Its flying a little under the radar this morning, but the Fed just disavowed the market of the notion that they would defend the 10-year at 3%. Today’s Permanent Open Market action was to buy a paltry $3 billion in 10-year and longer notes.

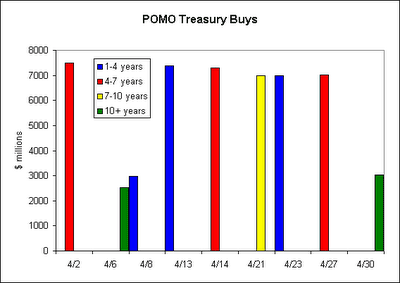

Here are the last several POMOs of Treasury bonds (excluding TIPs):

I color coded it by the portion of the yield curve which the Fed was buying at each action. Notice that its very clear that the Fed isn’t doesn’t have a soft target of 3% on the 10-year. Moreover, the Fed isn’t focused on the 10-year portion of the curve at all. Most of the buyer has occurred in the 4-7 year area, which I’m assuming the Fed thinks will be most influential on consumer borrowing rates.

This leaves me tactically short the 10 and longer part of the curve, looking to re-enter (I’m still a deflation believer) at a higher yield level. Technically, I don’t see any stop points between 3.07% and 3.80%, so I’ll probably we waiting a bit before re-entering the long-term Treasury market.

Leave a Reply