line of work.

Also your insistance on the long term effects of inflation while ignoring the short term effects is were you simply lost this debate. I’m sure you know this though.

People who support the idea that it is good to give the monopoly rights to printing money to a small secretive group have employed thousands of professional economist. These economist all work at the Federal Reserve Bank. They fund significant portions of all the major colleges. These economist sit around all day and thank their luck that they have good jobs. When they are needed to write articles defending the institution that pays their salary they do so. They say it doesn’t matter if they print money(has no affect on who becomes rich and who doesn’t)…but IT IS EXTREMELY IMPORTANT THAT THEY KEEP THIS POWER …and if you don’t support it they call you names. David admits in this Q&A that yes it is theft in the short run…TOUGH SHIT. Do something about it bitches.

David, you didn’t come out from under your desk for very long now did you? I am still patiently waiting for a response to many of the opposing opinions on this topic. I really need for you to explain a few things to us.

I think your students will be sorely disappointed if you do anything less, just as I will be.

Handyjob,

If you have a question to raise, raise it.

Stop playing coy.

I learned a lesson a long ago, don’t get into conversations that I am not qualified to enter. I read these blogs for my own edification. There is a presidential election in 2012 and I’d like to be an informed voter. If you will simply respond to the many questions regarding your piece it will go far in helping me decide who is full of hot air and who is not.

I realize that you depend on the less educated to make ill-informed statements as they are so easily disemboweled. I prefer to listen, so I’ll just stand by and hope that I get more than just entertainment from this post as the only substance that can be found thus far is in the comment section.

I agree with you david. The dollar devaluation that Ron Paul so often criticizes doesn’t have nearly as big an impact as he and a lot of supporters seem to think. However a lot of his other arguments are very true. For instance his criticism of the Feds easy monetary policy and interest rate manipulation are still good points.

Morgan,

Precisely. And the silly arguments he makes detracts from the force of the good ones he could make. His rhetoric simply helps fuel unthinking anger; and I think we see plenty of evidence of this here.

You have reduced all the previous posts to “unthinking anger; and I think we see plenty of evidence of this here”

That was a reasoned and well supported response to the posters.. Thank you for clearing things up for me and perhaps many others who unsure of why we felt the way we do. It’s anger, you are right.

What is the price of gold telling you David?

It’s amazing to watch the Fed ignore Gold prices…I am not in favor of a gold standard but their needs to be limits to what the federal reserve can and cannot do. Why not allow competing currency and see what the people choose to save their wealth in. I bet it wouldn’t be dollars!

Nathan,

You are free to convert your USD into the currency of your choice, or the assets you want (real estate, stocks, gold, etc.). And, in fact, that’s what people do when they save (for retirement, for example).

And if you want to see how the return on gold compares to the stock market, take a look at this:

http://andolfatto.blogspot.com/2011/02/is-gold-good-store-of-value.html

Sure David, I have that option as an investor but what about my elderly mother or someone that knows nothing of investments. Most folks simply do not have the $$$ or the options to get out of the dollar and it’s illegal to issue any other currency to compete. How are poor people supposed to go buy real estate or stocks with meager amounts of money? They are forced to save with US Dollars, or not really save at all. With that dollar comes 14 trillion of debt hanging alongside. 14 TTTTTTRILLLION! Give the poor folks a legal alternative

Your viewpoint on this is telling…you are speaking to 5% of the population that has that kind of money. It’s the 95% of the masses that you should be explaining why you erode their savings year in and year out.

First of all gold is not an investment as it does not produce returns .. It is money.. there is a huge difference between the two..

Also regarding storing wealth in other assets is more difficult because we need to pay taxes if we purchase gold/euros/real estate/stocks etc and we cannot use gold to purchase items because of the legal tender laws…

David, you miss the point all together. Its true as you said, that wages also increased. Where someone made only 1 dollar in 1913, they make 20 dollars now. The problem here, as mentioned already, is that wages to not increase at the same rate with inflation. Inflation happens, then a year or two wages start to increase. All during that time savings are eroded, people spend more on their purchases, in general the middle class gets poorer while you and your elite stay on top. I’m sure you think thats fine.

Another problem is that wages are usually increased based on the CPI. And that is how the Government and the Fed measure inflation. The problem is that the CPI calculations change over time to make inflation look better. For example, not measuring food and energy prices. What do we spend most of our money on? Yeah, food and energy. What has been increasing in price at frightening rates? Yeah, food and energy. What has been told (lied) to us? Inflation is low. So while we are spending more of our money on food and energy, eroding our wealth, we are not getting your Cost of Living increases, because the Government and Fed decide to make inflation look low by not measuring it properly.

Tell me, why in the middle of the century could 1 person work in a family and could afford a home, car, food, education. But now 2 people need to work to afford a home, car, food, and not education… Inflation. Because your Fed has been printing money at the request of Congress. Because its not limited by anything so you can keep increasing the total dollars.

Tell me, who in America has had their wages increased by the same amount that the Fed has increased the money supply? I have not. No one I know has received a large increase in their wage. Maybe several years from now when the damage and erosion has already happened, when its too late, will our wages start to creep up.

The power the Fed wields of being able to print up money when needed is a power that no one should be allowed. Before you say it, No. Congress CANNOT print up money. America is ONLY allowed to use GOLD and SILVER as money. That’s it. Be happy that you have been able to rape Americans of their wealth for almost 100 years, it has to end. Either Americans end it and keep our sovereign state, or you in the Fed keep destroying the dollar to the point where it collapses all together and force us to run to an International body to bail us out. You make me sick David.

Or maybe you just wrote this about Ron Paul to get traffic to your article. Many people seem to take advantage of his popularity that way.

I apologize. Maybe you, David, do not make me sick. But Bernanke, Geithner, and the rest of these big Government Democrats and Republicans (or RHINO) make me sick. I was watching an interview with Geithner at one of the International Banking conferences on CSPAN, and it was quite obvious he knew that he was lying in his answers. You could see it in his laughs and smiles while answering that he knew, and knew that we knew, that he was actively deceiving and lying. I guess he felt comfortable with fellow globalists surrounding him, but had to pretend in what he was saying for the viewers of CSPAN.

etieseler,

What you say is simply not true. Real incomes have (on average) been growing at 2% per annum for at least 100 years. True, there has been some divergence in this growth in recent decades across different groups of society. But the generaal trend has been upward. Generally speaking, we can afford way more real goods and services than our ancestors of a generation ago. This is what the data tells us. The Fed has had, in my view, almost nothing to do with this. It is American ingenuity and hard work at play.

There are always people in any society that feel hard done by, that fall by the wayside, that feel victimized by the “power brokers.” The Fed is simply a convenient scapegoat. I sometimes wonder whether this was the reason it was created by Congress.

I’m sorry that I make you feel sick.

The thing that upsets me the most is the revolving door at the Fed with all the banks. Why can’t they hire people oustide of the circle and get some differing perspectives. They have allowed so much conflict of interest that it’s now just a good ole boys club. It’s truely so unamerican that it makes me sick…It’s corporate welfare if you have the right connections. We all know this. Most of the public is coming around to this and thank god for it

JoBe,

You all know this?

Wasn’t it Mark Twain who said “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

Be careful in what you (think you) know, JoBe.

Do you really want me to start a list of all the positions held in the revolving door between goverment/fed/commericial banks? Ok I will. Next post will be federal reserve/goverment connections

From the CBS article

http://www.cbsnews.com/8301-31727_162-20001981-10391695.html

Just for Goldman Sachs

Our alphabetical list:

Joshua Bolten

Government: President George W. Bush’s Chief of Staff from 2006-2009; Director of Office of Management and Budget from 2003-2006; White House Deputy Chief of Staff from January 20, 2001 – June 2003.

Goldman: Executive Director of Legal Affairs for Goldman based in London aka the bank’s chief lobbyist to the EU from 1994-1999.

Kenneth D. Brody

Government: President and Chairman of the Export-Import Bank of the United States (1993-1996).

Goldman: Former general partner and member of the Management Committee at Goldman Sachs where he worked from 1971-1991.

Kathleen Brown

Government: Former California State Treasurer

Goldman: Senior Advisor responsible for Public Finance, Western Region.

Mark Carney

Government: Governor of the Bank of Canada since 2008.

Goldman: Mr. Carney had a thirteen-year career with Goldman Sachs in its London, Tokyo, New York, and Toronto offices. His progressively senior positions included Co-Head of Sovereign Risk; Executive Director, Emerging Debt Capital Markets; and Managing Director, Investment Banking. He stated at Goldman in 1995.

Robert Cogorno

Government: Former Gephardt aide and one-time floor director for Steny Hoyer (D-MD.), the No. 2 House Democrat.

Goldman: Works for [Steve] Elmendorf Strategies, which lobbies for Goldman.

Kenneth Connolly

Government: Staff Director of the Senate Environment & Public Works Committee 2001-2006.

Goldman: Vice President at Goldman from June 2008 – present.

E. Gerald Corrigan

Government: President of the New York Fed from 1985 to 1993.

Goldman: Joined Goldman Sachs in 1994 and currently is a partner and managing director; he was also appointed chairman of GS Bank USA, the firm’s holding company, in September 2008.

Jon Corzine

Government: Governor of New Jersey from 2006-2010; U.S. Senator from 2001-2006 where he served on the Banking and Budget Committees.

Goldman: Former Goldman CEO. Worked at Goldman from 1975-1998.

Gavyn Davies

Government: Former chairman of the BBC from 2001 -2004.

Goldman: Chief Economist at Goldman where he worked from 1986-2001.

Paul Dighton

Government: Chief executive of the London Operating Committee of the Olympic Games (LOCOG).

Goldman: Former COO of Goldman where he worked for 22 years beginning in 1983.

Mario Draghi

Government: Head [Governor] of the Bank of Italy since January 2006.

Goldman: Vice chairman and managing director of Goldman Sachs International and a member of the firm-wide management committee from 2002-2005.

William Dudley

Government: President Federal Reserve Bank of New York City (2009-present)

Goldman: Partner and Managing Director. Worked at Goldman from 1986-2007.

Steven Elmendorf

Government: Senior Advisor to then-House minority Leader Richard Gephardt.

Goldman: Now runs his own lobbying firm, where Goldman is one of his clients.

Dina Farrell

Government: Deputy Director, National Economic Council, Obama Administration since January 2009.

Goldman: Financial Analyst at Goldman Sachs from 1987-1989.

Edward C. Forst

Government: Advisor to Treasury Secretary, Henry Paulson in 2008.

Goldman: Former Global Head of the Investment Management Division at Goldman where he worked from 1994-2008.

Randall M. Fort

Government: Assistant Secretary of State for Intelligence and Research from November 2006-Jan 2009.

Goldman: Director of Global Security 1996-2006.

Henry H. Fowler

Government: Secretary of the Treasury from 1965-1968.

Goldman: After leaving the Treasury Department, Fowler joined Goldman Sachs in New York City as a partner.

Stephen Friedman

Government: Chairman of the President’s Foreign Intelligence Advisory Board and of the Intelligence Oversight Board; Chairman Federal Reserve Bank of New York from 2008- 2009; former director of Bush’s National Economic Council. Economic Advisor to President Bush from 2002-2004.

Goldman: Former Co-Chairman at Goldman Sachs and still a member of their board. Joined Goldman in 1966

Gary Gensler

Government: Chairman of the U.S. Commodity Futures Trading Commission since 2009; Undersecretary to the Treasury from 1999 to 2001; Assistant Secretary to the Treasury from 1997-1999.

Goldman: Former Co-head of Finance for Goldman Sachs worldwide. Worked at Goldman from 1979-1997.

Lord Brian Griffiths

Government: Head of the Prime Minister’s Policy Unit from 1985 to 1990.

Goldman: International Advisor since 1991.

Jim Himes

Government: Congressman from Connecticut (on Committee on Financial Services) since 2009. Goldman: Began working at Goldman in 1990 and was eventually promoted to Vice President.

Robert D. Hormats

Government: Under Secretary of State for Economic, Energy and Agricultural Affairs-designate since July 2009; Assistant Secretary of State for Economic and Business affairs from 1981 to 1982.

Goldman: Vice Chairman of Goldman Sachs International and Managing Director of Goldman Sachs & Co. He worked at Goldman Sachs from 1982-2009.

Chris Javens

Government: Ex-tax policy adviser to Iowa Senator Chuck Grassley.

Goldman: Now lobbies for Goldman.

Reuben Jeffery III

Government: Under Secretary of State for Economic, Business, and Agricultural Affairs from 2007-2009; Chairman of the Commodity Futures Trading Commission from 2005-2007.

Goldman: Former Managing Partner of Goldman Sachs Paris Office. Worked at Goldman Sachs from 1983-2001.

Dan Jester

Government: Former Treasury Advisor.

Goldman: Former Goldman Executive.

James Johnson

Government: Selected to serve on Obama’s Vice Presidential section committee but stepped down.

Goldman: Board of Director of Goldman Sachs since May 1999.

Richard Gephardt

Government: U.S. Representative (1977 to 2005);

Goldman: President and CEO, Gephardt Government Affairs (since 2007). Hired by Goldman to represent its interests on issues related to TARP.

Neel Kashkari

Government: Interim head, Treasury’s Office of Financial Stability from October 2008-May 2009; Assistant Secretary for International Economics (confirmed in summer 2008) Special assistant to Treasury Secretary Henry Paulson from 2006-2008.

Goldman: Vice President at Goldman Sachs from 2002-2006.

Lori E Laudien

Government: Former counsel for the Senate Finance Committee in 1996-1997.

Goldman: Lobbyist for Goldman since 2005.

Arthur Levitt

Government: Chairman, SEC 1993-200;

Goldman: Advisor to Goldman Sachs (June 2009- present).

Philip Murphy

Government: U.S. Ambassador to Germany since 2009.

Goldman: Former Senior Director of Goldman Sachs where he worked from 1983-2006.

Michael Paese

Government: Top Staffer to House Financial Services Committee Chairman Barney Frank. Goldman: Director of Government Affairs/Lobbyist (2009)

Mark Patterson

Government: Treasury Department Chief of Staff since February 2009.

Goldman: Lobbyist for Goldman Sachs from 2003-2008.

Henry “Hank” Paulson

Government: Secretary of the Treasury from March 2006 to January 2009; White House Domestic Council, serving as Staff Assistant to the President from 1972 to 1973; Staff Assistant to the Assistant Secretary of Defense at the Pentagon from 1970 to 1972.

Goldman: Former Goldman Sachs CEO. Worked at Goldman from 1974-2006.

Romano Prodi

Government: Two time prime minister of Italy.

Goldman: From March 1990 to May 1993 and when not in public office, Mr. Prodi acted as a consultant to Goldman Sachs.

Steve Shafran

Government: Adviser to Treasury Secretary Henry Paulson.

Goldman: Worked at Goldman from 1993- 2000.

Sonal Shah

Government: Director, Office of Social Innovation and Civic Participation (April 2009); advisory board member Obama-Biden transition Project; former previously held a variety of positions in the Treasury Department from 1995 to early 2002.

Goldman: Vice President 2004-2007.

Faryar Shirzad

Government: Served on the staff of the National Security Council at the White House from March 2003 -August 2006; Assistant Secretary for Import Administration at the U.S. Department of Commerce in the Bush Administration.