In a new financial landscape in which leverage is limited by worldwide regulation and the gradual digestion of toxic assets will weigh on bank’s balance sheets, the US will face tougher terms to finance its external imbalance. Perfectly at odds with the global imbalance premonitions of the early 2000s, the dollar’s weakness will likely be the best gauge of the turnaround of the global crisis.

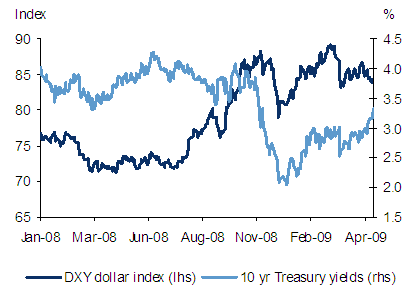

For several years before the current crisis, economic doomsayers predicted an apocalyptic scenario where investors would turn their back on US assets, leading to a downward spiral of dollar weakening and US rate steepening. While this apocalyptic scenario did materialise, it occurred in a very different way than most had expected. A few weeks into the crisis, it was clear that the global flight to safety was benefiting US Treasuries (Reinhart and Reinhart 2008), and that the financial deleveraging was favouring the US dollar, along with other so-called “funding” currencies (Figure 1).

Figure 1. Response of US dollar and Treasury rates to the crisis

Source: Bloomberg

We believe this behaviour can be largely explained by three factors of varying degrees of persistence:

- A drastic decline in risk appetite that benefited low-risk US assets.

- A collapse of financial cross-border flows – i.e., “financial de-globalisation” – associated with an increase in the home bias of domestic portfolios, which brought home an important stock of dollar -funded portfolio investment abroad.

- A sharp increase in US household savings due to the combined wealth effect of the burst of the housing bubble and stock market correction that, together with lower oil prices, contributed to balance the current account.

We believe this unexpected response of the US dollar will be reversed and that quantitative easing will only temporarily be able to keep US long-term rates at their current low levels. Three reasons lie behind this (See Broda, Ghezzi and Levy-Yeyati, 2009):

- An increase of global risk aversion that is eminently a transitory phenomenon that benefits US assets.

- The “savings drain” that has replaced the pre-crisis savings glut, as fiscal stimulus and narrower trade surpluses take hold in major external savers (Japan, China and oil-exporting countries).

- The lower degree of financial globalisation in a world with more financial regulation, which will toughen the terms at which current-account deficit countries can finance themselves

Coming home: The dollar bias of “home bias”

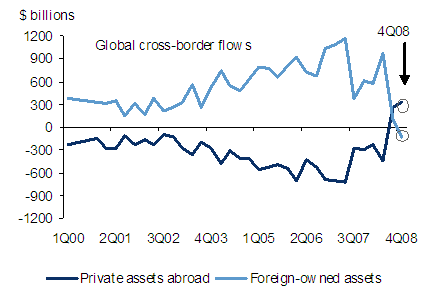

The widely publicised “flight-to-safety” dimension that favoured US Treasuries as a safe haven for investors all over the world has masked a potentially more important aspect – cross-border capital flows have collapsed. Figure 2 succinctly illustrates the undoing of financial globalisation. After reaching a peak in mid-2007, gross flows started to fall dramatically, particularly since mid-2008, reflecting an increase in the so-called “home bias”, as investors’ relocated their battered savings to domestic assets.

Figure 2. The undoing of financial globalisation

Note: Figure 2 shows the sum of assets abroad and foreign-owned assets of the largest 30 countries globally by portfolio volume.

Source: IMF, Barclays Capital

This pattern has been particularly dramatic among private investors. Private inflows to the US have reversed as foreign investors have reduced their holdings of American assets in the past two quarters by $115 billion (whereas in a typical quarter between 2003 and 2007 private capital inflows were close to $300 billion). A similar pattern is evident in the behaviour of American investors, who have repatriated their foreign capital aggressively in recent quarters. In a typical quarter Americans tend to buy around $250 billion of foreign assets, in 3Q08, Americans sold $240 billion of foreign assets. Concurrent with the decline in overall cross-border flows, the shift in the composition of foreign investors’ portfolios toward US Treasuries has also been notable. Although total inflows by foreign investors declining sharply, the demand for Treasuries increased at the expense of both agencies and corporate bonds. The flight to safety in recent quarters is an unmistakable pattern in the data.

Dollar warning: The “savings drain” of global lenders

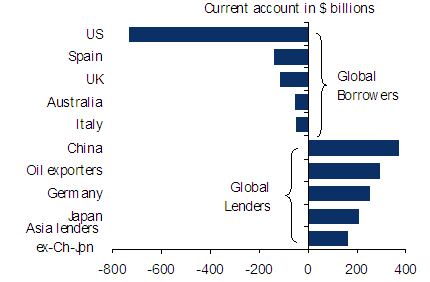

The bursting of the oil bubble and China’s shift toward domestic sources of growth, coupled with Japan’s falling savings and a generalised collapse in international trade, are bound to lower external savings in current account surplus countries (global lenders). This reduced availability of funds is expected to worsen the terms under which countries with current account deficits (global borrowers) are likely to be able to fund themselves (see Figures 3 and 4).

Figure 3. Global lenders and borrowers in 2007

Note: Current account = Savings – Investment. Asia lenders ex China Japan include Singapore, Taiwan, Malaysia, Hong Kong, Thailand, Indonesia, Philippines, Laos, Nepal, Myanmar.

Source: IMF, Haver, Barclays Capital.

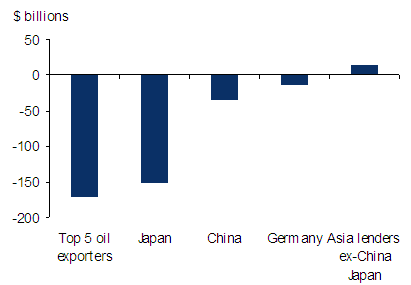

Figure 4. Expected fall in global lenders’ external savings, 2008 vs 2009

Note: Asia lenders excluding China and Japan include Singapore, Taiwan, Malaysia, Hong Kong, Thailand, Indonesia, Philippines, Laos, Nepal, and Myanmar.

The Chinese side of the global imbalance has been the subject of lively debate in recent years, fuelled by concerns about a growth path increasingly dependent on exports and investment. However, as Figures 4 suggests, the fixation with China should not mask the general nature of the decline of current account surplus countries. Indeed, the expected fall in China’s external surplus is not even the largest among global lenders in 2009. The collapse in oil prices immediately implies lower savings for oil-exporting countries. Likewise, Japan has been running trade deficits since August 2008. Part of that may be directly related to the crisis, but there is an underlying structural decrease in the Japanese savings rate that suggests more deficits to come.

Is the US getting hit or getting away with it?

The ongoing return of risk appetite will cease to favour low-risk, low-yield US assets. Moreover, the collapse of financial cross-border flows – the more persistent aspect of “financial de-globalisation” – will require that global investors allocate a larger share of their cross-border portfolio to assets of current account deficit countries such as the US (see Box 1). The new financial landscape – with greater financial regulation and lower leverage – is likely to make this shortage of international capital more persistent. In turn, the retrenchment of private savers – especially in oil-exporting countries and Japan – and expansionary fiscal policies almost everywhere are likely to lead us towards a “savings drain” by global lenders – the opposite of the “savings glut” in pre-crisis years.

In a new financial landscape in which leverage is limited by worldwide regulation, and where the gradual digestion of toxic assets will weigh on bank’s balance sheets for some time, limiting the availability of credit, the US will face tougher terms to finance its external imbalance. In our view, these tougher terms, together with the sharp increase in US household savings, could have gone a long way towards unwinding the global imbalances in a non-traumatic way. However, that would have entailed passive fiscal and monetary policies and a politically unpalatable economic contraction. Instead, a massive fiscal stimulus partially financed directly by the Fed through the purchase of Treasuries should ultimately lead to a reversal of the dollar bonanza. Perfectly at odds with the global imbalance premonitions of the early 2000s, the dollar’s weakness will likely be the best gauge of the turnaround of the global crisis.

Box 1: Financial de-globalisation is bad news for the US

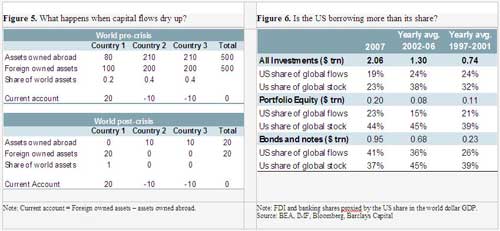

A notable feature of the period of financial globalisation that started in 2002 is that, despite the heavy borrowing in recent years, the US has financed its large current account deficits without experiencing an unusual build-up in foreign investors’ holdings of US assets. A simple exercise helps clarify this point (Figure 5). Consider a two-country world with one surplus country (country A) and one deficit country (country B). To focus on the effect of gross – as opposed to net – flows, assume that current account balances remain unchanged before and after the crisis, but the level of A’s investable income halves from a pre-crisis level of 1,000 (20% of which goes to finance country 1’s current account) down to 500. It follows that, to finance the same current account deficit in the post-crisis, country B needs to induce country A’s investors to double their foreign portfolio share by raising expected returns, which could be achieved either through higher rates or appreciation expectations.

The example illustrates the effect of today’s sharp decline in capital flows. In the past five years, the cumulative US borrowing has been $3.4trn, which amounted to almost 60% of net external surpluses. However, courtesy of the surge in financial globalisation, US borrowing was only 23% of the assets that foreign investors were investing abroad, less than its estimated share in the global asset portfolio (Figure 5). Even debt securities, blessed by the flight to quality, captured 41% of 2007 cross-border debt flows, roughly in line with their 37% share at the beginning of the year. In other words, international flows to the US were barely keeping track with the foreign portfolio shares of international investors. Not anymore. We believe this pattern of drier international capital markets is likely to persist for many quarters, in which case, the same US funding needs would need to stretch the share captured by US assets – at a cost in terms of higher rates and/or a weaker dollar.

References

Christian Broda, Piero Ghezzi, Eduardo Levy-Yeyati, “The new global balance”, March 23, 2009, Barclays Capital

Reinhart, Carmen M. and Vincent Reinhart (2008), Is the US too big to fail?, VoxEU.org, 17 November

![]()

Leave a Reply