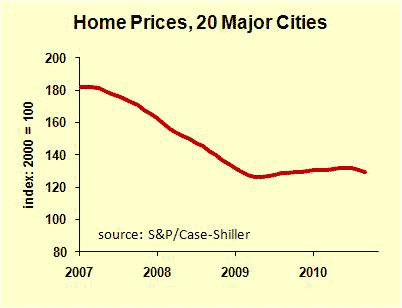

Home prices edged down again, though the decline was much milder than we saw in 2007 and 2008.

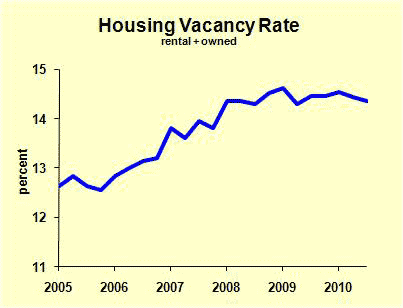

The problem is not caused by underwater mortgages or foreclosures or problems sub-prime families have getting new mortgages. It’s simply supply and demand. We have too many housing units relative to the number of families. That shows up clearly in the housing vacancy data.

The high vacancy rate means we have excess housing, which pushes down prices. But why do we have high vacancy? The primary reason is that we built too many housing units (houses, condos and apartment units) in the boom. A secondary reason is that in the recession, people moved in together. Most commonly, adult children moved back in with mom and dad. To a lesser degree, young people out on their own take roommates rather than rent their own home. To an even lesser degree, some couples are delaying divorce for economic reasons, or even divorcing but living in the same house. (Which I imagine would present extra problems for the always-difficult dating after divorce challenge.)

What’s the outlook? We are underbuilding housing relative to our usual long-term need. That means that natural growth of population will help solve the problem. When job growth accelerates (which it will do, though ever so slowly), those kids will move out. The excess supply of housing unites will be gradaully absorbed.

So when will housing prices recover? That’s a somewhat different story. Once we get into supply-demand balance, prices should stop falling. But that does not mean they recover. That peak in prices was unsustainable, due to speculative excess. Going forward, look for something like growth at three percent or so. That implies 10 to 15 years before home prices regain their boom-time peak.

One final comment: people tend to generalize from their own experience to an assessment of the economy as a whole. Speak to a stock investor, and her notion of whether the economy is improving is tied to stock prices. Speak to a guy selling aluminum castings, and his view is primarily determined by demand for aluminum castings. Speak to a real estate investor and you’ll hear cries of how awful the economy is. And for that guy, it’s true the economy is lousy. For the rest of us, it’s not so bad.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply