According to the New York Fed, “Research beginning in the late 1980s documents the empirical regularity that the slope of the yield curve is a reliable predictor of future real economic activity.”

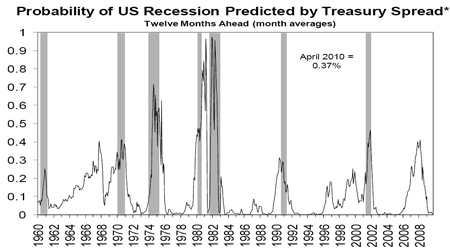

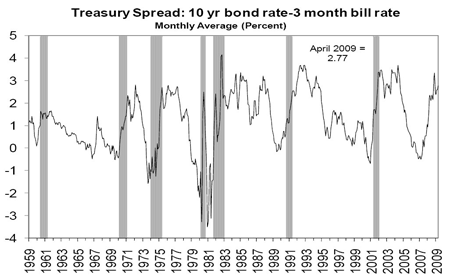

The New York Fed just released its latest “Probability of U.S. Recession Predicted by Treasury Spread,” with data through April 2009, and the Fed’s recession probability forecast through April 2010 (see chart above, click to enlarge). The NY Fed’s model uses the spread between 10-year and 3-month Treasury rates (currently at 2.77%) to calculate the probability of a recession in the United States twelve months ahead (see chart below of the Treasury spread).

The Fed’s data show that the recession probability peaked during the October 2007 to April 2008 period at around 35-40%, and has been declining since then to less than 10% for December 2008 and January 2009. Looking forward through 2009, the Fed’s model shows a recession probability of only about 1% on average through the next 12 months, and below 1% by the end of the year (0.82% in December 2009). By April of 2010, the recession probability will be only 0..37%, close to the lowest level since mid-2005.

Further, the Treasury spread has been above 2% for the last 12 months, a pattern consistent with the economic recoveries following the last six recessions (see chart above).

Bottom Line: My reading of the New York Fed’s Treasury spread model suggests that an economic recovery is probably already underway, and the Fed’s model predicts the end of the recession in 2009.

eager to know the end of recession