Boston Beer Co. (SAM) recent raised its full-year outlook driving shares even further. The stock is trading at all-time highs, but still remains reasonably priced.

Look for shares of this Zacks #1 Rank (Strong Buy) to keep climbing.

Company Description

Boston Beer Co. makes and sells more than 20 different kinds of beer, as well as other alcoholic beverages, in North America and Europe. Sam Adams is the company’s most recognizable brand.

Upping Their Outlook

On Dec 14 Boston Beer Co. raised its earnings outlook for the year after seeing increases in shipment volumes and a clearer forecast for expenses. The company expects shipments to be up 12% year-over-year.

Included in the update outlook was and increase in the EPS forecast. The company now expected to earn between $3.30 and $3.60 on the year. Earnings for next year are expected to grow to $3.95.

Analysts followed suit, with all 3 quickly raising full-year estimates. The Zacks Consensus Estimate for this year is up 30 cents, to $3.50, after the release. Forecasts are up 43 cents on average in the past 2 months.

Next year analysts polled by Zacks are expecting EPS of $3.94, up 47 cents on the news. Given these projections, annual growth rates are expected to be 61% and 13%, respectively.

Great Quarterly Results

In early November Boston Beer Co. reported depletions at a 8.5 million case equivalent, which is a company record. Revenue jumped 14% to $124.5 million.

Net income came in at $15.4 million, more than tripling since the same period last year. Earnings per share worked out to $1.09, which was 23 cents better than expected. This was Boston Beer Co.’s second surprise in the past 3 quarters.

Good Comparisons

While Boston Beer Co.’s profit margin is a slightly thinner than the industry average, at 9.8% compared to 11.4%, its ROE of 26.7% is well ahead of its peers, which average 14.8%.

Shares of SAM are trading with a forward P/E near 27 times and a PEG of 1.2. Now, these are higher than many would like, but still fall within the historic range for the stock.

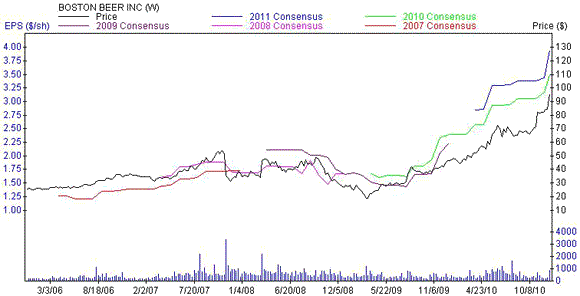

Off the Charts

Yes, the stock has been on fire recently, which may keep some investors at bay. But if you take a stop back and see just how fast the earnings have been growing, it may change your mind. Rising earnings leads to a rising share price. So, as long as the consensus keeps rising at this pace, you can expect similar moves in shares of SAM.

BOSTON BEER INC (SAM): Free Stock Analysis Report

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply