Visa Inc. (V), the world’s largest electronic payment network for both credit and debit cards, is a global retail payments tech co. that connects millions of people who live at different levels of the economic pyramid in more than 200 countries and territories worldwide.

Visa Inc. (V), the world’s largest electronic payment network for both credit and debit cards, is a global retail payments tech co. that connects millions of people who live at different levels of the economic pyramid in more than 200 countries and territories worldwide.

With its secure and scalable processing capability of handling 10,000 plus transactions per second, Visa is enabling more and more customers, including midsize and large corporations, and governments to use digital currency instead of cash and checks.

The electronic-payment giant — whose base business remains solid, fast-growing and its prospects for long-term growth, driven by the co.’s resilient network business model, continues to be very attractive — makes its money by charging card issuers service fees for use of its Visa brand. Visa had more than $4.6 trillion transacted on its payment products over the four quarters ended March 31, 2010. For the three months ended June 30, 2010, the San Francisco Calif.-based company, which for the year estimates a net revenue growth of 11% to 15%, saw its payments volume growth, on a constant dollar basis, increase by 14% year-over-year. But much of Visa’s recent growth has been on the debit side. With the U.S. debit market soon to undergo changes following implementation of the Consumer Protection Act next year, which will cap ‘swipe’ fees charged to merchants on each transaction, many investors without considering the tangible benefits to consumers worldwide that the new global shift from paper money to digital currency will have on revenue streams, and more importantly, how significant Visa’s technological advantage is at the center of this change, have convinced themselves that the beaten-down (V) stock is risky to own at current levels. As a result Visa shareholders, who are clearly reacting to recent returns on the basis that a worldwide recession reduces the use of both debit and credit cards, are adjusting (in same cases even dumping) their Visa holdings in anticipation of a price shift. Another reason supporting that view is that the slide in Visa shares may be accelerated by fears over the pace of the U.S. economic recovery. I think this is clearly an overreaction and reflects investor outlook, which confirms that a stock move is imminent. To the upside that is. Yes, Visa will be impacted by e few changes and a slowing economy but that isn’t going to last forever.

The reality is that despite the concerns the credit card processor is a leader in its field and continues to make money. Visa delivered a solid financial performance during its fiscal third quarter, exceeding most Wall Street estimates for a 10th straight quarter. Service revenues were $873 million, an increase of 13% versus the prior year. Net income for the quarter was $716 million, or 97 cents a share, compared with $729 million, or 96 cents, in the same period a year earlier. GAAP net operating revenue came in at $2.0 billion, an increase of 23% over the prior year and driven by strong contributions “across all revenue categories”. Furthermore, Visa’s recent stock price doesn’t reflect in my view the co.’s strong balance sheet which is manifested in its key financial ratios that are as follows: Revenues generated during fiscal year 2010 reached $7.8 billion with a net income of $2.7 billion. TTM operating margin came in at 55.00%. The co.’s return on assets currently stands at 8.22%, followed by 11.44% return on equity. Meanwhile, profit margins contributed 34.57% to the co.’s bottom line while gross profit printed $4.40 billion, suggesting Visa has a healthy pricing strategy in place which is evident in both ratios. Operating cash flows — a solid measure of a company’s profits — came in at almost $1.6 billion, showing not only how well the business is doing but also reinforcing the idea the company can continue spending, if it chooses to do so, in expanding its business. I also think that Visa’s multiple will expand as its management continues to successfully innovate and execute their strategy of a debt-light balance sheet — only $47 million vs $5.3 billion in total cash — combined with an attractive FCFY that certainly facilitates Visa’s continuation of stimulating growth through organic means.

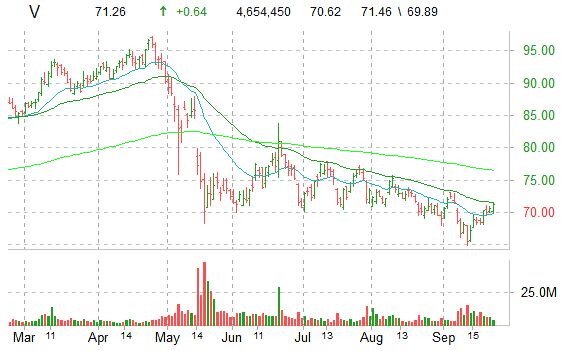

It’s worth pointing out that Visa shares have been overall good performers since going public at $44 per share a little over two years ago. Also, let’s keep in mind here the fact that their IPO came amid a sea of troubles for the stock and the IPO markets and ticker still managed to surge 220% to an all time high of $97.19 before retreating into the mid 60s where it has been hovering lately.

From a technical perspective, Visa would be a steal at these levels for the long term since the stock has been halved recently and is clearly oversold and undervalued.

Supported by favorable fundamental factors, and as long as the economy sustains a gradual recovery, look for the stock to print above $95 level within 12 to 18 months.

Disclosure: No position

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply