The new news looks to me like the same old news.

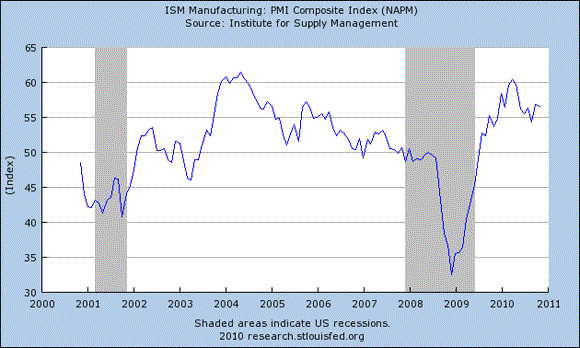

The brightest economic indicators continue to come from surveys of managers. The ISM manufacturing PMI held up at 56.6 for November. Any reading above 50 signifies that more responders reported improving conditions than reported deterioration, and a reading this high suggests manufacturing continues to do quite well. ISM nonmanufacturing PMI was also at a very healthy 55.

Source: FRED

U.S. auto sales for November were up 16.8% from a year ago, sustaining the kinds of year-over-year gains that we saw over the previous two months, but still stuck at a level far below what we used to think of as normal.

Data source: Wardsauto.com

A more troubling important economic summary is the Chicago Fed National Activity Index. Its 3-month average continued its recent slide, falling to -0.46 for October.

Source: Federal Reserve Bank of Chicago

The Bureau of Economic Analysis revised up its estimate of third quarter real GDP growth from the 2.0% annual rate initially reported to a revised estimate of 2.5%. On the other hand, the revised data also give us the first look at gross domestic income, whose difference from GDP represents a pure statistical discrepancy. The real GDI growth for 2010:Q3 is estimated at a more modest 1.6%. Personally I favor using an average of the reported GDP and GDI growth rates, which leaves us about where we thought we were with a 2.1% real growth rate. Growth rates in that neighborhood can easily be associated with a rising rather than a falling unemployment rate, since new job creation is probably not fast enough to keep up with a growing population.

Average of annual growth rates of real gross domestic product and real gross domestic income, 1947:Q2-2010:Q3

And unfortunately that was also the message from Friday’s very disappointing labor report from BLS, whose establishment survey implied that seasonally adjusted nonfarm payrolls increased by an anemic 39,000 jobs in November. The separate and somewhat noisier household survey was even more troubling, suggesting that 173,000 fewer Americans were working in November compared to October, bringing the unemployment rate up to 9.8%. Payrolls processed by ADP added to a mixed picture with a cheerier estimate of a net gain of 93,000 in private-sector employment. Whatever you make of this, it certainly provides no confirmation of the notion that we have turned the corner in terms of employment growth.

Altogether, I think this leaves us where we’ve been for some time now– the economy is growing, but painfully slowly.

Leave a Reply