Where from here? Yesterday has (or should that be had?) the potential to mark a significant turning point for markets, though as yet follow-through has been indifferent, to say the least. The Eurostoxx closed below its 200d moving average, and while the SPX fell 2.4% yesterday it remains 1.5% above its 200d. It is slightly dangerous to get aggressively short SX5E without confirmation from US equities; unsurprisingly, therefore, European equities have been trading water this morning as they wait to see what the Americans do.

The past 24 hours have also seen a classic FX screw-job, as EUR/USD broke through a fairly obvious head and shoulders neckline, prompting a raft of stops……only to squeeze back above (also courtesy of stops) this morning. Apparently, the BRICs moratorium on talking down the dollar (thereby shooting themselves in the foot) only lasted a day, as the weekend comments from Kudrin that there was no real alternative to the dollar have been countered by Medvedev’s stated desire to…err…..create an alternative to the dollar.

With quarter-end falling two weeks from today, it’s perhaps worth considering what the next couple of weeks might hold. There’s the small matter of Friday’s triple-witching expiry and next week’s Fed meeting, of course, which could obviously add ample noise (and perhaps a dose of signal?) to price action.

Regardless, Macro Man has heard some rumblings that funds will be buying equities into the close of the quarter to get closer to benchmark, which has been cited by some green shoots/reflationist proponents as a rationale for further equity gains.

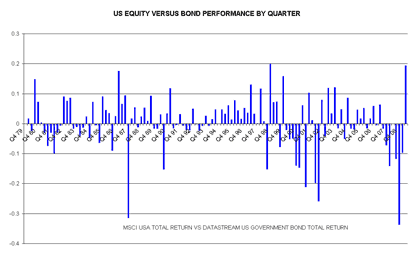

While this may be the case for individual managers, Macro Man isn’t so sure about asset allocators such as pension funds. Through yesterday’s close, US equities had posted their second-largest quarterly outperformance over government bonds of the last thrity years. In fact, until yesterday, it was the largest quarterly outperformance.

Now this admittdly comes on the heels of a record underperformance of equities in Q4, followed by another abject stock market performance last quarter. And if pension funds didn’t do any rebalancing over the last few quarters, then yeah, they are probably still underweight. But if they did……well, then they might even be overweight now. A pension fund that owned 60% equity and 40% bonds at the end of March would now own 65%/35%. Price has done a lot of balancing work for them.

We’ll only know in retrospect what allocators end up doing, but Macro Man has a funny feeling that anyone expecting a late-month or late-quarter bounce such as we observed in Q4 and Q1 might well be disappointed.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply