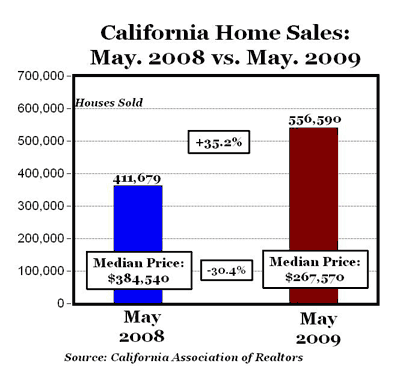

LOS ANGELES (June 25) – Home sales increased 35.2% in May in California compared with the same period a year ago, while the median price of an existing home declined 30.4%, the CALIFORNIA ASSOCIATION OF REALTORS (C.A.R.) reported (see chart above).

“With affordability for first-time buyers at a record high, sales of existing, single-family homes continued to remain above the 500,000 level for the ninth consecutive month,” said C.A.R. President James Liptak. “Buyers are beginning to realize that the combination of favorable home prices, historically low mortgage rates, and first-time home buyer tax credits, may not align again for many years.

The median price of an existing, single-family detached home in California during May 2009 was $267,570, a 30.4% decrease from the revised $384,540 median for May 2008, C.A.R. reported. The May 2009 median price rose 4.2% compared with April’s $256,700 median price.

“The statewide median price rose for the third consecutive month in May, posting the largest monthly increase on record for the month of May, according to statistics dating back to 1979,” said C.A.R. Chief Economist Leslie Appleton-Young. “Nearly all regions in the state reported positive month-to-month changes in median price.”

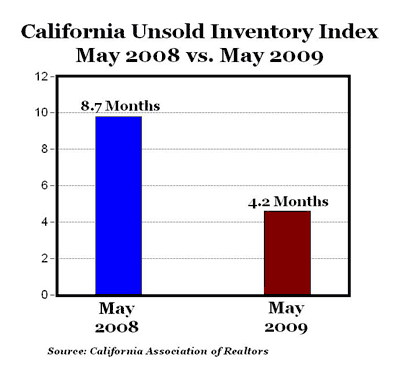

C.A.R.’s Unsold Inventory Index for existing, single-family detached homes in May 2009 was 4.2 months, compared with 8.7 months for the same period a year ago (see chart above). The index indicates the number of months needed to deplete the supply of homes on the market at the current sales rate.

WALL STREET JOURNAL — California’s median price for an existing single-family house rose for the third straight month, a sign that the state’s battered real-estate market may be bottoming out.

California’s real-estate market, the nation’s largest, is seen as a barometer of the U.S. economy. Housing prices soared during the boom, and their plummet during the market’s collapse resulted in massive foreclosures and fueled the recession. Economists say the state’s housing market will lag behind the nation’s in recovering, so any indication of improvement in California bodes well for the rest of the U.S.

MP: Unit sales increasing in CA + Median home prices increasing in CA + Median number of days to sell a home decreasing in CA + Unsold inventory index (4.2 months) falling to less than 50% compared to a year ago (8.7 months) in CA + Fewer foreclosed properties among those being sold in CA = REAL ESTATE MARKET IN RECOVERY.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply