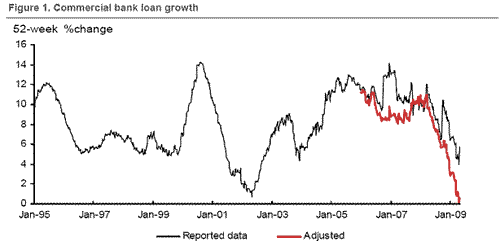

Further evidence on the decline in bank lending.

Last week I highlighted the debate over the degree of the contraction in bank lending. Another issue that I neglected to mention is that the series on bank lending used by Chari, Christiano and Kehoe referred only to lending by commercial banks. When assets of failed thrifts are acquired by commercial banks, the result is that the measured loans by commercial banks go up even though aggregate lending may have gone down.

Zach Pandl of Nomura Securities calls my attention to their analysis which constructs a series that tries to correct for these reclassifications. Nomura found that these corrections eliminate the increase in bank lending that one would otherwise see in the original commercial bank lending data.

Source: Global Weekly Economic Monitor, courtesy of Nomura Research.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply