More CIA numbers

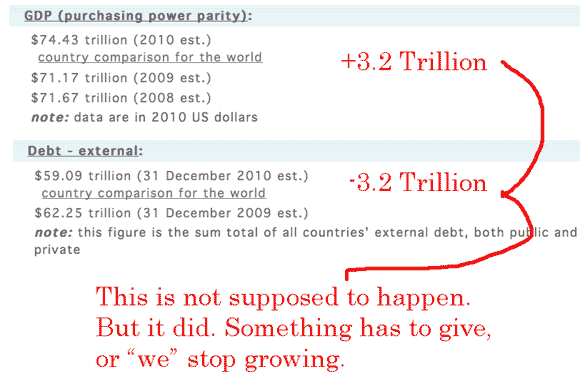

The CIA updated its estimate for global external debt and GDP this week.

I have watched these numbers for years. This is the first time that I have seen a significant drop in total debt and a meaningful expansion of global GDP. Two possibilities. Either the CIA has the numbers wrong, or 2010 was a fluke that can’t be repeated.

I am going with the “this can’t be repeated” as the answer to the puzzle. Either global debt increases significantly this year, or global growth is going to have to slow down. You can try to fight Mother Nature, but you can’t fight the basic laws of economics. In the world that we live in Debt = Growth. This rule will not change.

On Multifamily Default Rates

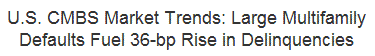

Fitch had this report out yesterday:

Looking through it is a breakdown of default rates on asset classes. Multifamily homes are at the top of the Fitch list.

– Multifamily: 17.40% (from 15.63%)

– Hotel: 14.43% (from 13.99%)

– Industrial: 8.53% (from 6.24%)

– Retail: 6.88% (from 7.20%)

– Office: 5.50% (from 5.69%)

I find the bad result for Multifamily interesting. Not so much that the default rates in the Fitch pools are so high, it is that the good folks at Fannie Mae are doing so well with their portfolio of Multifamily homes. The Fannie default rate is only .72%. The private pools are defaulting at a rate 24X’s Fannie.

To be sure there are different RE portfolios involved. That the results could vary significantly is reasonable. But 24Xs? Either the folks at Fannie have been doing a heck of a job, or they are sandbagging. I don’t mean to imply they are fudging with numbers. There are too many bean counters around for that to be the case. My suspicion is that Fannie has actually done a heck of a job in HAMPing, HARPing and generally extending and pretending their multifamily portfolio. That way they do not have big numbers on the “serious” default multifamily line. Why on earth would Fannie do that?

If the measuring stick for “success” was: How many families did the government help out? Then it would behoove the government to help out a multifamily borrower over a single-family borrower.

It’s about the optics….

More on “Hot Money”

George Washington had an article at Zero Hedge with information that Mubarak may have stashed away $70b . I suspect that this is more or less correct. This money will pop up all over. The US, UK and the Swiss banks are no doubt sitting on the bulk of it.

Let me give you a likely scenario. Mubarak leaves. Whoever comes into power the first thing they say is “We want our money back”. This creates a potential problem. Whose $70b is it after all?

I wrote about a subset of this earlier in the week. My focus was on the Swiss bank angle of the story. I quoted from NZZ. Well NZZ is back on the topic again today. I have no doubt that the NZZ is talking about it because the Swiss bankers and political leaders are talking about it. And they all think that something is going to blow. The NZZ interviewed a private Swiss banker. I thought it was worth noting: (my translation from German):

NZZ: What about a potential client such as a Russian oligarch who is now legitimate, but has come to his first millions years before by dubious circumstances?

Private banker: There are certain oligarchs, who were 10 or 20 years ago so bad that we do not do business still today. Other cases are less clear.

NZZ: And what about with countries like Saudi Arabia, Kuwait and the Emirates, where state and private property may overlap to such an extent that the term “corruption “would be redefined?

Private banker: The acceptance of funds from these countries is, in principal, in order.

Read through the lines. If you were a crook ten years ago but are now rich and respectable there is no problem to open a Swiss account. When the private banker says that it is “proper” that Swiss banks should have large banking relationships with the players from Saudi, Kuwait and the Emirates what he is really saying is that they have boatloads of their money already.

This gets back to where I started. When Potentates lose their “Po” the people left holding the bag are going to be asking for the dough. We will hear more of this in the weeks to come.

The SEC is going broke

From the WSJ this morning:

Securities and Exchange Commission Chairman Mary Schapiro said Friday that budget constraints were hampering the regulator’s ability to enforce the securities laws.

The agency doesn’t have the funds to hire market experts it needs to keep ahead of fraudsters and market manipulators.

The budget strain was forcing market analysts to use decades-old technology to “monitor trading that occurs at the speed of light.

This certainly is an American story. Two years ago the country was brought to its knees over financial abuses that the SEC should have seen coming. The Dodd/Frank bill that was passed with much fanfare a year ago is actually just a joke . Now there is no money to do the follow through. We are destined to revisit the sins of the past.

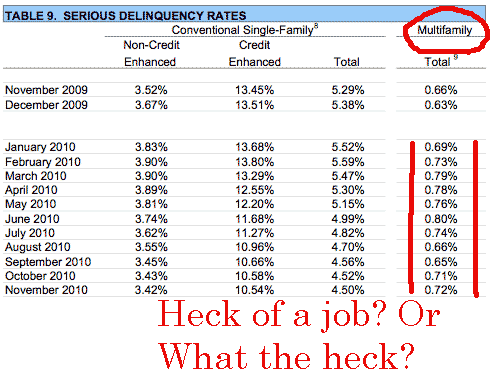

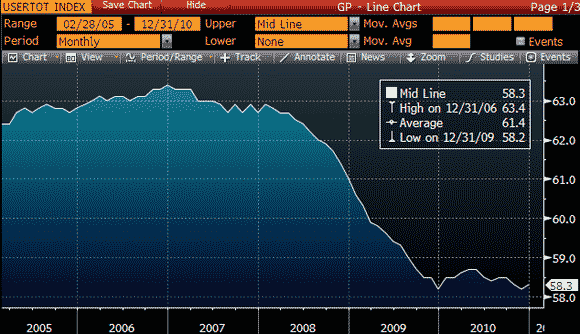

On the labor force

You’ve seen these graphs before but they are worth repeating. The US has gone through a structural change when it comes to labor force participation. This phenomenon is not going away. A significant number of people who were in the labor force a few years ago are now no longer interested in finding work.

I find this fascinating. What the hell are all these people doing that have dropped out? Just collecting UE and DI checks? Have they gone underground and are now day workers getting paid cash off the books? We’re talking about 8mm people here. 5% of the total workforce seems to have disappeared. How is that possible?

Should this trend continue for a few more years it will have very significant effects on Medicare, Social Security and general tax revenue. At the moment everyone in Washington is assuming that we are going to revert to the labor force participation rates of 2006. With that will come higher taxes at every level and the budget picture will magically come back into closer balance.

But I think these workers are gone for good. Should that be the outcome the budget picture is just a disaster for as far into the future as they eye can see.

There are no “fixes to this problem and it will not go away. Ben Bernanke is trying to fix this with a monetary policy that is upsetting the world and accomplishing nothing good.

Quote of the week

Texas Federal Reserve President Fisher during Bloomberg interview with Kathleen Hays:

Enough said.

Leave a Reply