At last, the end of an eventful week is upon us with the release of US unenjoyment figures today.

Yesterday’s central bank hoe-down was a bit of a limp fish, with no particularly earth-shattering revelations from the BOE, BOE, or JCT. Yet there was one interesting datapoint that certainly caught the eye, particularly in advance of today’s payroll report.

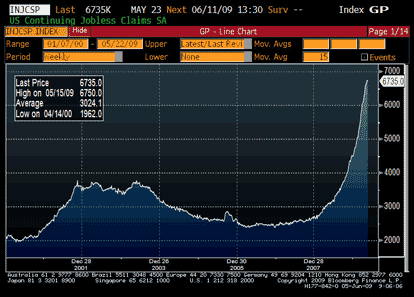

While the initial jobless claims figure was bang in line with expectations, the generally-smoother continuing claims figure registered a considerable surprise, coming in lower than the previous week and undershooting the consensus forecast by a robust 120k. Given that this data is among the most useful in pinpointing economic turning points, this would appear to be more fodder for the green shoots crowd.

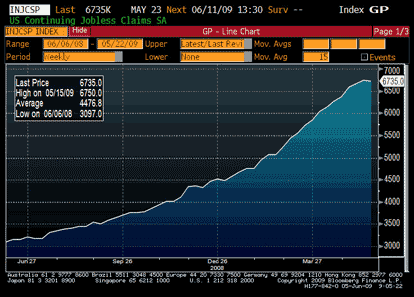

And so it might well prove to be, in the end. Then again, perhaps not. After all, it takes more than one week’s worth of data to confirm a trend or a turn. And while the chart above appears to suggest that continuing claims are indeed flattening out, with the benefit of a little perspective we can see that this change is essentially undetectable from a longer-term perspective. So while yesterday’s figure may prove to be an important turning point in the fullness of time, Macro Man is waiting to reserve judgement….and he certainly isn’t makign a judgement on today’s figures based on yesterday’s data.

One other notable feature yesterday was a melee in the foreign exchange market around 1pm London time yesterday, when the dollar suddenly went bid, particularly against sterling, and rumours started to fly that Gordon Brown was resigning/no he wasn’t/yes he was/no he wasn’t.

Leaving aside the issue of whether Gordo’s continued presence on the public stage is a positive or a negative for the pound, the recently-hibernating bears on sterling are beginning to rouse from the slumber. Surely recent price action is a turning point?

Well, again, maybe it is…but maybe it isn’t. It turns out that Rio Tinto has spruned Chinalco’s advances with a two-word response (the second word of which is “off”) and decided to raise money and go it alone. This capital raising is being done on an FX-hedged basis, which entails the sale of significant amounts of sterling….and guess what? Yesterday’s most notable sellers of the pound were the three book-runners!

It’s not like we needed a reminder that this market remains rather challenging for traditional macro punters, but yesterday’s sterling price action provided one anyways. Hopefully with the benefit of a few months’ perspective we can look back at this period, shake our heads, and enjoy a good chuckle.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply