Joy Global Inc. (JOYG) recently delivered its 9th consecutive positive earnings surprise on strong overseas sales growth.

The stock has been surging since late August, but estimates have been surging too, leading to reasonable valuations. It is a Zacks #1 Rank (Strong Buy) stock.

Fourth Quarter Results

Joy Global reported fourth quarter 2010 results on December 15. Earnings per share came in at $1.39, 23 cents ahead of the Zacks Consensus Estimate. It marked the company’s 9th consecutive positive surprise.

Net sales were up 8.9% year-over-year driven by solid growth in both underground mining machinery and surface mining equipment. Sales growth was particularly strong outside of the United States. Approximately 61% of sales came from overseas in the third quarter.

Meanwhile, operating income improved 23.1% as the company was able to leverage its fixed expenses. Earnings per share increased 15.8% over the same period.

Outlook

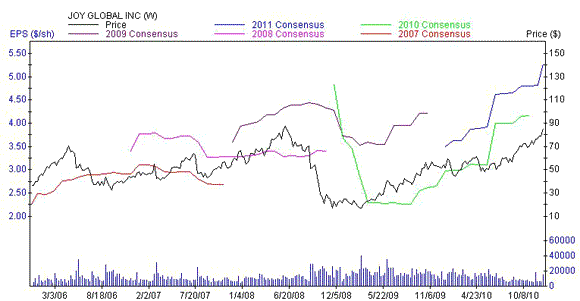

Estimates have been screaming higher over the past several months as the company continues to outperform expectations and fears of a double-dip recession subside.

Management expects 2011 “to be a year of increasing order rates and improving financial results.” The company expects to earn between $5.00 and $5.30 per share.

Analysts revised their estimates significantly higher following the strong quarter. The Zacks Consensus Estimate for 2011 is $5.27 (with guidance), a 20% increase over 2010 EPS. The 2012 estimate is currently $6.10, equating to 16% annual EPS growth.

It is a Zacks #1 Rank (Strong Buy) stock.

Dividend

The stock currently yields 0.8%. Joy Global hasn’t raised its dividend since 2008, however.

Its payout ratio of 16% is relatively low, so if the company continues to perform well expect more dividend hikes soon.

Valuation

JOYG has soared more than 60% since late August. Are shares overvalued here?

It doesn’t appear that way.

The stock trades at 16.4x forward earnings, a discount to the industry average of 19.9x. Its PEG ratio is a very reasonable 1.3.

Joy Global is a leading manufacturer of mining equipment. It is headquartered in Milwaukee, Wisconsin and has a market cap of $9.1 billion.

Leave a Reply