There is a large percentage of Americans who are enraged by the thought that it is OK for people to stop paying their mortgages and walk away from their homes, in other words — ceasing to make monthly loan payments and waiting for the lender to foreclose. Some even believe that walking away from your mortgage payment is not only unacceptable but also immoral.

There is a large percentage of Americans who are enraged by the thought that it is OK for people to stop paying their mortgages and walk away from their homes, in other words — ceasing to make monthly loan payments and waiting for the lender to foreclose. Some even believe that walking away from your mortgage payment is not only unacceptable but also immoral.

Obviously this rationale is at first glance, understandable. After all, most of us know money is more than a matter of numbers. We also know that an obligation is an obligation and there is none as important as the one that keeps a roof over one’s head. On the other hand, there is the crowd of homeowners with “underwater” mortgages — that is they owe more to the bank than their houses are worth — who don’t care about the stigma that comes with failing to make mortgage payments and insist that reneging on a mortgage obligation is no big deal. It’s only a business decision, they say, and nothing more. They will even point out that in many cases the contract made between a homeowner and lender does not say that the homeowner has a “moral obligation to pay”, making it OK for the homeowner to walk away from the mortgage.

Of course, the mortgage industry loves for a change the idea of getting ‘ethical’ by questioning the morality of this argument. They say the concept of paying is only a moral obligation and that someone who signed a contract should see it through, regardless of how home prices have deteriorated. But millions of underwater homeowners who have apparently suffered significant losses from the housing collapse – have a different perspective. According to them, the big banks and lending institutions who forced taxpaying American citizens to bail them out after defrauded them with predatory lending practices on over inflated homes, should, minimally, be forced into a situation where renegotiation is beneficial to them as well as the borrower, or face the logical consequence of homeowners placing their families first. Struggling homeowners also argue that the “creativity” of Wall Street and the mortgage industry, who put together a system that protected only them as they kept booking profits upfront, are responsible for the housing crisis. Many underwater homeowners still believe that demand in the mortgage market was inflated by lenders who without taking into account the borrower’s ability to repay kept approving “higher” risk loans. This process, they say, contributed to a massive shift toward less creditworthy borrowers and home buyers by approving nontraditional loan originations, such as interest-only and pay-option mortgages. To compound this issue, the lenders — who carelessly and without thinking of their possible disappointment grew their origination infrastructure to accommodate the surge in mortgage demand — kept pressuring appraisers to artificially appraise homes at the highest amount possible to allow the loan to be approved. Top all of this off with skyrocketing home prices and the fact that when risky and unaffordable mortgage loans are made, the individual borrower is subjected to unnecessary risks, and it was a house of cards.

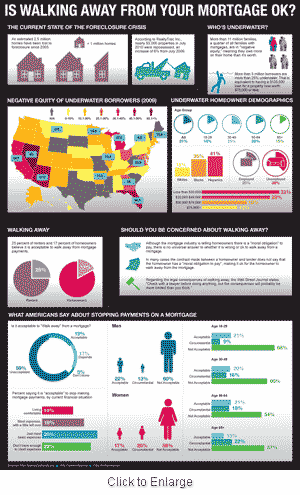

But regardless who’s side you’re on, or whether it’s OK to ditch a mortgage or not, in total 59% of Americans, as the above infographic from www.creditloan.com shows, think it’s “unacceptable” to walk away from a mortgage. Among those who own homes, only 17% think it’s OK to stop paying. Many people of both genders believe that if you decide to walk away by “necessity” rather than default “strategically”, it may be OK to ditch that mortgage.

Credit Loan’s infographic, which offers more curious facts about the foreclosure and the housing crisis, also shows that an estimated 2.5 million homes have been lost to foreclosure since fiscal 2005. In addition, more than 11 million families, a quarter of all families with mortgages, are currently in “negative equity,” meaning the value of their asset is less than the outstanding balance on the loan.

According to online foreclosure specialist RealtyTrac, banks moved to repossess a record 2.87 million (2,871,891) US homes in fiscal 2010 as the housing crisis continues to weigh heavily on the economy. Foreclosures hit 2.23% of all housing units in the country, (one in 45), an increase from 2.21% in 2009, RealtyTrac said in its year – end 2010 report.

Total properties receiving foreclosure filings would have easily exceeded three million in 2010 had it not been for the fourth quarter drop in foreclosure activity — triggered primarily by the continuing controversy surrounding foreclosure documentation and procedures that prompted many major lenders to temporarily halt some foreclosure proceedings,” RealtyTrac chief executive James Saccacio said in a statement. [emphasis added]

Saccacio predicted that an estimated 250K foreclosures held up in Q4’10 would be restarted in early 2011.

Infographic: CreditLoan

I strongly disagree with the idea that lenders should be forced to modify mortgages regardless of what the lender did because no one forced the borrower to buy the house and it’s obviously unfair to people who either paid cash for their house or have paid their mortgage payments even though they are underwater. Our economic system has been successful largely because we let people and businesses go bankrupt. Bailing out anyone is a bad idea including Wall street, General Motors, AIG, your neighbor, or you.

I respect your opinion but at same time fact is – if the mortgage industry had functioned as it did prior to the collapse when you had to actually put down 20 and qualify for a loan as oppose to a NINJA, we would not be in this mess. What’s wrong with the idea of lenders requiring the borrower to show a stable stream of income or sufficient collateral b4 approval?!!. It’s only a fundamentally sound n required business approach.. Also, let’s keep in mind here that products like NINJAs and ALT-As — which were specifically designed to ignore the verification process — were offered by the lender not the borrower. Dont forget also the fact that the thrift and banking crisis of the 80s resulted in enactment of FIRREA and FDICIA. In the 20 years following the enactment of these two laws (particularly after fiscal 2000) we allowed the shadow financial system (investment banks, hedge funds, and money market funds…key components of the subprime mess) to grow much more quickly than the traditional banking system. As a result, at the onset of the crisis, approx. 50% of all financial services were conducted in institutions that were not subject to regulation and supervision. The borrower can only make market if the lender facilitates it, not the other way around.

If there were any justice in this world people like Dick Fuld, James Cayne, Stan O’Neal, and Angelo Mozilo wouldn’t have enough money to buy a cup of coffee. The system encourages reckless gambling because if the roof doesn’t fall in you get rich and if it does so what ? Bailouts encourage bad behavior. Bailouts reward bad behavior. The worst part though is the precedent. California wants a bailout, ditto Illinois. All of this discussion really is just a symptom of how much trouble the U.S. is in. Most people can’t spell simple words or do simple math, even successful people. I read a website populated by BMW owners and the spelling and logic is often atrocious. I think we’re doomed.