Martin Wolf has a somewhat disquieting column in the FT. He notes that the current recession is striking in the manner in which it is tracking the Great Depression.

From the FT:

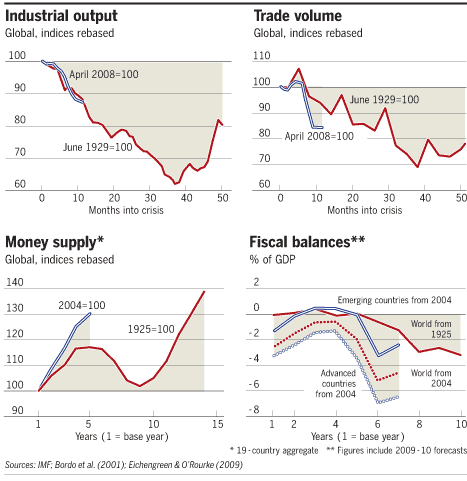

Two economic historians, Barry Eichengreen of the University of California at Berkeley and Kevin O’Rourke of Trinity College, Dublin, have provided pictures worth more than a thousand words (see charts).* In their paper, Profs Eichengreen and O’Rourke date the beginning of the current global recession to April 2008 and that of the Great Depression to June 1929. So what are their conclusions on where we are a little over a year into the recession? The bad news is that this recession fully matches the early part of the Great Depression. The good news is that the worst can still be averted.

First, global industrial output tracks the decline in industrial output during the Great Depression horrifyingly closely. Within Europe, the decline in the industrial output of France and Italy has been worse than at this point in the 1930s, while that of the UK and Germany is much the same. The declines in the US and Canada are also close to those in the 1930s. But Japan’s industrial collapse has been far worse than in the 1930s, despite a very recent recovery.

Second, the collapse in the volume of world trade has been far worse than during the first year of the Great Depression. Indeed, the decline in world trade in the first year is equal to that in the first two years of the Great Depression. This is not because of protection, but because of collapsing demand for manufactures.

Wolf goes on to note the difference is that the response from governments has been massive and far beyond that which occurred during the Depression. Based on that fact, he contends that the jury is out as to whether we continue to closely track the experience of the 1930’s. He feels that the crucial element will be the ability of government to continue to stimulate economies and not pull the plug too quickly, nor let stimulus linger too long.

Wolf is not in the “green shoots” camp. He thinks that anyone who sees recovery in the private sector at this point in time is deluding themselves. A long hard climb out is what he expects to be the economic recovery road.

I don’t disagree with much of what he has to say and certainly it conforms to what a lot of other pundits are suggesting. I do think the similarities with the Depression are worth noting and probably should alert us to the fact that we may well indeed be exposed to the same sort of cataclysmic event if policies mistakes are made. At the same time, I think that the comparison can be overdone.

It’s a much different world now with at least a partial understanding of the mistakes that made the Depression so bad. Presumably that leads to fewer errors of judgement. By and large most of the world’s developed economies are working in concert this time instead of trying to export the downturn so individual stimulus efforts are not being undercut by contrarian policies from abroad. Finally, I think that the superior information systems that we now have make managing through this easier. Manufacturers were able to quickly shut down production as the extent of the downturn became evident thus avoiding a disastrous accumulation of inventory. Likewise, they should be able to ramp up production smoothly as demand does return, resulting in less of a start-stop recovery.

It is a long road ahead but we do have some advantages they did not have in our grandparents day. Unfortunately, our politicians are probably no more adept at making good choices than theirs were. That particular piece of the puzzle hasn’t improved at all.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply