Amerigroup Corp. (AGP) continues to pressure its multi-year high after more than doubling the Zacks Consensus Estimate in its recent Q2 results. The great quarter pushed the current-year estimate 25% higher, now pegged at $3.48, a 44% growth projection.

Company Description

Amerigroup Corp. operates as a multi state managed healthcare company with an emphasis on serving people receiving healthcare benefits through publicly sponsored programs such as Medicare and Medicaid. The company was founded in 1994 and has a market cap of $947 million.

Although there is still plenty of uncertainty in the healthcare sector due to reform legislation, that did not prevent Amerigroup from delivering solid Q2 results on July 30 that came in well ahead of expectations.

Second-Quarter Results

Revenue for the period was up 5% from last year to $1.4 billion. Earnings also came in strong at $1.31, 111% ahead of the Zacks Consensus Estimate. The company now has an average earnings surprise of 113% over the last three quarters.

The solid results were driven by gains in premium revenues, which were up 11% from last year to $1.4 billion on the back of two recent acquisitions and expanded Medicaid participation that drove enrollments.

The company also benefited from a compelling cost structure where Sales, General and Administrative expenses accounted for just 7.5% of total revenue, down from 8.6% last year.. Health benefit expenses fell to 82.3% from 85.9%.

Balance Sheet

Amerigroup also continues to maintain a healthy balance sheet, with cash and equivalents of $410 million compared to long-term debt of $240 million. Its debt to equity ratio of 22.5% is well below its peers 28.2%.

Estimates

Estimates took a big jump forward on the good quarter, with the current year adding 70 cents to $3.48. The next year added 34 cents to $3.28.

Valuation

The valuation picture looks pretty solid too with a forward P/E of 11X against its peers 10X.

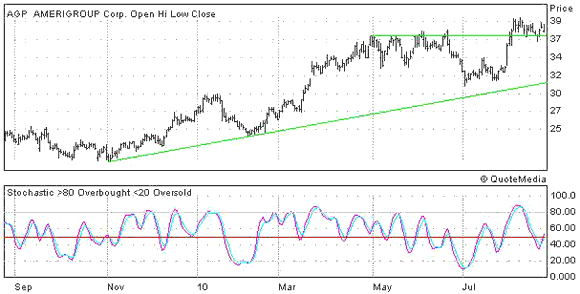

12-Month Chart

AGP jumped higher on the good quarter, hitting a new multi-year high at $39.35. The stochastic below the chart is signaling that shares are trading well away from over bought territory. Look for support from the longer-term trend and recent low above $36 on any weakness. Take a look below.

Leave a Reply