Well-known author and investment consultant Roger Gibson recently hosted a webcast where he educated investors on the importance of diversifying into international markets and we believe it is an opportune time to explore new areas with your portfolio.

Global investment guru Nicholas Vardy says “there’s always a bull market somewhere” and it’s up to investors to find it. We think there’s a bull market emerging in Eastern Europe.

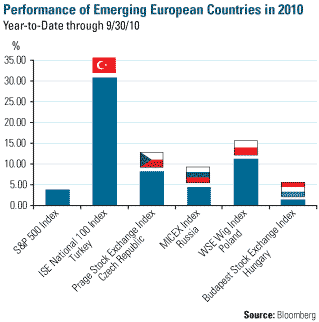

Russia may be the first country that comes to mind when you think of Eastern Europe, but it’s the other countries of Emerging Europe, countries such as Poland, the Czech Republic and Turkey, that have outperformed.

While the S&P 500 Index was only up 3.89 percent as of September 30, Turkey had risen nearly 31 percent, extending a large lead on other Emerging Europe countries. The Czech Republic (up 8.19 percent) and Poland (up 11.16 percent) have also outperformed most emerging markets. Meanwhile, Russian markets have only gained 4.39 percent.

Even with the good performance of these markets so far this year, Emerging Europe markets still have attractive valuations. Emerging markets generally trade at a higher—many times in the double digits—price-to-earnings ratio than the developed markets, but Forbes reports that five of the six cheapest emerging equity markets in terms of price-to-earnings ratio are from Emerging Europe. Russia, Hungary, Czech Republic and Turkey are all currently trading at or below 10 times earnings and Poland comes in at 11 times earnings.

Historically, the German economy has held high importance for Emerging Europe economies because its relatively wealthy population consumed large amounts of goods such as cars, dishwashers and refrigerators imported from the region.

That’s not the case in today’s world. A report out this week showed that German exports into the Eastern Europe region were up 20 percent during the first half of the year from the same time last year. In addition, total trade between Germany, Europe’s largest economy, and Emerging Europe totaled $143.6 billion.

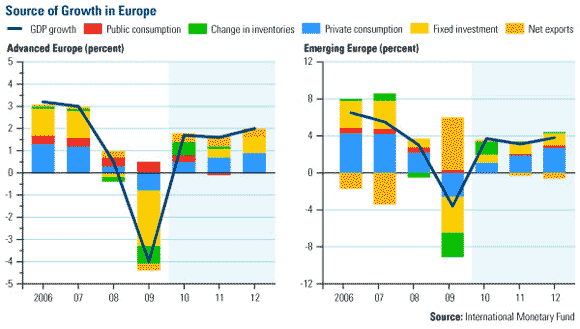

This chart from the International Monetary Fund (IMF) shows the strong rebound in both private consumption and fixed asset investment that Emerging Europe is currently seeing. Private consumption includes retail sales and orders of durable goods while fixed investment represents productive assets like power plants, factories and other infrastructure.

During the depths of the economic crisis, Emerging Europe experienced substantial contractions in both. This year, private consumption and fixed investment will contribute to nearly half of the region’s GDP and it is expected to contribute to nearly all of it next year.

The IMF estimates Emerging Europe will see 3.7 percent GDP growth this year and then dip slightly to 3.1 percent in 2011. But that doesn’t tell the full story.

Poland, which is the only country in the region that avoided recession, grew by 3.4 percent this year and is forecast for higher GDP growth next year. This growth is Poland’s opportunity to close the gap with other members of the European Union.

After contracting nearly 5 percent in 2009, Turkey has notched the highest level of growth for any country in Europe this year—up almost 8 percent. Turkey’s strength is in its robust banking sector and strong domestic demand.

Things are also looking up for Russia. BCA Research upgraded Russian stocks this week, based on increases in household income and spending, improved employment figures and a decrease in household savings rates. Russia also plans to expand oil production in the near term which should be a positive driver for energy stocks that are trading 30 percent below global peers.

We’re positive on Russia because recent weakness in the U.S. dollar bodes well for the country’s energy and commodity exports.

Recognizing these changes and identifying catalysts for outperformance is something our experience investing in the region brings us. We were able to recognize the softness in Russian markets early, allowing us to move larger portions of the portfolio into the better-performing countries. This week, Zack’s named our Eastern European Fund (EUROX) in the Top 5 for European Mutual Funds—click here to read what they said.

Tim Steinle, co-manager of the U.S. Global Investors Eastern European Fund (EUROX), contributed to this commentary. Tim and Evan Smith have just returned from Russia and Turkey, obtaining that tacit knowledge you can only gain from being on-the-ground.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The Istanbul Stock Exchange National 100 Index (XU100) is a capitalization-weighted index composed of National Market companies except investment trusts. The MICEX Index is the real-time cap-weighted Russian composite index. It comprises 30 most liquid stocks of Russian largest and most developed companies from 10 main economy sectors. The MICEX Index was launched on September 22, 1997, base value 100. The MICEX Index is calculated and disseminated by the MICEX Stock Exchange, the main Russian stock exchange. The WSE-WIG Index is a total return index which includes dividends and preemptive rights (subscription rights). The index includes all companies listed on the main market, excluding foreign companies and investment funds. The Budapest Stock Exchange Index is a capitalization-weighted index adjusted for free float. The index tracks the daily price-only performance of large, actively traded shares on the Budapest Stock Exchange. The Prague Stock Exchange Index is the official index of the Prague Stock Exchange.

Leave a Reply