According to WSJ, Ford Motor Co. (F) announced late Monday it will offer 300 million common shares in a public offering designed to shore up the automaker’s cash reserves and keep the company out of bankruptcy. All common shares will be offered at a par value of $0.01 cent/share.

The company said in a government filing Monday that proceeds from the stock offering, which could be between $1.7 billion to $2 billion, are expected to fund its cash obligation to the health-care trust. Ford believes raising the cash is worthwhile despite objections from current stockholders who fear shares will be diluted. Citigroup (C), Goldman (GS), J.P. Morgan (JPM) and Morgan Stanley (MS) will book-run the deal.

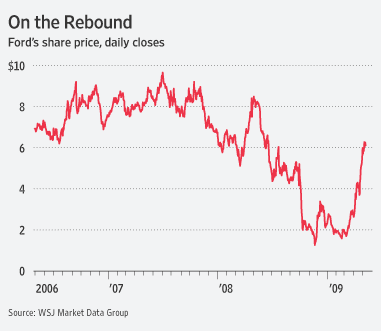

Ford’s announcement today is perhaps putting the cart before the horse — the annual shareholder meeting is Thursday May 14th. However, can’t blame the company for taking advantage of a market rally that has sent its shares up nearly fourfold in the last two months.

The Ford stock offering is set to price after the market closes Tuesday. Typically, companies don’t announce offerings unless they are confident they can sell the shares at a reasonable price, the Journal said.

Graph: Wall Street Journal

Leave a Reply