Is it true that the three basket-case countries of Europe–Greece, Ireland, and Iceland–have outperformed Germany on real GDP and productivity growth? Or do the implausible official numbers demonstrate the bankruptcy of the global economic statistical system?

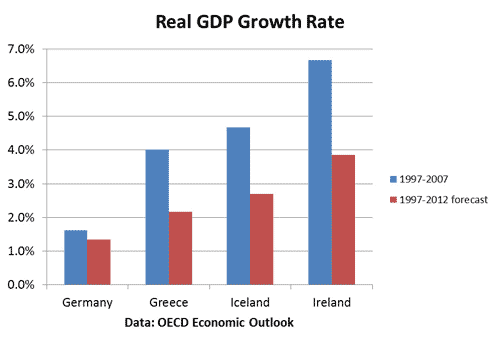

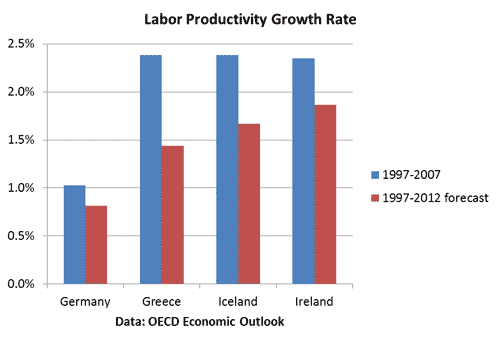

I was nosing through the just-released OECD Economic Outlook (top secret project, don’t ask), and I noticed something very interesting. The Outlook includes forecasts through 2012 for all sorts of macroeconomic variables, so we can now look at a 15-year time period (1997-2012) which includes the ten years of tech+housing boom (1997-2007) and the five years of the financial bust. Here are two charts comparing the strongest economy in Europe, Germany, with the three basket cases, Greece, Ireland, and Iceland. We’re looking at real gdp growth and total economy labor productivity growth:

These charts show that the three basket-case countries of Europe–Greece, Ireland, and Iceland–substantially outperform Germany during the boom years, which is to be expected (blue bars). For example, Greece had productivity growth averaging 2.4% per year from 1997 to 2007, compared to only 1% per year for Germany.

What is more surprising is that Greece, Ireland, and Iceland continue to outperform Germany, even when we factor in the 5 years of the bust, including forecasts through 2012 (the red bar). For example, average real GDP growth in Iceland is projected to be 2.7% annually over the 1997-2012 time period, almost double the 1.4% growth rate of Germany.

What can we make of these disparities? After all, we economists have been trained to believe that productivity growth is an essential measure of the health of an economy. Here are four possible explanations:

- OECD forecasters have drunk too many bottles of wine, leading to overoptimistic forecasts

- Five years post-bust is too short: The basket-case countries will be suffering for many years.

- Boom-and-bust beats slow-and-steady in the long-run.

- The usual way of measuring Gross Domestic Product overestimates both debt-fueled growth (Iceland, Greece) and growth fueled by supply chains (Ireland).

As anyone who has been reading me for a while knows, I lean towards #4. I think there’s a first-order problem with the way we measure GDP growth, because trade–including flows of knowledge capital–is being incorrectly counted, or not counted at all.* That’s a big gotcha, since bad macro data have and will distort decision-making by policymakers,corporate leaders, and investors.

*I will recap the full set of statistical issues in a post soon. If anyone wants to be on my “alternative system of global economic statistics” mailing list, just drop me a note.

Leave a Reply