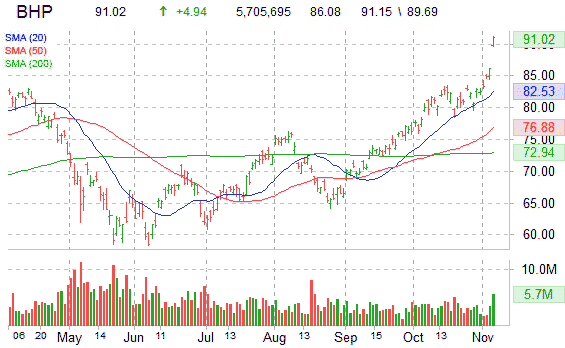

Shares of BHP Billiton Ltd. (BHP) are higher on the session by nearly 6 percent, currently trading at $91.05, on rumors that the company could initiate e large buyback.

According to MarketWatch, BHP could be backing away from its potential acquisition for Potash Corp. (POT), following Canada’s rejection of BHP’s $39 billion bid for the world’s largest fertilizer company. Late Wednesday the Canadian government said it would block BHP’s hostile bid for Saskatoon – based Potash because a sale of the company wouldn’t provide a “net benefit” to the country. As e result of this development UBS analysts based in Australia and the U.K. believe the Australian miner could initiate a share buyback.

MW: “In our view, should BHP not proceed with Potash Corp. they would look to commence a share buyback program,” the analysts said. “While BHP has the balance sheet to support the ‘mother of all share buybacks’, we envisage they would look to proceed with something more manageable say US$10 billion, to provide flexibility for other potential M&A opportunities.”

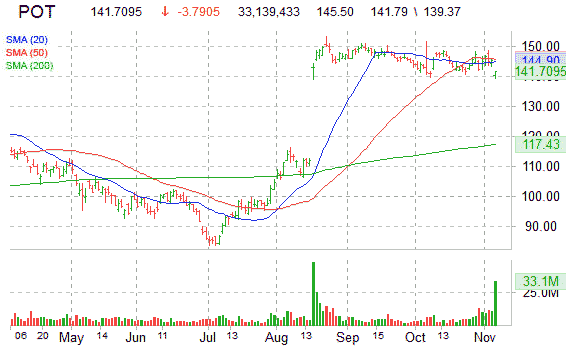

Last week UK’s Sunday Times reported that BHP was considering raising its $130 a share offer for Potash by 10 percent.

At last check, BHP shares gained $4.93, or 5.73 percent, to $91.01 in New York Stock Exchange composite trading.

Potash fell $4.44, or 3.05 percent, to $141.06 at 3:10 p.m EDT. Today’s POT volume is huge: nearly 33.5 million shares have exchanged hand so far into the session. The ticker’s average volume over the last 13 weeks is 7.1 million shares.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply