Shares of Amazon.com (AMZN) registered a new all-time high this morning after J.P. Morgan (JPM) analyst Imran Khan reiterated his Overweight rating on the shares and lifted the online retailer’s price target to $198, from $154.

The JPM analyst said he is raising his EPS estimates for FY 2011 to $3.64 per share, from $3.40, and is introducing a FY 2012 EPS estimate of $4.97 per share.

“Our core thesis on Amazon remains: the co. is gaining market share within e-commerce, while e-commerce is gaining market share within retail,” Khan wrote in a research note to investors. “Margins can improve as Amazon benefits from growing third-party sales.”

Optimism is clearly on the rise toward the security. With shares of Amazon up more than 5.00% to $160.89 today, JPM’s new price target implies potential upside of about 23%. In addition, the shares of the $72 billion market cap company now represent a good value relative to strong growth prospects.

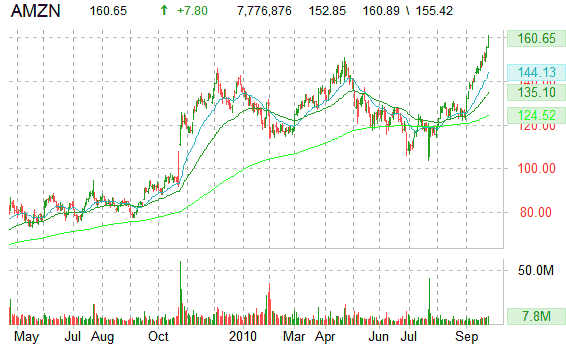

From a technical perspective, AMZN’s 1-year chart has its share of volatility, but the current trend is going in the right direction. The ticker recently broke through the upper end of its recent trading channel of $139.08 – $155.92 on huge volume and is now attempting to plow its way through the $160 – $165 neighborhood. Having said that, the ticker’s RSI now rests at 84.25 – in overbought terrain – indicating that a pullback from current levels may be in the cards.

AMZN is currently trading well above its 200 day MA of $128.59 and 50 day MA of $130.95, which has held the stock in check since mid-August.

At last check, Amazon.com, Inc. shares, a co. which operates as an online retailer in North America and internationally, were up $7.53, to $160.38, a gain of 4.95 percent.

It’s nice to see that online retailers, if not THE biggest online retailer is doing so well, particular in the critical eyes of Wall Street analyst.

It’s another very significant sign that online business still are growing and booming.

May this up-rating serve to encourage those still undecided entrepreneurs to make that step, in a still somewhat slow but recovering economy, to take their own ideas out of the draw and take their business online as well.

After all, competition is good for business.