A blog post by SuperAngel investor Fred Wilson of Union Square Ventures in NYC has struck a nerve. He argues that the venture industry is splitting in two: the traditional venture funds which focus on capital-intensive start-ups in info tech, biotech and cleantech, and the new emerging SuperAngel funds which focus on capital efficient software start-ups (many of which launch consumer Internet services). The capital efficient VCs focus on the “lean start-up” model, which I see coming from the Era of Cheap technologies that I discussed in the prior post on this topic.

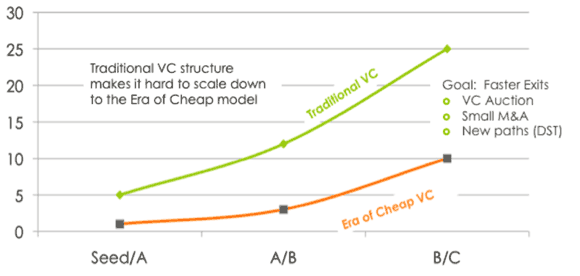

The traditional VCs have not changed their investment model; if anything, in the New Normal environment with few IPOs and low exits, they have doubled-down on putting even more money to work to build a few big winners. Looking at funding patterns within just one sector of venture, info tech, two different funding curves are evolving:

The whole SuperAngel phenomenon is getting more attention. A course will be offered at Harvard B-School next year to see how the lean model might apply to other sectors than software, including clentech, which is the most capital intensive sector. (Recent data says average first institutional money in is $30M with cleantech and under $5M with software.) A tech reporter, the always-newsworthy Michael Arrington of TechCrunch, broke into a meeting of SuperAngels and came out claiming collusion! This is really funny since the SuperAngels represent a fraction of the capital in venture capital and blip of around 20 funds within a universe of almost 1000 venture funds – now the traditional VCs are worried about price-fixing from the challengers?

What is going on is that the traditional VC industry, which has funded disruptive startups to take on other industry sectors, is now getting disrupted itself!

The venture capital model tends to fit the dominant technology trend. In the Era of Cheap, the traditional venture industry is caught in the wrong model. The New Normal has highlighted the problem of the old model: more money pouring into fewer exits means really bad returns. In contrast, the new capital efficient funds promise much higher returns on smaller and quicker exits – plus they are picking up some wascally-wabid high-fliers like Zynga, Twitter or Groupon. Imagine their returns if they catch the next tech bubble as well.

Leave a Reply