Flextronics (FLEX) just might have it all. Following the sixth consecutive earnings surprise, management raised its outlook above the consensus estimates at the time.

Growth rates are looking fantastic and valuations are great for this Zacks #1 Rank (Strong Buy).

Company Description

Flextronics is an electronics manufacturing service company that offers design, engineering and manufacturing services to OEMs in a variety of industries. The company’s logistic and other services help customers vertically integrate their business to reduce costs and time to market.

Sales Jump 27%

On Oct 27 Flextronics reported quarter results including a 27% jump in sales, to $7.4 billion. This was a 13% increase over the previous quarter. Net income jumped an impressive 72%, to $179 million.

Earnings broke down to 21 cents per share, which was up 8 cents since last year and beat the Zacks Consensus Estimate by 3 cents. Flextronics has now beaten expectations in each of the past 6 quarters.

The CEO said the improvements were spread throughout the company’s business segments, with each growing sequentially and year-over-year.

Estimates are Rising

Given the strong results and projected growth from the company coming in above the consensus, analysts quickly raised estimates. The full-year consensus for fiscal 2011 picked up a penny into the report and another 6 cents after to get to 79 cents.

Next year’s average forecast is also up 7 cents, to 92 cents. Given the 66 cents earned in the previous year, expected growth rates are 20% and 16%, respectively.

And Shares are Cheap

Even after a spike on the earnings news, you can still get in FLEX without overpaying. The forward P/E is just under 10 times and the PEG ratio is showing a bargain, at 0.8.

Flextronics has an ROE that is north of 27%, about 1,200 bps higher than its closest peer. It also leads the group in ROI.

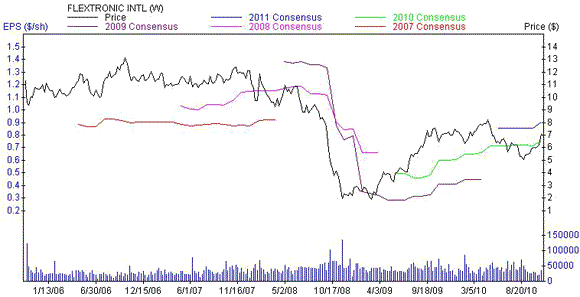

The Chart

FLEX has spiked on the earnings news, which can be tough pill to swallow for some. However, if you look at the longer-term earnings trend you can see estimates gradually increasing, which bodes well for continuing gains.

Leave a Reply