Shares of Akamai Technologies (AKAM) are down sharply on Monday, falling the most in S&P 500 Index, after an analyst at Oppenheimer cut the stock from “Outperform” to “Perform”. AKAM fell 5.60 percent to $46.98 after erasing nearly 7 percent earlier. Volume for the ticker remains heavy in late midday trading with more than 7.5 million shares already trading hands compared to a 12-wk daily average volume of 5 million.

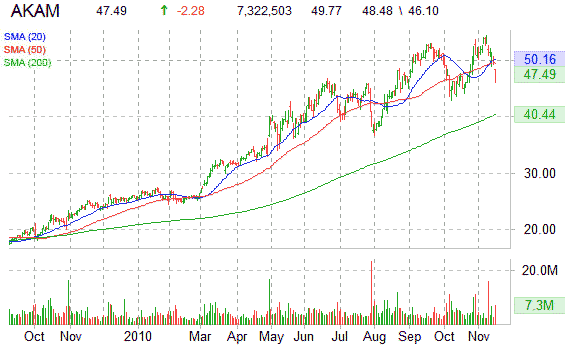

Technically speaking, AKAM has been showing support around mid/$48.00 and resistance in the $51.36 range. After a strong multi-week uptrend since mid-October, AKAM reversed off its new Nov. 8/ high of $54.39 and has been sliding ever since. The equity, which currently is hovering along session lows as it continues trading below its 50-day $49.51 moving average, tried last week to maintain its breakout levels above the recent 52-wk range highs, but it couldn’t sustain the move.

Needless to say, the stock’s recent rally has come to a crashing halt, as the equity has pulled back below support at its 10-day/ SMA and 20-day/ SMA…$51.62, $50.14, respectively. Certainly, short sellers are adding more fuel to the stock’s recent nosedive. Short interest on the equity rose 2.91% for the Sept. – Oct. period, and now accounts for approximately 4.60% of the stock’s float.

AKAM now looks poised to revisit former support at the 44.00 level. Having said that however, is worth noting that shares of AKAM — which currently trade at a trailing P/E of 55.89, a forward multiple of 28.83 and a P/E to growth ratio of 2.16 — have outpaced the broader S&P 500 Index (SPX) by an impressive 94% during the last 52 weeks.

AKAM lost $2.28, or 4.64%, to $47.49 at 2:49 p.m. ET in Nasdaq composite trading.

Over the last 52 wks the stock of the $8.6 billion market co. has ranged from a low of $23.40 to a high of $54.39.

Leave a Reply