Global energy consumption fell for the first time in nearly three decades last year as slowed manufacturing and idled factories drove consumption lower. Overall, global energy consumption fell 1.1 percent in 2009, the largest decline since Ronald Reagan’s inauguration.

Contracting consumption in the developed world was the largest driver of the decline.

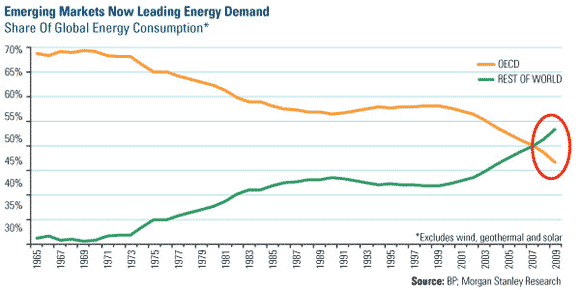

This week’s chart breaks down share of global energy consumption by developed markets—the U.S., Western Europe, Japan and others represented by the Organization for Economic Co-Operation and Development (OECD)—and the rest of the world. You can see that the OECD’s share of global energy consumption has tumbled from nearly 70 percent in 1965 to well below 50 percent last year.

Meanwhile, the lights are shining bright in emerging markets. Emerging markets’ share of global energy consumption has more than doubled since the 1960s. More importantly, the speed of advance by emerging markets has accelerated the past few years, stealing away more than a 10 percent share of the total since 2003.

Credit Suisse expects oil demand to grow 9.3 percent in China, 4 percent in Latin America and 4.4 percent in the Middle East in 2010. In contrast, it expects oil demand to contract by nearly 2 percent in Western Europe and manage only meager growth in North America.

The global recession has allowed emerging markets to gain ground as activity in the developed world slowed to a crawl, but the long-term trend is a significant one and will likely continue. Improving economic conditions in the developing world means more people have more money to spend on personal cars and electricity for their homes. Also, a wealthier population consumes more goods and electronics which leads to more manufacturing activity and increased energy demand.

Leave a Reply