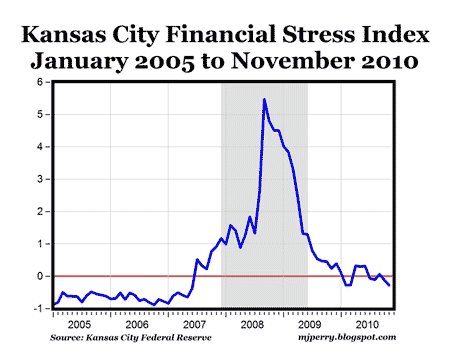

The Kansas City Federal Reserve Bank calculates and reports a monthly “Financial Stress Index” (KCFSI), (see chart above, data here). The index is described here by the K.C. Fed:

“The KCFSI is a monthly composite index of 11 variables reflecting stress in the U.S. financial system. These variables fall into two broad categories–average yield spreads, and measures based on the actual or expected behavior of asset prices. The index is calculated using the principal components procedure. Under this procedure, the coefficients of the 11 variables are chosen so that the index explains the maximum possible amount of total variation in the variables from February 1990 through the current month.

A positive value of the KCSFI indicates that financial stress is above the long-run average, while a negative value signifies that financial stress is below the long-run average.”

From last week’s press release about the December KCSFI:

“The Kansas City Financial Stress Index (KCFSI) was -0.28 in December, down moderately from -0.12 in November. With the decrease, the index remained below its long-run average of zero and moved near its low for the year, reached in March.”

MP: As the chart shows, the KCFSI has now been below zero for the last two months, and was negative for six months in 2010 (March, April, August, September, November and December). The December 2010 index reading of -0.28 was the lowest index level since July 2007, and the KCFSI has now returned to its pre-recession level, indicating the financial stress of the recession and financial crisis is becoming a fading memory. From the KCFSI peak of 5.5 in October 2008 (“financial ground zero”) we’ve made a lot of progress, and we’ve returned to a new period of below-average financial stress in the U.S. economy, i.e. a return to “normalcy” (see below).

Although Scott Grannis was commenting today about the VIX peaking in October 2008, he could have just as easily been talking about the KCFSI, which peaked in the same month:

“The near-collapse of the global financial industry in late 2008 sent a tsunami of fear throughout the global financial markets and temporarily paralyzed global economies. Activity in many areas ground to a halt as consumers hoarded cash, institutional investors scrambled to sell risky assets, and everyone tried to deleverage. Fear was the common denominator, as captured by the VIX Index (the implied volatility of equity options), and it peaked in late October 2008.

Two years ago the financial markets were priced to an “end-of-the-world-as-we-know-it” scenario. Today financial markets are beginning to realize that a return to “normalcy” is possible and within reach. We should all breathe a great sigh of relief.”

Leave a Reply