Cooper Industries plc (CBE) has been soaring since early September as the global economic recovery gains traction. Despite a nice run up, the stock doesn’t appear to be overvalued with a PEG ratio of 1.3.

Management is optimistic that the company will experience solid growth in 2011, and earnings estimates are rising. The company is also producing strong free cash flow that it is using to buy back shares and hike its dividend.

It is a Zacks #2 Rank (Buy) stock.

Company Description

Cooper Industries plc is a global electrical products manufacturer. Sales for the third quarter were divided as follows:

Energy & Safety Solutions: 53%

Electrical Products: 47%

The company was founded in 1833 and is headquartered in Dublin, Ireland. It has a market cap of $9.6 billion.

Third Quarter Results

The company reported third quarter earnings per share of 85 cents, a penny ahead of the Zacks Consensus Estimate. EPS was up 25.0% over the same quarter in 2009.

Core revenue growth was 8.2%, its highest rate in nearly three years. The Energy & Safety Solutions division grew 7.2% while the Electrical Products group was up 9.3%.

The company saw its gross margin expand in the quarter from 31.9% of sales to 33.8%. This, along with solid sales growth, led to a 25.7% increase in operating income.

Solid Growth Ahead

CEO Kirk Hachigian stated that Cooper is “well positioned for solid growth in 2011 and beyond.” For the remainder of 2010, the company expects to earn between $3.14 and $3.18 per share.

The Zacks Consensus Estimate for 2010 is slightly above guidance at $3.20, a 27% increase over 2009 EPS. The 2011 estimate is currently 16% higher at $3.71. It is a Zacks #2 Rank (Buy) stock.

Returning Value to Shareholders

Cooper has generated $334.5 million in free cash flow year-to-date. The company spent $276 million of that cash buying back 6.2 million shares so far this year.

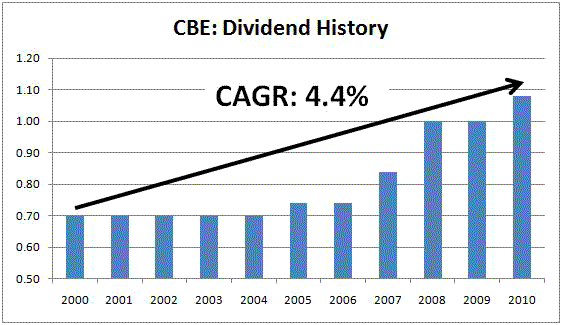

Cooper also announced an 8% hike in its quarterly dividend in February. Since 2000, it has raised its dividend at a compound annual growth rate of 4.4%.

It currently yields 1.8%.

Valuation

Shares have soared more than 40% since late August, but valuation is still within reason. The stock trades at 18.4x forward earnings, a premium to the industry average of 15.4x, but its PEG ratio is a very respectable 1.3.

Leave a Reply