The Federal Open Market Committee announced yesterday that:

the Committee decided today to expand its holdings of securities. The Committee will maintain its existing policy of reinvesting principal payments from its securities holdings. In addition, the Committee intends to purchase a further $600 billion of longer-term Treasury securities by the end of the second quarter of 2011, a pace of about $75 billion per month.

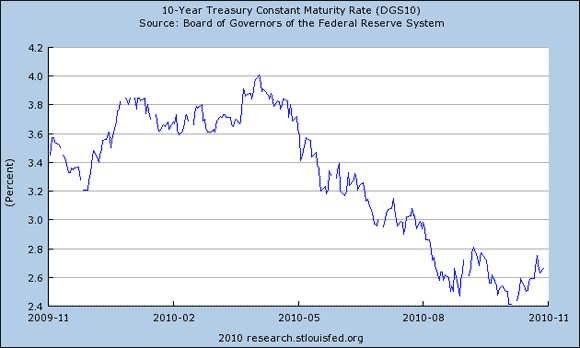

The market often figures out what the Fed is going to do before the Fed itself figures out what it’s going to do, and this time was no exception. Today’s announcement was very much what most analysts were expecting. And for that reason, the effects of the new program were in my opinion already priced into bond yields.

Specifically, one estimate is that this level of security purchases might be enough to depress the 10-year yield by 20 basis points or so. But that’s exactly what may have already happened as the conviction grew over the last few months that such an announcement would be forthcoming today.

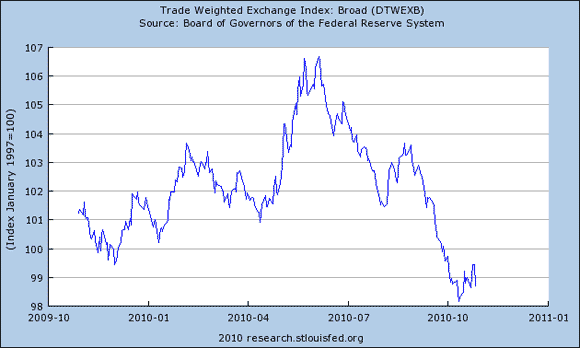

Another possible effect of QE2 is some depreciation of the dollar. But that too appears to have been already priced in.

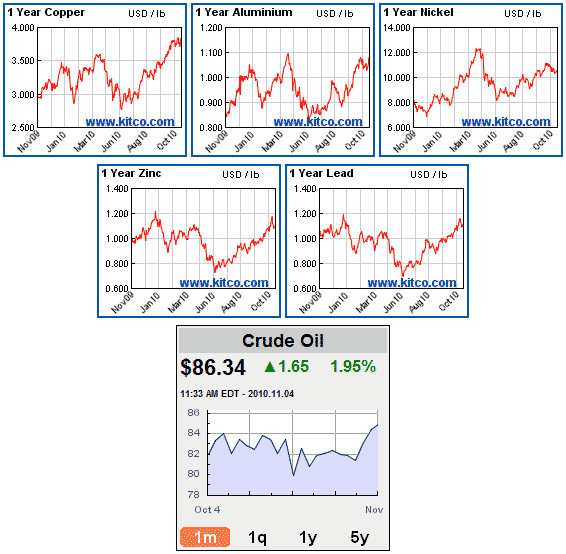

I believe that the recent rise in commodity prices also anticipated today’s announcement from the Federal Reserve.

So if QE2 has already done what it’s going to do, does that mean that our problems are already solved? Certainly not, because our problems were much bigger than any of the weapons in the Fed’s limited arsenal. I do think that QE2 may be modestly helpful in terms of making credit more available to small businesses, encouraging a little more refinancing to enable more spending, encouraging net exports, and breaking the deflationary psychology that may have been a factor in so much cash sitting idle.

More than that, I do not ask or expect from the Fed.

Leave a Reply