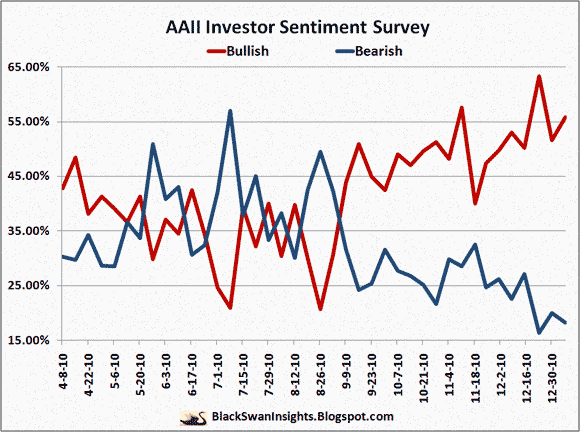

The American Association of Independent Investors released its weekly sentiment survey. This week bullish sentiment increased to 55.88%, up from 51.6%, while bearish sentiment fell 1.8 points to 18.25%. Neutral investors fell slightly to 25.86%.

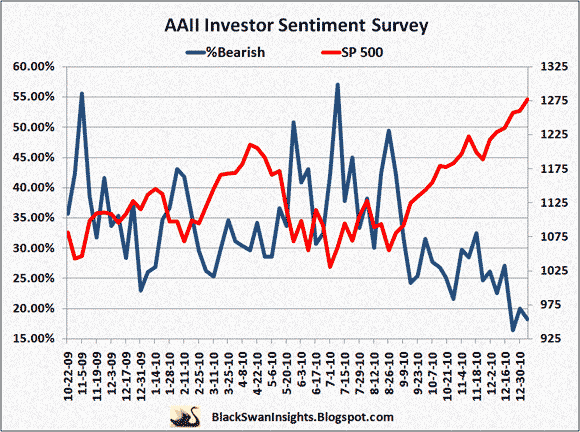

As has been the case for quite some time, AAII bullish sentiment has remained elevated as investors continue to consume Zimbabwe Ben’s QE elixir. If you remember, the extremely high bullish sentiment is one reason Marc Faber thinks a correction is just around the corner. While I generally agree, we have to remember that traditional trading signals seem to be almost useless when you have the Fed openly pumping stocks and explicitly saying the goal is a rising stock market. These truly are unprecedented times where you cannot rely on the usual trading signals. So while bullish sentiment is very high, it does not necessarily mean we will have a correction. One thing I like to keep track of is AAII bearish sentiment, which I have found to be a little more accurate in predicting market movements. Currently, it stands at only 18.25% and clearly indicates widespread complacency, thanks to the Fed’s actions. I took a look at what happens when AAII bearish sentiment falls below 18.50%. Over the last 6 years, there have been 13 occasions, which makes it very rare indeed. Over the next three weeks the market fell 7 times and rose 6 times. It should be noted that the decline was not terribly steep, only a few percentage points. You certainly would not want to bet the farm either way based on the numbers. However, it suggests that if you are thinking about establishing new long positions, then you should probably wait for a correction, instead of jumping on the bullish bandwagon.

Here is a short-term chart of AAII sentiment.

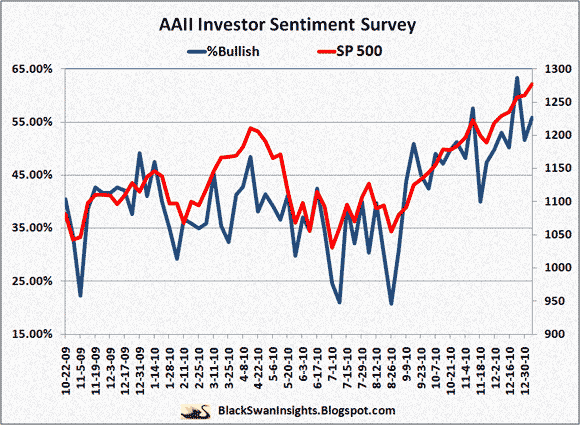

Here is a long-term chart which compares AAII bullish sentiment to the SP 500.

Finally, here is a a chart which compares AAII bearish sentiment to the SP 500.

Leave a Reply