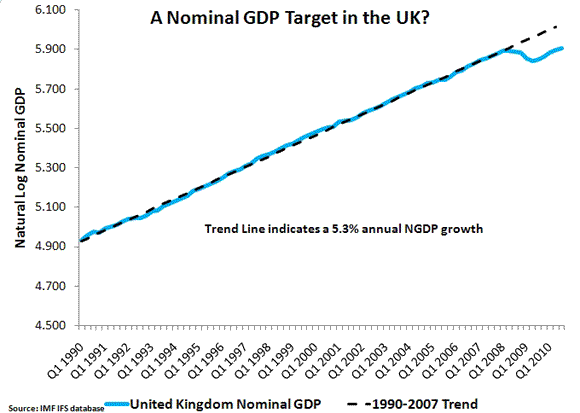

Scott Sumner directs us to a Financial Times piece that claims the Bank of England is secretly targeting a nominal GDP growth rate of 5%. As a proponent of nominal GDP targeting, I was intrigued and wanted to see if the UK data supported this claim. So I created the figure below using the IMF’s IFS database. It shows the natural log of UK nominal GDP data for the 1990:Q1-2010:Q3 along with a fitted trend for the 1990:Q1-2007:Q4 period.

This slope of the trend line indicates an average nominal GDP growth rate of 5.3%. It seems plausible, then, that the Bank of England is actually targeting nominal GDP. This is not entirely surprising given there are respected economic commentators in the UK like Martin Wolf and Samuel Brittan that endorse the idea. Of course, it would be even better if the Bank of England were targeting the nominal GDP level and thus aimed to close the NGDP gap in the figure above. However, given the grief the Bank of England is getting for its current monetary policies a level target seems unlikely.

Here, here, and here are a few of my most posts that explain why I like nominal GDP targeting.

Every dollar of deficit spending is included in “nominal GDP”- Keynesians like the “respected” Mr. Wolf can create whatever nominal growth is desired through the very disreputable practice of what would be called counterfeiting if done in one’s home- but either way is inflationary. This is another sore topic,with the publicly reported rate bearing no resemblance to anyone’s real cost of living.