For those of us still fretting over a struggling US economy, the first week of February delivered a host of data that should raise red flags. Simply put, the solid activity of 4Q2010 looks to have carried through into the new year. This could be shaping up to be a far more interesting year for monetary policy than I would have imagined just six weeks ago. While I believe the baseline forecast – complete the current asset purchase program and then move to the sidelines for the remainder of 2011 – incoming data suggests a need to be prepared for a fallback position. And that fallback is no longer toward additional easing.

If you believed the 4Q10 GDP report revealed a far stronger economy than the headline number suggested, you would have been looking for some blowout numbers from the ISM reports. And that is just what we got. In addition to the headline gain, the ISM manufacturing report had very strong internals. New orders gained 5.8 percentage points, promising future production. But is the capacity there? Note the 11 percentage point surge in border backlogs. Sustained backlogs would prompt firms to add additional capacity, which would obviously reveal itself in stronger investment spending in the months ahead. Likewise, supplier deliveries were slower. And the pressure on factories is stimulating a desperately needed demand for labor – the sector added 49,000 jobs during January, possibly underestimated given the weather related concerns with the January establishment survey. In short, it was tough to ignore the strength in the ISM report. Moreover, its service sector counterpart revealed similar trends, albeit to a lesser degree.

The manufacturing report also revealed accelerating price pressures, with the prices paid index jumping 9 percentage points to 81.5. All commodities were reported up in price. Via the baseline forecast, these gains should not be cause for worry, as excess slack in labor markets implies a very difficult environment to push through price increases. But should the employment report force us to rethink that story? More on that later.

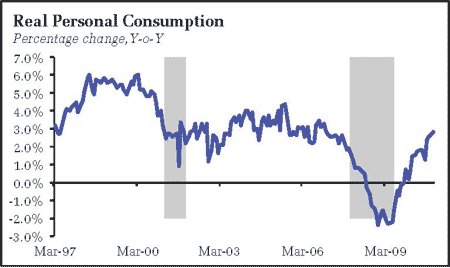

The Personal Income and Outlays report pointed to a consumer willing to step back up to the plate. Although real income gained a scant 0.1 percent, real spending grew 0.4 percent. Compared to a year ago, real spending is up 2.8 percentage, respectable given the damage done to household balance sheets over the past three years:

Not surprisingly, the saving rate declined – one has to consider the possibility that saving is settling into a new equilibrium around the five percent mark. If so, pessimism on the consumer outlook was overblown and, more importantly for the immediate outlook, the rise in the saving rate is now behind us. Income gains will thus largely translate into spending gains in the months ahead.

Moreover, early evidence suggests that consumer spending continued to grow in January. Auto and light truck sales continued to mover higher, climbing steady off of the recession lows. Also, retail sales, expected to have been negatively impacted by the weather, were surprisingly strong. Overall, the evolving story is a reminder that betting against the US consumer is a bet that will always wear thin sooner than you expect.

Against the backdrop of generally solid data (yes, homeownership rates continued to decline, but no one expected anything else), the headline gain of just 39k nonfarm payroll jobs was something of a slap in the face. The weak showing, however, was quickly discounted as a weather-related event. As is now well known, the household survey was also challenging to interpret due to new population benchmarks. Jim Hamilton has the story here, along with plenty of links to excellent insights on the topic. Cutting through the analysis, it seems that most are in agreement on one important point – the unemployment rate has made a dramatic drop in the past two months. The kind of dramatic drop that points to some real improvement in the labor market.

And yes, I know that we are still deep, deep in the hole on the labor market. But this is one of those “journey of a thousand miles begins with a single step” situations. We have just one solid quarter of real final demand behind us, and the early read on January data is reinforcing the importance of that demand. Sustain final demand anywhere near 7 percent growth – or even 4 to 5 percent – and labor market improvements will emerge in short order.

We aren’t there yet. I have already expressed concern that final demand will yield in the face of rising imports. But if the unemployment rate continues to drop at this pace, the Fed’s forecasts will quickly seem overly pessimistic. And that will turn Fed officials back to the issue they began with in 2010 – will they need to shrink the balance sheet sooner than later?

Still, the baseline scenario provides leeway on this issue, even if growth is higher than expected. That leeway comes from the extent of the job losses during the recession and the likely cyclical decline in the labor force participation rate. The baseline assumes that labor force participation will climb as the economy gains strength. This will constrain the potential for wages gains and, consequently, inflation as well. Simply put, there is no reason the Fed cannot allow the economy to run hot, hot, hot for several quarters.

Unless, of course, labor force participation does not climb rapidly. If people do not swarm back into the labor markets as expected, this year will get very interesting. This is not in my baseline forecast, but neither was final demand growth of 7.1 percent in the final quarter of 2010. Nor a 0.8 percentage point unemployment decline over just two months. Data is evolving well ahead of my expectations, and unlike this time last year, I can’t count on declining stimulus from fiscal policy and inventory correction to guarantee a midyear slowdown. Both those stories are behind or upon us already, leaving me with the generic risks of “financial market disruption,” “oil price shock,” or “political risk.” Basic CYA risks that are virtually meaningless.

Bottom Line: The January employment report was a mess, but the sharp drop in unemployment is difficult to ignore, especially given the general better-than-expected tone of recent data. At this junction, I believe it is reasonable to believe that overall activity will prove to be better than expected by Federal Reserve policymakers. Still, an upward revision to the forecast does not alone imply that Bernanke & Co. will find it imperative to return to the question of when to tighten. The output gap remains strikingly large for an economy in expansion since the middle of 2009. That should be sufficient to leave the baseline forecast of steady policy intact. But incoming data suggests the balance of risks is no longer on the side of disappointment. It may be that, for the first time in four or five years, the pessimists will need to find a new hobby.

Leave a Reply