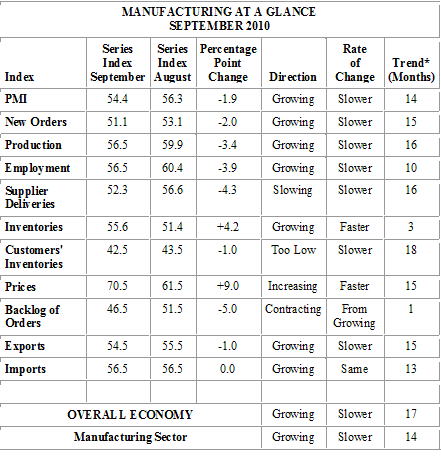

The Institute For Supply Management’s (ISM) manufacturing index fell to 54.4 in August from 56.3 in August. In July it was at 55.5. This was a minor negative surprise as the consensus had been looking for the index to fall to 54.8. This is a “magic 50 index” where any reading over 50 indicates that the manufacturing side of the economy is expanding, and any reading under 50 indicates a contraction in manufacturing.

The overall index has now been above the “magic 50” mark for 14 straight months. The key takeaway from this number is that the manufacturing sector is still expanding, but at a slower rate than in July. The overall index topped out in April at 60.4.

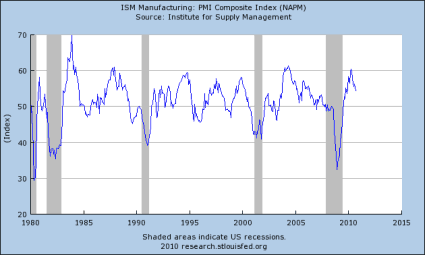

The graph below shows the history of the overall index for the last 30 years. It shows that while declining in recent months, it still remains at what has historically been a very solid rate. Over that period, the average has been 51.2, and the December 2008 low was 32.5.

The ISM index has a very long and venerable history; it used to be known as the Purchasing Managers Index or PMI. The overall index is made up of ten sub-indexes. Overall, six of the indexes showed improvement over last month and four showed deterioration. Eight are above the magic 50 level, while the index tracking purchasing managers views of their customers inventories, and the backlog of orders were below the 50 level. On the other hand, eight of the sub-index posted declines, while only the indexes tracking firms own inventories and the index of prices paid showed increases.

Breakdown by Index

The sub-indexes are as interesting as the overall index. In terms of the current state of the economy, the most important of these is the production index. It fell 3.4 points to 56.5, which is still a pretty good reading. The production index has been in positive territory for 16 straight months now. Eleven industries reported an increase in production while just four saw production fall in September, the same as in August.

However, the index with the biggest impact on the very short term is the backlog of orders, and there the picture is not nearly as good: the order backlog sub index fell to 46.5 from 51.5, and 54.5 in July. The decline in order backlogs is a troubling development. This was the first decline after 8 straight months of increases.

Four industries reported an increase in September, while eight reported declines. In August, eight industries reported an increase in backlogs while seven showed a contraction. Looking just a bit further out, as existing orders in the backlog are worked off, they need to be replaced with new orders. The new orders sub-index thus gives us the best view of where things will be in the next few months.

The new orders index fell to 51.1 from 53.1 and from 53.5 in July. In other words, new orders continue to rise but at a somewhat slower pace than last month. New orders have been on the rise for 15 straight months now.

With unemployment at 9.6% in August, and expected to rise when the employment report comes out next Friday, the employment sub-index is of particular interest. The employment index fell to 56.4 from a very strong 60.4 in August. However, that did not translate into strong employment gains in the manufacturing sector in August. Eight industries reported an increase in employment while only three reported declines.

The prices paid index posted the largest increase, up 9.0 points, and the highest overall level at 70.5. This would be an indication that deflation is not around the corner as some of the other price indexes like the CPI have seemed to be indicating. Most of the prices paid in this index, though, tend to be commodities, not final goods.

Still, the big jump in prices paid will be ammunition for those on the Federal Reserve who are hesitant to go forward with another round of quantitative easing. The bond market has clearly been worried about the potential for deflation, as that is the only macro-scenario in which 10-year T-note yields of under 2.5% make any sense. This report should be good news then for the short bond ETF’s like the TBT.

A Look Into Foreign Trade

The ISM index also gives a bit of a glimpse into the foreign trade situation. It seems to be indicating that overall trade is still increasing. The index tracking new export orders, though, fell 1.0 point to 54.5 while the index tracking imports was unchanged at 56.5. However, the import figure only refers to imports of materials or components that domestic manufacturers use, not to finished goods.

Still, the figures seem to point to a further deterioration in the trade deficit and net exports. Net exports were a huge drag on GDP growth in the second quarter, subtracting 3.50 points from growth. In other words, if the trade situation had remained unchanged from the first quarter, GDP growth would have been 5.2% in the second quarter, not 1.7%. Thus this sign of further potential weakness in net exports does not bode well for GDP growth in the third quarter.

Overall this was a disappointing report, not so much for the 0.4 point miss versus the consensus estimates, or even the 1.1 point decline in the overall index. The deterioration in the key sub-indexes of production, new orders, backlog and employment are not welcome developments. The table below shows the details of this month’s report.

Leave a Reply