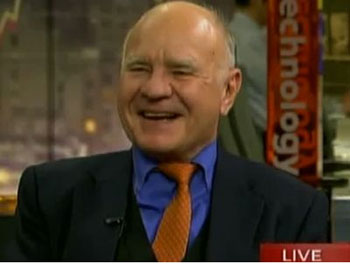

Investor extraordinaire Marc Faber is out with his latest Gloom, Boom, and Doom report, which discusses his outlook for 2011. Here are a few highlights:

Investor extraordinaire Marc Faber is out with his latest Gloom, Boom, and Doom report, which discusses his outlook for 2011. Here are a few highlights:

1. Equity Markets–Faber believes a correction is imminent for the stock market as bullish sentiment (AAII sentiment) nears record levels and mutual fund cash positions remain very low. Furthermore, the latest upward move in stocks has occurred on declining volume, which is usually bearish from a technical point of view. The correction should occur in January. That being said, you should be buying into the correction as it represents a good buying opportunity. Faber prefers energy companies and speculative stocks such as home builders and even AIG. He goes on to say that the third year of a Presidential cycle is very good for speculative stocks versus traditional blue chip value plays.

2. Gold and Silver–Reiterates his favorable opinion on gold and silver. Doubts they are currently in a bubble as some analysts postulate. Faber notes that investor exposure is very low when you look you compare it to the world’s financial wealth, meaning that gold and silver are still under-owned and have room to run.

3. Emerging Markets–While he is very bullish long-term on emerging markets, investors should avoid (or at least lighten up on) emerging market stocks right now. They should only be bought on corrections which would represent favorable entry levels. Overall, Faber thinks the SP 500 will outperform emerging markets in 2011. The only emerging market that looks attractive right now is Vietnam (VNM).

4. Commodities–On a correction, Faber likes energy companies since the long-term trend in oil is up, as supply fails to keep up with surging demand from emerging markets. Notes that emerging markets have surpassed the developed world in oil consumption and that this trend should keep demand strong for the foreseeable future. Faber likes the majors like Exxon, Hess, and even Chesapeake as natural gas is too cheap on an inflation adjusted basis. Continuing the energy theme, coal and uranium stocks should be gradually accumulated on weakness as the world looks for alternative sources of reliable energy. Peabody on the coal side and Cameco for uranium should outperform over the next few years.

5. Bond Market–Reiterates his bearish long-term view on US Treasuries, but notes that they are currently oversold and could be a good trade at this point (TLT). But this would only be a short-term bounce as rates have likely bottomed and higher inflation will erode future returns.

6. Japan Equities–While everyone is still bearish on Japan, Faber likes Japanese equities and thinks they have the potential for more upside. In particular, he likes Japanese financials such as Nomura and Mizuho Financial.

Overall, Faber is pretty bullish on equities despite his prediction of a short-term pullback in January.

Happy New Year!

Leave a Reply