It’s been an eventful week at home and abroad with several events directly showing up in the performance of global markets and the price of gold. Today, Egypt’s mayhem in the streets caused uncertainty in the markets, but sent gold shooting up over $21 to close at $1,336.75.

On Wednesday, a continuation of the Federal Reserve’s easy monetary policy pushed gold up double-digits. Earlier in the week, a small hedge fund that had overleveraged itself to gold futures blew out its position, causing the biggest ever one-day reduction in futures contracts for the Comex.

This small hedge fund trader fell victim to one of the oldest flaws in capital markets—arrogance with excessive leverage. This is the same infallible, overleveraged attitude that took down Fannie Mae, Lehman Brothers, Long-Term Capital Management, Enron and a number of Main Street American Home Buyers who leverage themselves 100-to-1.

By overleveraging his small $10 million fund, he was able to control the equivalent of South Africa’s annual gold production, according to the Wall Street Journal. That’s one small fund controlling an amount of gold equal to the world’s third-largest producer?

Leverage of this magnitude is impossible to manage, no matter how intelligent the investor. However, danger and crisis can equal opportunity for long-term investors. All these events have created a lot of short-term noise but not derailed the long-term story.

Life is about managing expectations and that’s why we educate investors to anticipate before they participate (View our Anticipate Before You Participate presentation) by studying the DNA of volatility inherent in different asset classes.

As I mentioned in my blog earlier this week (Frank Talk- Mythbusting Gold’s Volatility), gold is far less volatile than other commodities such as oil, copper and other metals. In fact, gold’s volatility has been less than domestic equities over the past several years.

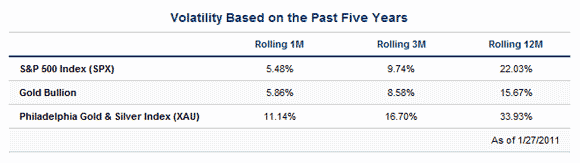

This table shows the rolling one-month, three-month and 12-month volatility for gold bullion, the S&P 500 Index and the XAU. You can see that the average one-month price movements for both the S&P 500 and gold are roughly equal over the past five years.

When you go further out on the time horizon, gold’s volatility shrinks when compared with the S&P 500. For a one-year period, the average volatility for gold bullion has been 28 percent less than the S&P 500 over the past five years.

I’ve included gold stocks in the table because it illustrates the leverage you get with gold equities versus the bullion. As you can see, the ratio has roughly been 2-to-1 over the past five years for all three time periods. This means that if gold goes up 2 percent, then gold equities typically move up 4 percent, and vice versa on the downside.

That is close to what we’ve experienced so far this January with gold prices and the XAU slipping 7.52 percent and 12.26 percent, respectively.

Long-term gold investors must remember that we have been here before. Remember that gold is always being driven by the fear trade and the love trade. During weeks like this, the fear trade gets most of the media coverage, especially when a country like Egypt implodes because roughly 30 percent of the world’s oil travels through the Suez Canal, according to Dahlman Rose. The story is much bigger and more complex.

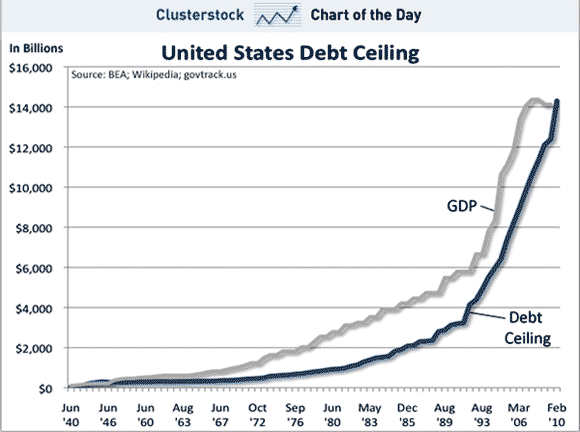

The fear trade drivers are negative real interest rates and deficit spending to support social welfare programs. This chart from Clusterstock shows how the U.S debt ceiling has risen to unprecedented levels. Since the mid-1980s, the U.S. has raised its debt ceiling hand-in-hand with the country’s economic growth, even faster in some cases.

Meanwhile, the Federal Reserve reaffirmed this week that real interest rates will remain negative for the long haul. The Congressional Budget Office (CBO) has set the deficit estimate for 2011 at $1.5 trillion. The only thing keeping gold prices from skyrocketing has been money supply, which has been slow to rise. However, money supply in emerging economies is well above the G7 levels.

Governments in the developed world, not just the U.S., have a long-term spending problem. Will they address their fiscal deficit spending on social welfare by making serious cuts or will they try to reflate their economies, devalue their currencies to stimulate exports or raise taxes to an extent they choke economic activity? Whichever way, it should be a positive for gold. Bottom line, it is prudent to have some exposure to gold in a diversified portfolio.

As I have said in the past, the other side is the love trade, gold jewelry demand in emerging economies is rising and remains the biggest component of the demand equation. India’s gold imports were up roughly 46 percent in 2010 and China’s nearly 500 percent. Overall global jewelry demand was up 10 percent in 2010, according to the World Gold Council.

As long as both the love trade and the fear trade are intact, gold will remain attractive.

The correction in gold appears to be over for the reasons cited above. We’re near the 200-day moving average which is a key psychological support level.

Just today, Richard O’Brien, the CEO of Newmont Mining, said he expects gold to reach $1,400-$1,500 per ounce in 2011. The head of the world’s second-largest gold producer also added that he could see gold hitting $2,000 in the future because of rising demand from emerging markets and a hedge against inflation.

I agree that there’s plenty more upside for gold, especially for the miners as supply decreases. I like buying the junior miners through GDXJ.