Nvidia Corporation (NVDA) rose 3 percent to $11.98, the highest intraday PPS since June 22, after the maker of chips for computer graphics cards scored a bullish brokerage note this morning from BMO Capital Markets analyst Ambrish Srivastava.

In a note to clients Mr. Srivastava said he is raising his rating on the NVDA shares to “outperform” from “market perform”, and setting a new target of $16, up from $9, based on fundamental improvements in the co.’s business. The BMO analyst also said that NVDA looks undervalued versus its growth potential at current levels, especially with its Tegra chips and Fermi graphic card products gaining some traction in the market. Srivastava raised his January 2011 fiscal year EPS estimate to $0.58, from $0.55.

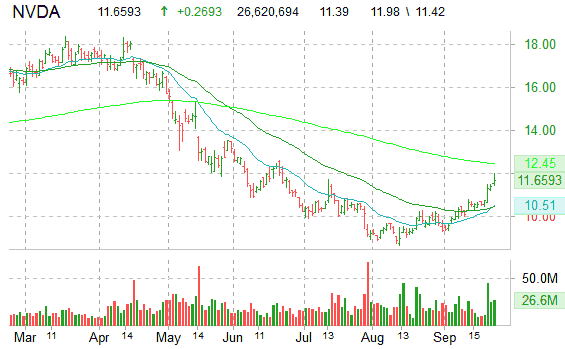

From a technical analysis perspective: NVDA closed yesterday at $11.39 on volume of nearly 25 million shares. The ticker, which is currently trading above its 50-day MA of $9.97 and should find resistance at its 200-day MA of $14.05, is continuing a recent breakout above resistance at its 20-week MA. Speculative traders however, seem somewhat pessimistic on the ticker’s ability to sustain its short-term rally. Personally, I remain relatively bullish on shares of NVDA not only on the basis of the co.’s positive profitability aspect, currently printing 6.30 percent, or its debt-light balance sheet — only $232.74 million vs $1.8 billion in total cash– but also on the basis that the stock is pushing above both its 20/50 day EMA’s for the first time since NVDA’s broader bottoming process that occurred between April and August where the stock lost over 50 percent of its value.

On a short term basis I think ticker could be on its way for a test of its 200-day EMA, which is located near the $12.50 area, and a move above $12.50 should mark a renewed uptrend and a test of the $14.05 level.

Nvidia gained $28 cents, or 2.46 percent, to $11.67 at 2:57 p.m. ET in Nasdaq composite trading.

Leave a Reply