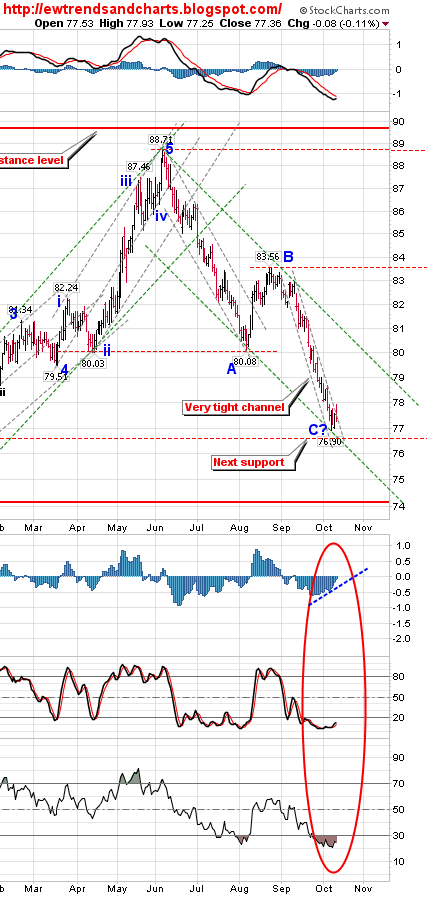

In the last two days the Dollar appears to be forming a bottom. You can see in the attached chart how its rapid decline has paused, and it even spiked above the upper trendline of its descent. Overnight it has fallen back inside, and it still may get to DX76 before bouncing. Currently it is right above DX77.

EWTrends adds to this a discussion of the circled technical indicators, which appear to have reversed.

Sentiment is more bearish than at any time in history (at least since the Dollar was finally severed from gold in 1971).

The downward momentum stalled late last week when the Euro hit $1.40. The AUD is hovering around 98c and flirting with parity, hitting 99.2c so far.

The most crisp analysis comes from Credit Suisse, which predicts a 100% chance of a rally from here based on net speculative positions. They believe QE2 has been fully priced into the USD “and then some.”

Finding a bottom? Using the article’s charts, the same could have been said July-August. Chart chasing eventually strikes a bottom or top. Maybe this is that time. But speaking of my own associated firm, investment research shop Wainwright Economics, Wainwright became bullish on gold (bearish on the dollar, really) in 2004, remained so and continues. The metal’s price is a major economic barometer for the firm. For most pros, the dollar-gold price is a fuddy duddy forecasting instrument akin to Grandpa’s arthritic knee, but to those who have listened, the bones have been very good indeed. Wainwright is the modern master of including this price as a principle and profitable analytical tool to explain past, current and expected monetary inflation.

According to a September 25 research study by the shop this year, the most recent rise in the price of gold is no surprise, as its upward trend has now been established for a decade. Over that period, the annual rate of increase has been nearly 17 percent. Scope continues to build for a large increase in oil prices.

And as the dollar falls relative to gold, so the return on equities expressed in terms of dollars, declines. That represents a twofold reduction in US real wealth. How much wealth has been lost by the dollar’s inconstancy? It won’t matter to those who measure successful investment by the Dow, S&P or other index number, but it’s a pull up your socks conclusion regardless.

BTW, there are no gold bugs at Wainwright Economics. The staff flees from the attribution. The case for investment in gold and more importantly its proper use in determining investment decisions has been long catalogued through meticulous research and empirically founded evidence by the research provider, and studies older than two-years are available gratis on its website.

Luis de Agustin