It is difficult to imagine a world without Steve – he has been the prime driver for three generations of computing: Apple // begat PC and MSDOS; Mac begat Windows; and iPod begat a whole new mobile experience, with iPhones and iPads. This is an unparalleled achievement. Whither technology if Steve really retires, or his illness worsens?

His leave was announced a day before earnings, which suggests Steve’s situation is too serious to wait even a day.

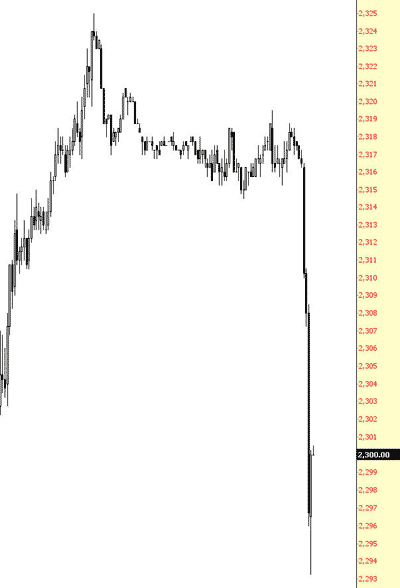

Apple (AAPL) is expected to announce blow-out earnings tomorrow, but AAPL is down 7% in German markets, and the Nasdaq 100 futures are down hard (see next chart from SlopeofHope). Apple has had such a run that stories are beginning to emerge that the stock has no place more to go. The next frontier would be to conquer TV, but Steve has insisted the Apple TV offering is but a hobby – which means his vaunted Steveness has not yet figured out how to conquer the world of Mad Men. Most likely it is his failure to negotiate deals that would enable Apple to offer a $30 cable TV bundle over the Internet within iTunes. It could be this is the time to sell AAPL, not buy the coming dip.

Of course, last time this happened, the stock dipped 10% and then tripled. This time Steve’s condition may be worse.

This drop started before the Steve announcement, which suggests the expected January correction has begun. This event could trigger a series of falls. Investors are best described as jittery.

Leave a Reply