Mike Rorty has been on something of a crusade to ban prepayment penalties on mortgages. Somehow he has concluded allowing banks to charge prepayment penalties leads them to make riskier loans.

So I don’t misstate his argument, here is how it appears in his most recent post:

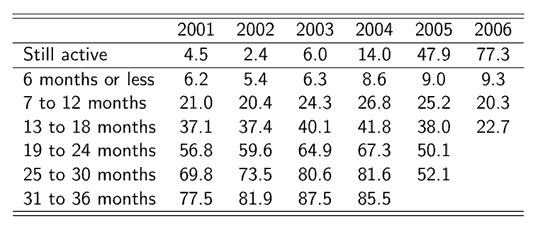

Nope. One way to do it would be to ban prepayment penalties at the federal level. In that entry, we worked out a model where banks were able to bet on house prices rising by using prepayment penalties to capture part of the rises and by making sure the loans were bad enough, with desperate enough people with terrible enough 2-year resets, to force refinancing. Let’s peek at one of my favorite charts of the subprime market, the percent of mortgages not alive by time after origination:

30 months out 80% of subprime loans aren’t active, most having refinanced. Of those subprime loans, 80%+ had a prepayment penalty. We work the numbers in that model; on average prepayment penalties reflected 6 months interest, so around 3% of the houses values. So if the house appreciates 10% in two years, the bank gets to exercise an option that transfers 3% of that equity straight over.

Because remember, banks do not normally have a delta (exposure) on housing values. If house prices rise on a prime mortgage the only value they get are secondary (less default, higher recovery); subprime mortgages were a way for them to tap that equity. Betting on house prices directly is not what we want banks to be doing. This is a direct law that could be passed by this agency. Let’s go one level higher.

Let’s take this one step at a time.

First, the chart is fairly typical of what you would expect to see among different vintages of mortgages regardless of type. Whether subprime, Alt-A or prime, Americans tend to move or refinance in fairly predictable patterns during any normal real estate market. The real estate market during the time periods cited in Mike’s graph were anything but normal. They were red hot.

Homeowners, regardless of the type of loan they held were refinancing, selling and moving-up at a spectacular pace. The fact that few subprime loans of a given vintage were outstanding after 30 months should come as no surprise.

Now a couple of suppositions that Mike makes to prove his point are more than a bit shaky. First, he asserts that subprime loans were written with 2 year resets that forced refinancing due to onerous interest resets and resulted in the banks capturing their prepayment penalties.

In reality, most subprime loans were written with various reset maturities. Anywhere from one to five years. Generally, the prepayment penalty was not for the life of the loan but tended to match the reset. In other words a loan with a 3 year reset would also have a 3 year prepayment penalty. Thus the borrower was locked in during the teaser rate period and would not be subject to the payment of the penalty unless he refinanced prior to adjustment.

Additionally, subprime loan prepayment penalties generally applied only to a refinance of the underlying loan. In the event of a sale of the property the prepayment penalty was not operative.

Now, Mike asserts that most of the 80% of the loans in his graph that have vanished were refinanced and that 80% of those loans had a prepayment penalty. Unfortunately he doesn’t provide a data source for this claim. Let’s take him at his word, though. If 80% were refinanced and 80% had a prepayment penalty we still don’t know anything because we don’t know at what point in time those loans were refinanced. If the borrowers, in fact, refinanced after the prepayment penalty lapsed then it resulted in no income to the holder of the mortgage.

Given that during the time period that Mike’s graph represents housing prices were exploding, it’s quite likely that borrowers were able to refinance either into new subprime loans or other mortgage products without incurring a prepayment penalty. It’s equally likely that the supposition that 80% were refinancing is wildly over estimated as many homeowners were using their out sized equity gains and easy financing to overbuy, in other words more of these loans may have been paid off than Mike estimates.

So, it’s hard to follow Mike’s argument that banks were looking for extra juice from subprime loans by imposing prepayment penalties. If that were in fact the case one would expect that they would have structured the loans to ensure the payment of the prepayment penalty. In fact, the penalties were structured to give the borrower an incentive to prepay exactly at the point in time that the penalty expired and the loan became more onerous. Hardly a prescription for extracting extra income.

It’s worth noting that among the countries with advanced mortgage finance schemes, the U.S. stands pretty much alone in not imposing prepayment penalties on most mortgages. Canada, Australia, most of the European countries and many others impose a penalty for prepayment — sometimes for the life of the loan. Most of those countries have a far superior track record than the U.S.

There is no doubt that prepayment penalties carry the potential for abuse. They also serve to deliver superior interest rates to the borrower as investors demand lower spreads in exchange for the call protection. Additionally, prepayment penalties serve to discourage some of the very activities that landed us in this mess. Cash out refinancing and property flipping become less attractive alternatives when the borrower is subject to an early termination penalty.

Sorry, Mike, but I just don’t see how the facts fit your theory. Heck, prepayment penalties might be in borrowers’ best interest. Think about it. They deliver lower rates, discourage the use of homes as piggy banks and slow down the churning of property. Not all bad.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply