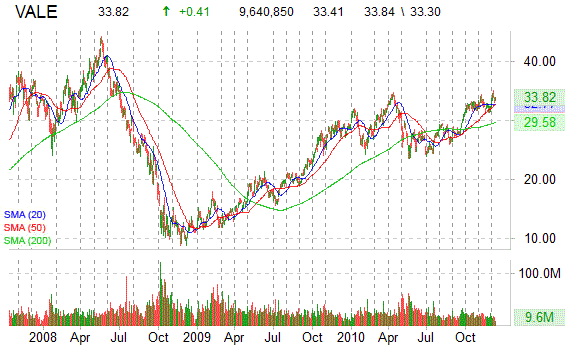

Vale S.A. (VALE) – Shares of the world’s largest iron-ore producer are popping up on our ‘intraday breakout’ market scanner in the second half of the session. The Brazilian mining conglomerate has broken out intraday after spending much of the first half of today’s session in red territory. Shares in Vale are currently up 1.20% to trade at $33.84, exceeding yesterday’s high of $33.79.

Technically speaking, VALE continues to consolidate (with consolidation comes raising support at each level) in a tight range with the $40 level being the ticker’s next focus. The security should be able to realize that price target once it gets above its 52-week high of $35.00, a move which we believe is imminent. The past 60 sessions have seen the equity trade between $32.00 -$34.00. All of the share price action during the period has been entirely consolidative in nature.

Judging from the stock’s one-year and weekly-charts, things are looking very positive. The move from $32.00 to $34.00 was off of a flag formation and the high it reached was a measured high (based on the flag). We have seen a couple of corrections from that high but we have been building over the last two to three weeks another flag formation from which to launch another rally up to retest $35. My take to this whole scenario is that if there are no surprises then the stock will act technically as well as fundamentally. That means that once the $35.00 level is broken then we are likely to be heading up to the $40 level within a very short period of time.

At last check [2:39 p.m. EST], VALE shares were up 38 cents, or 1.14%, to $33.79 in trading on the NYSE.

Disclosure: Long position

Leave a Reply