Albany International Corp (AIN) analysts are feeling bullish after the latest earnings report. Estimates are up and the stock is a great entry point.

Company Description

Albany International is a textile and materials processing company. The company produces custom-designed fabrics and belts for the making paper and paperboard. Other areas include aerospace composites, building products, synthetics for outerwear markets and much more.

Beat the Street

On Aug 4 Albany International reported second-quarter results that left the company and analysts bullish on the future. Sales were up about 7% since last year, with gains in each segment.

Net income for the period was $7.9 million, up from a $12.7 million loss a last year. Earnings per share came in at 50 cents per share, blowing estimates out of the water, which were averaging just 37 cents.

The CEO had plenty to say about the quarter and the company’s future. He commented that the strong quarterly results are showing good near-term revenue potential and very promising.

Estimates Spike

Following the earnings news all 4 analysts upwardly revised their full-year estimates. The Zacks Consensus Estimates for 2010 is up 17 cents to $1.45. Next year’s forecasts are coming in at $1.89, up 16 cents.

Given the $1.08 that Albany International earned last year, expected growth rates are currently 34% and 30%, respectively.

Valuations

Albany’s stock is still showing great valuations. Currently you can pick up shares at 12 times the forward estimates. The projected growth is priced at a discount, with the PEG being 0.9 times.

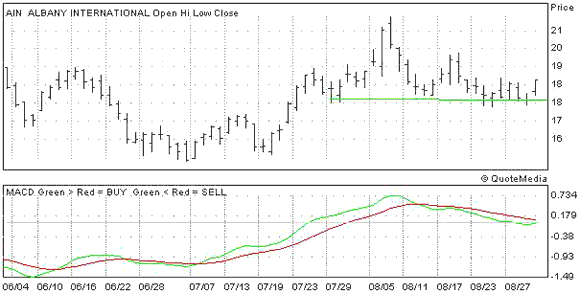

The Chart

Shares of AIN jumped on the earnings news, but quickly retraced to pre-earnings levels. The stock is now just above the recent level of support, and with an upcoming shift in the MACD and valuations, this could make for an excellent entry point.

Leave a Reply