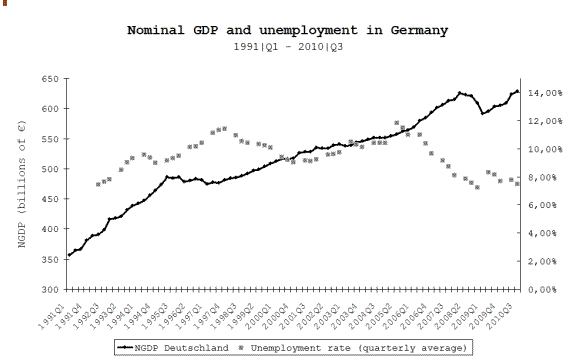

Kantoos has a German language blog that shares my quasi-monetarist perspective. He recently sent me an english version of a post that has this graph showing German NGDP and unemployment:

You’ll notice that German NGDP growth is less stable than US growth, even before the recent recession. Here are a few observations, with the caveat that I am not an expert on Germany.

Smaller economies tend to have more unstable real and nominal growth. Although Germany is big in absolute terms, it is small relative to the US. For instance, Germany had 8% real growth in the second quarter, and the slightly smaller UK economy just reported negative 0.5% growth in the 4th quarter. US RGDP growth doesn’t tend to show such big swings.

Because Germany is part of the eurozone, nominal and real GDP movements are more independent than in the US. Thus suppose the ECB targets 2% inflation. In that case fast growing eurozone members will have higher NGDP growth than slower growing members, even without higher inflation. In fact, inflation is usually higher in faster-growing economies.

After the reunification boom, Germany had a difficult period from 1994 to 2006. Notice that nominal growth was slow and unemployment was in the 10% to 12% range. It is reported that during this period Germany went through a painful process of adjusting nominal wages downward, to reflect the slow NGDP growth (and inflation, which was lower than elsewhere in the EU.) Ironically, during this period ECB policy was arguably too tight for Germany, and too easy for fast-growing Spain and Ireland.

Here’s what I found most interesting. It seems to me that this graph might help explain Germany’s relatively good performance during this recession. Notice that NGDP growth picked up sharply in 2006, and then NGDP fell sharply in late 2008. Current levels of German NGDP look very similar to what would have occurred if you extended the fairly straight trend line from 1997-2006. My hypothesis is that the wage restraint practiced by German unions during the difficult years of high unemployment may have carried over into the 2006-08 boom. If so, wages may be closer to equilibrium than in the US, where current NGDP is far below the trend line of the past few decades.

This is a very tentative hypothesis. It is dangerous to look for trend lines, as the eye tends to spot patterns that aren’t really stable. In addition, I am relying on news reports about German wages, not hard data. I would add that the low unemployment rate overstates Germany’s success. Output has fallen sharply in Germany, and many workers had to accept shorter hours. Still most observers think that Germany has recently done better than other major developed economies, and the temporary nature of the 2006-08 NGDP bulge may partly explain why.

Germany could probably benefit from a bit faster NGDP growth, but from a “level targeting” perspective they may be closer to long run equilibrium than most other developed countries.

PS. Interested readers should also read the Kantoos post, as he covers other topics that I am not qualified to discuss.

Leave a Reply