Back in March, Barron’s ran The Case For Bonds, poo-pooing a spate of articles back then on a bond bubble. The expectations were that the ending of Quantitative Easing (QE) would lead to a rise in rates. As we know now, didn’t happen.

What did happen was the Euro debt crisis drove money to safer havens in Treasuries, and the pronouncement of a continuation of QE led observers to expect a bigger QE2 ahead. Bonds soared as rates dropped. In the last few weeks, however, we have seen them reverse dramatically (chart from StockTiming):

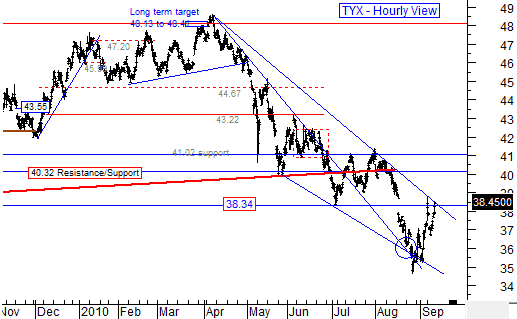

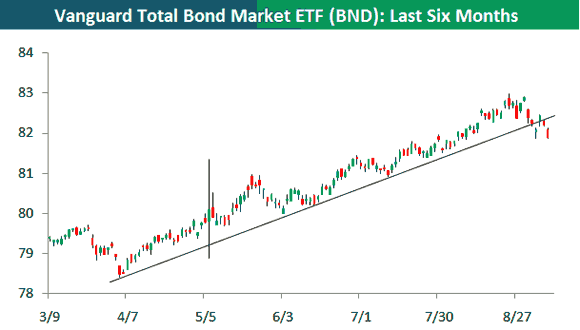

Marty Chenard (of StockTiming) notes how the 30-yr has come back to a recent resistance level at 38.34 (see chart), suggesting a break will lead to a bond bust of very broad proportions. The bust is already being felt. Monday’s WSJ will report how the last ten days have shaved 2.5% off the 10-yr, a sharp drop after a five month stunning rise. Bespoke noted late last week how the drop in bonds was already being felt in bond funds, and had raised the spectre of a breakdown in fixed income:

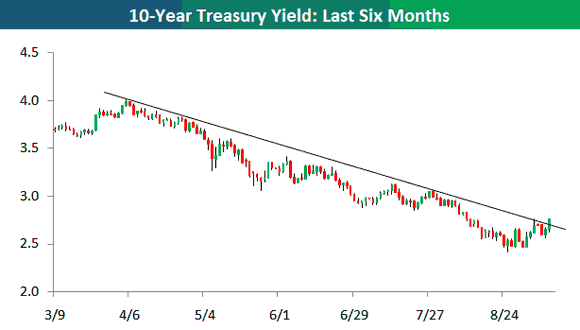

More ominously, the 10-yr has has not broke above the five-month trendline, an indication (if it doesn’t reverse quickly) of a change of trend for a considerable period:

Credit for an auspicious call goes to Jeremy Siegel in the WSJ, whose op-ed The Great american Bond Bubble published on August 18, right as the trend reversal was starting. He noted how a reversal from the 2.8% rate then to the 4% rate of a mere five months ago would cause a capital loss 3x worse than the low yield. This led to a new spate of Bond Bubble articles. An update is here.

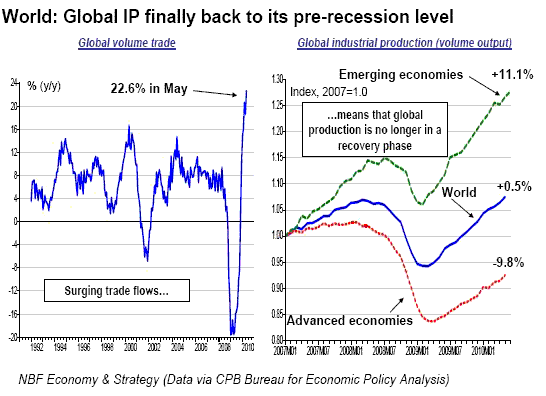

An even earlier call came from ZH, which noted that global industrial production got back to pre-recession levels, and drew the implication that a Global Bond Hiccup was soon to come:

Before the bears celebrate, they should ponder what changed: expectations of the double-dip abated around the time the bond yields bottomed. If you have been following my posts on the Double Dip Countdown, I put the count on hold in early August, started it again around August 18, and have it on hold again – reflecting ambiguous economic signals. This has two big implications for rates:

- a flat patch would cause the Fed to hold off QE2, which suppresses rates

- a real recovery would cause market rates to rise, and the Fed to follow

Now fixed income investors face a dilemma: if the recovery is on, rates will rise; but if this is a mere blip before negative double-dip news begins to come back, rates will fall back. Should they stay (in bonds) or should they go?

I will comment separately on munis in a later post, bit as to Treasuries, these are the circumstances where technical analysis may give better advice than struggling with conflicting and ambiguous fundamentals. Friday’s STU has a wave count which is pretty daunting: the recent low rates reflect a 62% retracement from the low rates in 2008 to the recent highs in April. This suggest rates are going to continue to rise. Right now the technical indicator to watch is a definitive break of the trendline (see chart above).

Leave a Reply