We often talk about the auto boom in emerging countries but you don’t have to go overseas to find a red-hot auto market. Vehicle sales in the U.S. jumped 11 percent last year to 11.5 million vehicles sold.

The 1.1 million vehicles sold in December continues the rise from early 2009 lows but is still well off the 1.4 million per month pace seen in 2005. More than half (54 percent) of the vehicles sold in December fall in the light truck/SUV category, according to a recent report from Macquarie.

President Obama announced in his State of the Union speech on Tuesday that he’d like to see 1 million electric vehicles on the road by 2015. It will be a difficult task to transform consumer preference. During the month of December only 326 Chevy Volts and 19 Nissan Leafs, the two main electric cars on the market, were sold. In fact, four out of the top 10 selling vehicles of 2010 were light trucks.

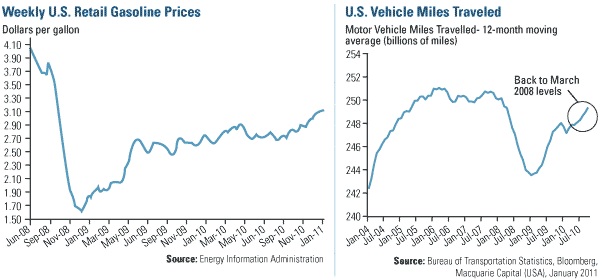

In addition to purchasing more vehicles, drivers are hitting the roads more frequently. The chart shows that the amount of vehicle miles traveled in the U.S. has experienced a healthy bounceback and is now at March 2008 levels, according to Macquarie.

The combination of more vehicles and traveling more miles is a bullish sign for gasoline and oil demand. This is one reason we’ve seen a jump in prices for both.

Over the past year, gasoline prices have risen almost 41 cents per gallon on average across the U.S. The Midwest has seen the biggest rise during the time period (46 cents), but the overall price per gallon in the region is still below the West Coast which has the most expensive gas in the country at $3.30 per gallon, according to data from the Energy Information Administration (EIA).

This year, it’ll be important to watch how both car sales and vehicle miles traveled fare in this economy. If both continue to grow, it could signal big increases in future demand.

Leave a Reply