I’ve just completed a new research paper that surveys the history of the oil industry with a particular focus on the events associated with significant changes in the price of oil. Here I report the paper’s summary of oil market disruptions and economic downturns since the Second World War. Every recession (with one exception) was preceded by an increase in oil prices, and every oil market disruption (with one exception) was followed by an economic recession.

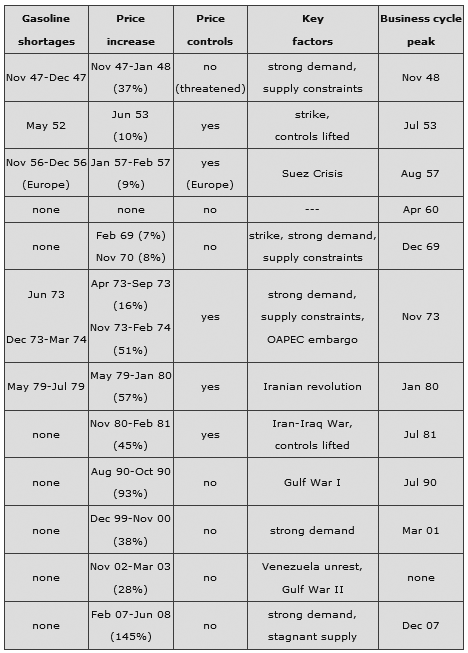

Summary of significant events since World War II. Source: Hamilton (2011).

The table above itemizes the particular postwar events that are reviewed in detail in my paper. The paper also provides the following summary discussion:

The first column indicates months in which there were contemporary accounts of consumer rationing of gasoline. Ramey and Vine have emphasized that non-price rationing can significantly amplify the economic dislocations associated with oil shocks. There were at least some such accounts for 5 of the 7 episodes prior to 1980, but none since then.

The third column indicates whether price controls on crude oil or gasoline were in place at the time. This is relevant for a number of reasons. First, price controls are of course a major explanation for why non-price rationing such as reported in column 1 would be observed. And although there were no explicit price controls in effect in 1947, the threat that they might be imposed at any time was quite significant (Goodwin and Herren, 1975), and this is presumably one reason why reports of rationing are also associated with this episode. No price controls were in effect in the United States in 1956, but they do appear to have been in use in Europe, where the rationing at the time was reported.

Second, price controls were sometimes an important factor contributing to the episode itself. Controls can inhibit markets from responding efficiently to the challenges and can be one cause of inadequate or misallocated supply. In addition, the lifting of price controls was often the explanation for the discrete jump eventually observed in prices, as was the case for example in June 1953 and February 1981. The gradual lifting of price ceilings was likewise a reason that events such as the exile of the Shah of Iran in January of 1979 showed up in oil prices only gradually over time.

Price controls also complicate what one means by the magnitude of the observed price change associated with a given episode. Particularly during the 1970s, there was a very involved set of regulations with elaborate rules for different categories of crude oil. Commonly used measures of oil prices look quite different from each other over this period. Hamilton (2010) found that the producer price index for crude petroleum has a better correlation over this period with the prices consumers actually paid for gasoline than do other popular measures such as the price of West Texas Intermediate or the refiner acquisition cost. I have for this reason used the crude petroleum PPI over the period 1973-1981 as the basis for calculating the magnitude of the price change reported in the second column of Table 1. For all other dates the reported price change is based on the monthly WTI.

The fourth column of Table 1 summarizes key contributing factors in each episode. Many of these episodes were associated with dramatic geopolitical developments arising out of conflicts in the Middle East. Strong demand confronting a limited supply response also contributed to many of these episodes. The table collects the price increases of 1973-74 together, though in many respects the shortages in the spring of 1973 and the winter of 1973-74 were distinct events with distinct causes. The modest price spikes of 1969 and 1970 have likewise been grouped together for purposes of the summary….

These historical episodes were often followed by economic recessions in the United States. The last column of Table 1 reports the starting date of U.S. recessions as determined by the National Bureau of Economic Research. All but one of the 11 postwar recessions were associated with an increase in the price of oil, the single exception being the recession of 1960. Likewise, all but one of the 12 oil price episodes listed in Table 1 were accompanied by U.S. recessions, the single exception being the 2003 oil price increase associated with the Venezuelan unrest and second Persian Gulf War.

The correlation between oil shocks and economic recessions appears to be too strong to be just a coincidence (Hamilton, 1983a, 1985). And although demand pressure associated with the later stages of a business cycle expansion seems to have been a contributing factor in a number of these episodes, statistically one cannot predict the oil price changes prior to 1973 on the basis of prior developments in the U.S. economy (Hamilton, 1983a). Moreover, supply disruptions arising from dramatic geopolitical events are prominent causes of a number of the most important episodes. Insofar as events such as the Suez Crisis and first Persian Gulf War were not caused by U.S. business cycle dynamics, a correlation between these events and subsequent economic downturns should be viewed as causal. This is not to claim that the oil price increases themselves were the sole cause of most postwar recessions. Instead the indicated conclusion is that oil shocks were a contributing factor in at least some postwar recessions.

Leave a Reply