Shares of JPMorgan Chase (JPM) are trading sharply lower on heavy volume following a story by ProPublica stating the U.S. Securities and Exchange Commission is investigating whether JPMorgan allowed a hedge fund to improperly select assets for a 1.1 billion deal — called “Squared” and completed in May 2007 — backstopped with subprime mortgages.

According to ProPublica’s report, the deal was a CDO and made up of pieces of other CDOs. The hedge fund, Magnetar Capital, based in Evanston, Ill., purchased the riskiest slice of Squared as part of a strategy to short the mortgage market, the story said.

This sounds very similar to the Goldman Sachs (GS) case, which involved the selling of Abacus 2007-AC1, a mortgage security. Goldman was accused for not disclosing that hedge fund Paulson & Co. helped design the asset and was betting it would fail.

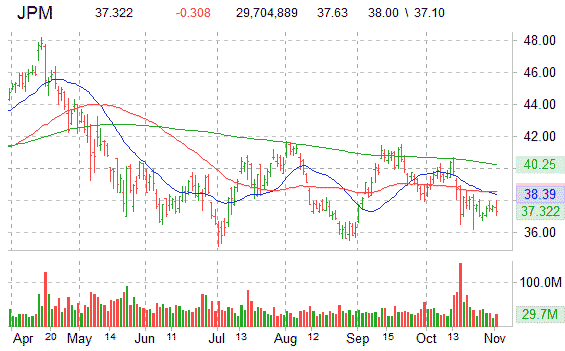

JPM lost $0.29, or 0.77 percent, to $37.34 at 3:25 p.m. ET in New York Stock Exchange composite trading.

Leave a Reply