Bed Bath & Beyond Inc. (BBBY) recently hit a new all-time high at $50.95 on another strong quarter from mid December that included a 12% earnings surprise. With an average earnings surprise of 13% over the last four quarters and a solid 14% growth projection, this Zacks #1 rank stock

Company Description

Bed Bath & beyond, together with its subsidiaries, operates a chain of retail stores that specializes in a wide range of home appliances and furnishings. The company was founded in 1971, operates over 1,100 stores and has a market cap of $12 billion.

Retail stocks are hot right now as holiday sales results continue to come in strong. That dynamic and general consumer strength helped lifted BBBY to strong Q3 results from late October that came in ahead of expectations.

Third-Quarter Results

Revenue for the period was up 11% from last year to $2.2 billion. Earnings were also strong at 74 cents, 12% ahead of the Zacks Consensus Estimate.

The company was also able to curb its expenses, with sales, general and administrative costs falling to 27% of revenue from 28.7% last year.

BBBY also discussed its growth trajectory, noting that it is on pace to add about 40 stores this year across all its concepts, which would place its store count to just over 1,130. The company also added that it believes it can operate more than 1,300 stores, implying an appetite for more openings.

New Share Buy Back Approval Announced

The company has also been busy returning value to its shareholders, buying back 5 million shares during the quarter for $211 million. BBBY also announced a new $2 billion authorization from by the Board of Directors that is set to kick off in early 2011 after the existing program is finished. The company has bought back $2.6 billion in shares since 2004.

Financial Profile

BBBY also has a great financial profile, with cash and equivalents of $840 million and no long-term debt.

Estimates

We saw some decent movement in estimates off the good quarter, with the current year adding 11 cents to $2.91 and the next-year estimate gaining 16 cents to $3.31, a solid 14% growth projection.

Valuation

But in spite of the nice gains, BBBY still has value, trading with a forward PE of 17X, a pinch below the industry average of 18X.

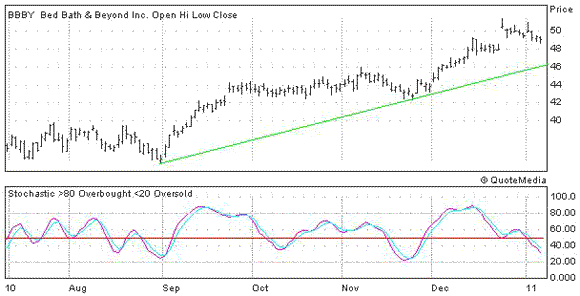

6-Month Chart

On the chart, BBBY has been strong for the last few months, recently hitting a new all-time high on the good quarter and strong holiday sales. Look for support from the long-term trend on any weakness, take a look below.

Leave a Reply